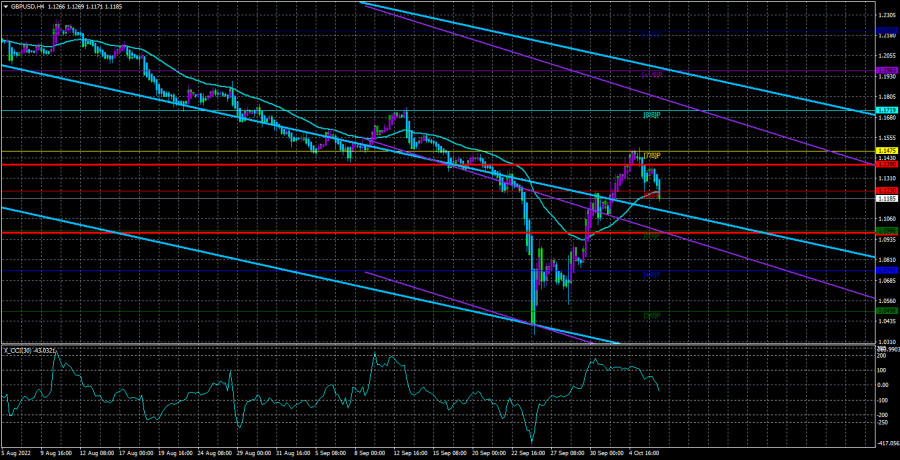

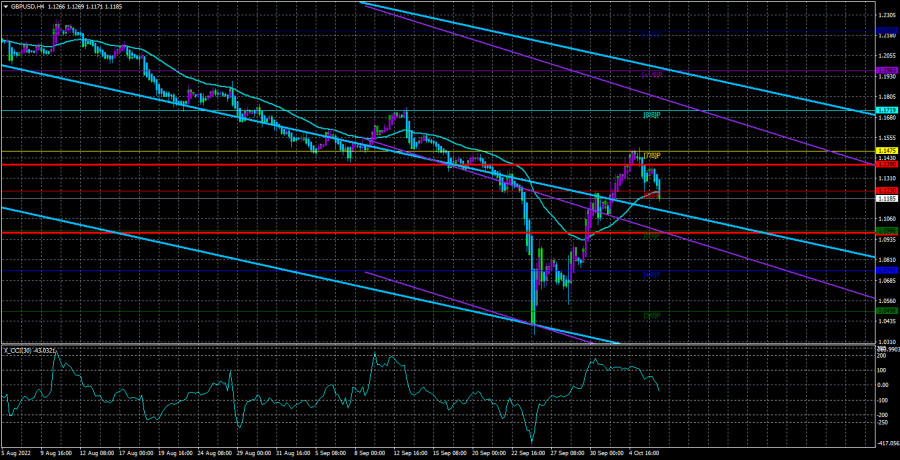

The GBP/USD currency pair was also mostly adjusted on Thursday. We have already said that there are plenty of reasons for resuming the downward trend in the euro currency. For the pound sterling, this statement is also true. From a technical point of view, we have seen a sharp drop and an upward pullback over the past three weeks. Such a pound/dollar pair movement may end the entire downward trend. However, unfortunately, fundamental and geopolitical backgrounds can ruin everything for the British pound. It should be understood that the latest collapse of the British currency turned out to be quite unexpected and was provoked by the announcement of a tax cut in Britain, as well as the Bank of England's application to start the process of buying treasury bonds. However, the market has already recovered from these events. BA is not in a hurry to buy debt securities and is thinking more about the consequences of such a step and taxes in the UK if they are reduced at a minimum. Thus, the last collapse and further recovery can be crossed out, as it were, and then we will get the same price levels at which the pound was trading before all these events. Therefore, if there was no last round of decline, the pound was not adjusted against it, which means it may well continue its decline.

Now the pair needs to gain a foothold (confidently) below the moving average line, and with two linear regression channels pointing downwards, all indicators will again point to a fall. The fundamental background for the pound remains difficult, despite rumors that BA may raise the rate by 1% at the next meeting. The economic prospects and inflation in the UK are now such that the pound can fall simply based on this factor alone. And if we recall geopolitics and the fact that the military conflict in Ukraine may spill out beyond its borders, then the prospects for risky currencies remain vague.

The technique can be crossed out by geopolitics.

Meanwhile, Russian Energy Minister Alexander Novak said that Russia is ready to resume gas supplies to Europe via the intact Nord Stream-2 pipelines if the European side wants it, and appropriate measures will be taken. Mr. Novak said there is a technical possibility of launching Nord Stream-2, but the consent of the European side is needed since this pipeline has not been certified and has never been in use. Recall that the Nord Stream-2 was built for about ten years, but Germany refused to certify it because of the invasion of Russian troops in Ukraine on February 24 this year. Later, the German authorities repeatedly stated that the Nord Stream-2 projects were buried and would never work again. This pipeline may become almost the only way to supply gas to Europe, particularly Germany. Recall that the only pipeline that continues its work is the one that passes through Ukraine.

At the same time, deputy government spokeswoman Christiane Hoffmann said that Germany does not intend to carry out deliveries via the non-certified Nord Stream-2. She noted that after Moscow recognized the independence of the republics of the LPR and DPR in February of this year, as well as due to interruptions in gas supplies during the subsequent time, Berlin recognized Russia as an unreliable supplier and decided to abandon Russian gas gradually. It is also reported that Germany's gas storage facilities are now 93% full, but this winter, the Germans and all Europeans will have to save in any case. Gas prices remain consistently high but have been trending down in recent weeks. The European Union plans to replace Russian gas with similar fuel from the USA, Norway, Great Britain, and other countries. In June, the percentage of gas imports from Russia to Germany had already dropped to 26%, and Norway took first place in the supply of "blue fuel."

From our point of view, further escalation of the "gas conflict" between Europe and Russia may lead to a new fall in risky assets and currencies. It is still a long way to the end of the conflict or the point when the parties can no longer impose any sanctions or measures against each other.

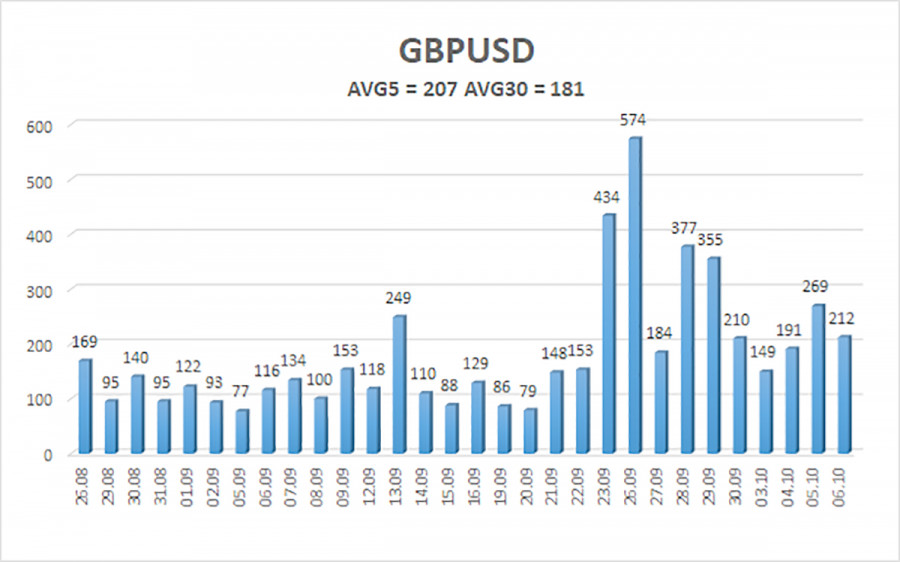

The average volatility of the GBP/USD pair over the last five trading days is 207 points. For the pound/dollar pair, this value is "very high." On Friday, October 7, thus, we expect movement inside the channel, limited by the levels of 1.0976 and 1.1390. The upward reversal of the Heiken Ashi indicator signals the completion of the downward correction.

Nearest support levels:

S1 – 1.1230

S2 – 1.0986

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1475

R2 – 1.1719

R3 – 1.1963

Trading Recommendations:

The GBP/USD pair continues its downward correction in the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.1475 and 1.1502 should be considered in case of a rebound from the moving average. Sell orders should be opened when anchoring below the moving average line with targets of 1.0986 and 1.0742.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.