The GBP/USD currency pair declined for no apparent reason on Tuesday. We refer to obvious causes, such as a solid "foundation" or macroeconomics. However, nothing comparable occurred on Tuesday. The sole report on business activity in the UK services sector could not cause a 150-point decline in the pound's value. In addition, we call attention to the fact that the euro and the pound once again exhibited perfectly synchronized price movements. Therefore, it is unlikely that the reasons lie in macroeconomic statistics, even in general. The market likely paused for a few weeks before resuming its pound sales as the global downward trend persisted.

Moreover, the pair during the most recent round of upward correction could not even surpass the moving average line, as seen in the above illustration. As expected, the bulls were unable or unwilling to participate, whereas the bears had no choice but to engage in their favorite activity. And what else can be done when all fundamental and geopolitical factors point to the dollar's growth amid a strong downward trend?

The most intriguing aspect is that the pound fell against the dollar despite certain factors providing support. Remember that the Bank of England has raised the key rate five times in a row, but what difference does it make if the pound continues to decline in the medium term? The UK economy performed better than the US economy in the first quarter, but what does it matter if inflation in Foggy Albion is also rising significantly faster and higher? The geopolitical conflict in Ukraine is unlikely to end, and there are numerous potential sites for the emergence of new military hotspots on the current political map of the world.

Do you recall how great things were during the pandemic?

Unfortunately, there is currently little to say about the British economy or politics. There is virtually no news or significant data, so there is nothing to analyze. The topic of Brexit, the topic of the "Northern Ireland protocol," and the topic of the Scottish referendum may be brought up multiple times. It is impossible to predict how and when the geopolitical conflict between Ukraine and Russia will end. The most optimistic experts predict completion by the end of 2022, but how will it conclude? Under the current circumstances, it is difficult to imagine that Moscow or Kyiv will back down and abandon the disputed territories. Consequently, there is a much greater likelihood of escalating the conflict, extending the front, and intensifying the fighting and shelling. In addition, the lend-lease program should begin operating this fall, allowing NATO weapons to flow into Ukraine like a river.

But everything now depends on more than just Ukraine. Recent articles have mentioned that Turkey capitulated to NATO pressure and approved Sweden and Finland's entry into their military bloc. Consequently, the Kremlin can or should respond, given that it has repeatedly warned Stockholm and Helsinki in recent months that such an action is unacceptable. It should be understood that they are not members of the military alliance until Sweden and Finland ratify their membership in NATO. Consequently, a potential conflict between Finland and Russia will not involve NATO. We fear another "special operation" will not commence in Finland, as the Kremlin has repeatedly cited Kyiv's desire to join NATO as one of the primary reasons for conducting it on Ukrainian soil. Now, the Kremlin can position NATO bases and missiles much closer to St. Petersburg and Moscow than it could have in Ukraine. It is highly unlikely that Russian authorities will ignore this issue.

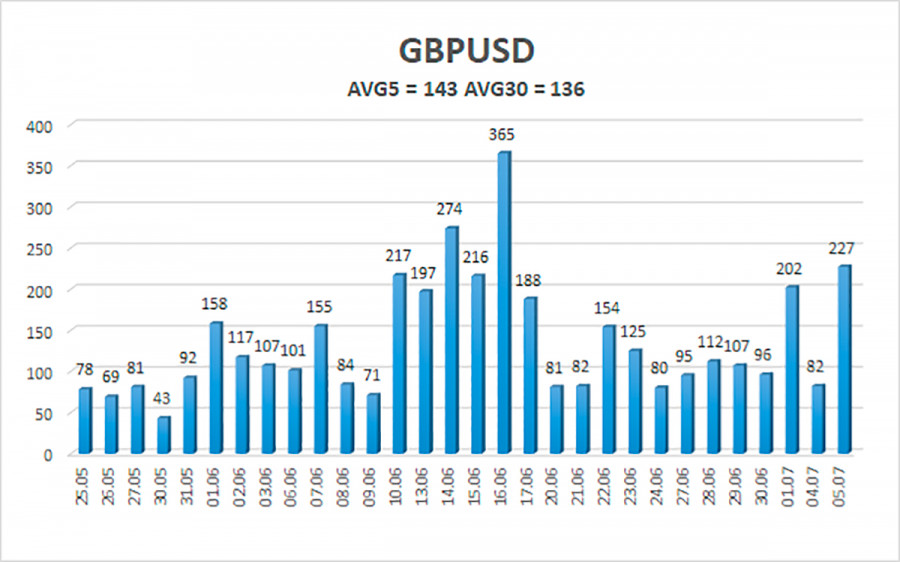

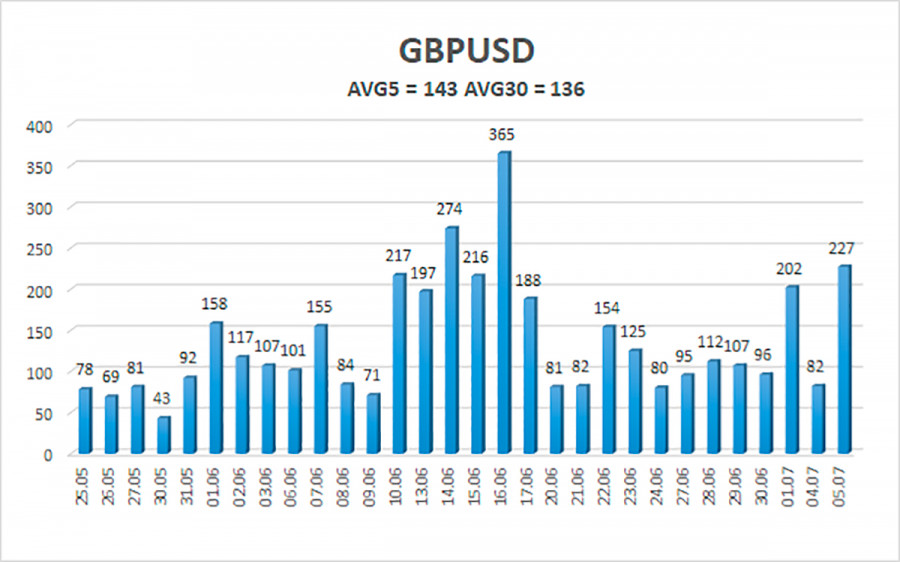

During the last five trading days, the average volatility of the GBP/USD pair was 143 points. This value is "high" for the pound/dollar pair. On Wednesday, July 6, thus, we expect movement inside the channel, limited by the levels of 1.1791 and 1.2078. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.1902

S2 – 1.1841

Nearest resistance levels:

R1 – 1.1963

R2 – 1.2024

R3 – 1.2085

Trading Recommendations:

The GBP/USD pair resumed its downward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in short positions with targets of 1.1841 and 1.1791 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixed above the moving average with targets of 1.2207 and 1.2268.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. The trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal in the opposite direction is approaching.