Details of the economic calendar for September 8

The European Central Bank (ECB) raised all three key interest rates by 75 basis points.

The base interest rate on loans was raised to 1.25%, the rate on deposits to 0.75%, and the rate on margin loans to 1.5%.

The main points of the ECB press release:

- Over the next few meetings, the regulator is considering further rate hikes to protect against rising inflation.

- The ECB will regularly review the course of its monetary policy in the course of incoming statistics.

- Future ECB rate decisions will be data driven and follow the approach taken at each meeting.

- ECB members have revised their inflation forecasts, which are expected to average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024.

- The ECB expects GDP in the EU to grow by 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024.

Conclusion from the meeting:

The regulator's decision to raise rates by 75 basis points was anticipated by the market. This event was already on everyone's lips. For this reason, there was no reaction, despite the historical scale of the hanging.

The main theses of Christine Lagarde's press conference:

- The regulator will continue to raise interest rates at upcoming meetings.

- The energy crisis is intensifying the economic slowdown.

- The weakness of global economic growth will slow down economic growth in the EU.

- A weak euro is bad; it leads to an increase in inflation.

- The decisions on the rate at the current meeting were made unanimously.

- The subsequent rate increase will not necessarily be by 75 basis points.

- The ECB is not at a neutral rate.

- In order to reach a neutral level on the rate, additional increases will be required.

- The unfavorable scenario considers a recession in 2023.

- Now is not the time to stop reinvestment in the Asset Purchase Program (APP).

- Rates are far from being necessary to reduce inflation, and even more rate hikes will be required than at the remaining two meetings this year.

- To curb the growth of inflation, it is necessary to raise rates at more than two meetings, but less than five meetings

Conclusion from the press conference:

Christine Lagarde has repeatedly spoken out in favor of further tightening of monetary policy. There is no clear understanding of the neutral rate yet, but the intention to raise it at the remaining meetings this year and next year is clear. Lagarde also noted that the regulator does not like the weak euro table.

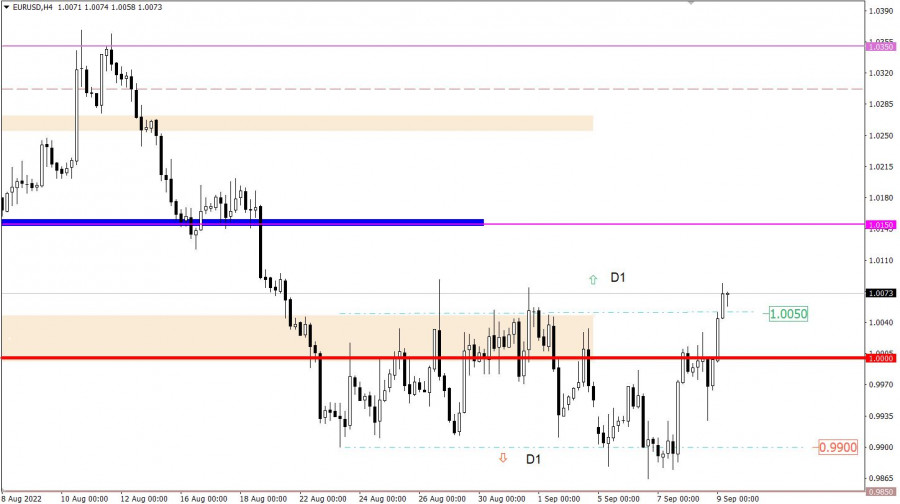

Analysis of trading charts from September 8

The EURUSD currency pair spent the past day in speculation, where at first there was a downward trend, and then all the drawdowns in the euro were bought off. As a result, the day was closed at the parity level, from which all speculation began.

The cause and effect of speculation is described above—this is an information and news flow.

The GBPUSD currency pair, despite the speculative activity, repeats the price fluctuations of its counterpart in the EURUSD market. This is due to the positive correlation between trading instruments, where at this time, the euro is considered the leading currency.

Economic calendar for September 9

Today the macroeconomic calendar is empty, important statistics for Europe, Great Britain and the United States are not expected.

Investors and traders are likely to continue to focus on the information flow of such hot topics as the energy crisis in the EU, the ECB/Fed, inflation.

Trading plan for EUR/USD on September 9

There was a rush on the market for long positions on the euro at the opening of Asian trading session. This led to an upward jump in the price, based on which the quote rose above the value of 1.0050. Stable price retention above the reference value (1.0050) in the daily period may indicate the formation of a full-size correction relative to the downward trend. Otherwise, it is impossible to exclude the scenario of a reverse move to the boundaries of the previous amplitude of 0.9900/1.0050.

Trading plan for GBP/USD on September 9

In this situation, the price rebound from the local low of 2020 led to the strengthening of the British currency by about 180 points. To move into the stage of a full correction, the quote needs to stay above the value of 1.1620 for at least a four-hour period.

Otherwise, the current ascending cycle may slow down, followed by a return to the support.

What is shown in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.