The EUR/USD currency pair continued its downward movement on Thursday, not paying any attention to the fact that there are no new local factors of the fall of the euro currency this week. What happened this week that the European currency fell by 300 points? There was not a single important macroeconomic report, not a single important fundamental event, and there was no important information at all. All the information that came to the traders' disposal was already familiar to them or did not have any "novelty effect". Nevertheless, the euro continues to fall every day, so we conclude that this movement is simply inertial. Traders see that the euro is falling every day, so why not continue to sell it if you can make money on it?

By the way, if we take into account the major players, they just do not get rid of the European currency. It should be remembered that in the foreign exchange market there are not only speculators who earn on the difference in exchange rates. Some commercial players buy and sell a particular currency for their operational purposes. And COT reports are now signaling the "bullish" mood of large traders in the euro currency. We have already said that this effect is achieved by higher demand for the US dollar. Or a drop in the supply of the US dollar. One way or another, it is the dollar that is growing now, and the reasons for its strengthening can only be geopolitical, fundamental, and macroeconomic, but at the same time general, global, and not local. We believe that in some way traders have already exceeded the plan to work out all these factors. The pair has fallen too much in recent weeks. Recall that the 20-year lows of the pair are located just above the 3rd level. The euro/dollar pair was trading below the 3rd level back in 2002. Therefore, the current positions of the European currency are very low and very weak. But they can get even worse.

The energy crisis has officially begun.

The European Union will have to look for new suppliers of gas, and maybe oil. Moscow made a "knight's move" and banned gas exports to Bulgaria and Poland. And this is just the beginning since the list of "unfriendly" countries consists of 90% of the EU countries. Therefore, it is possible that in the near future Moscow itself will refuse to export gas to other EU countries. From our point of view, this is a pretty strong step on the part of the Kremlin. Let's be honest, both the EU and Russia will suffer from the gas embargo. The budget of the Russian Federation is 80% dependent on foreign exchange earnings from the sale of oil and gas, and about 40-50% of energy resources in the EU come from the Russian Federation. However, Moscow, which is not going to complete the "special operation" in Ukraine, quite logically decided that it would be better to start refusing gas exports first than to wait for the moment when the European Union will make a similar decision. Moscow is ready to sell gas and oil to India or China at significant discounts, or not to sell these energy resources to anyone at all, rightly believing that oil will not spoil in the bowels of the earth, and sanctions will not last forever. And buyers will be found sooner or later, given the fact that there will be no more oil and gas on Earth.

Therefore, the "knight's move", although it is a blow to the Russian economy, is still a strong step by the Kremlin. This is probably why the Russian ruble is strengthening, and the Russian economy is increasingly closing off from the whole world. You can talk as much as you like about the fact that even buttons are imported in Russia, and paper for printers will now be gray, not white, but it is the Russian Federation that has huge natural resources. And other, "unfriendly" countries will either have to seriously reduce their production due to the lack of these very resources, or negotiate with Russia. Thus, the Kremlin decided that the European Union and other unfriendly countries should decide for themselves what to do next: observe the decline of their economy and support Ukraine or find a common language with Russia. The euro currency, meanwhile, continues to fly to hell, and so far only the States benefit from all this "turmoil".

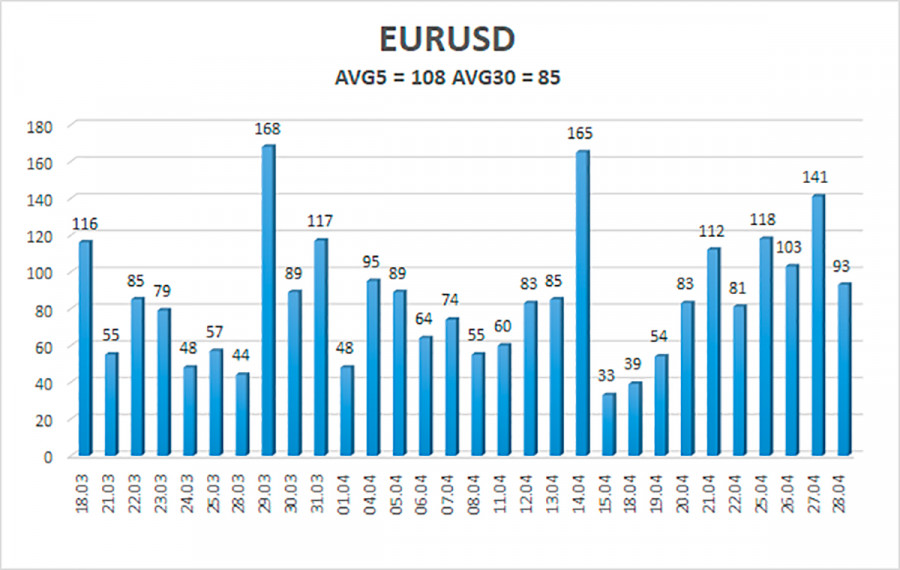

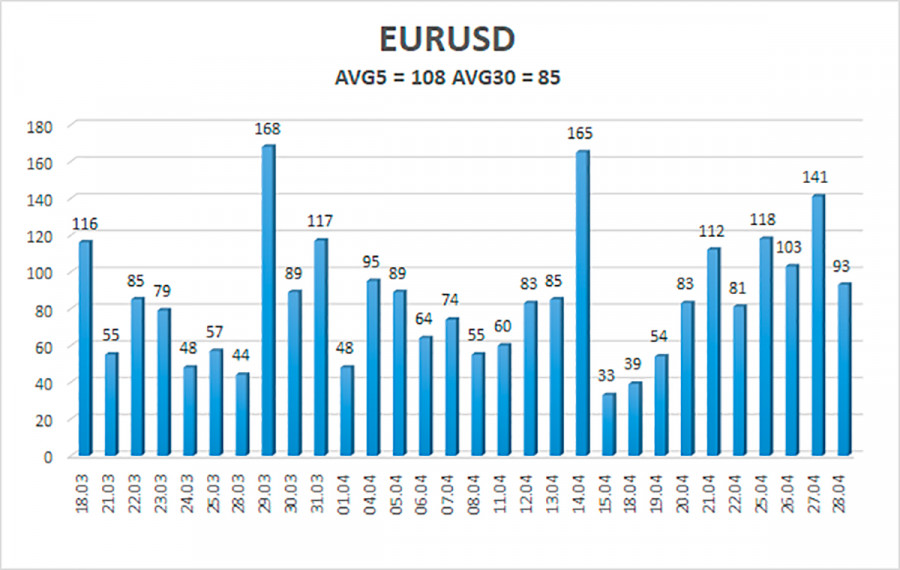

The average volatility of the euro/dollar currency pair over the last 5 trading days as of April 29 is 108 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0409 and 1.0625. The upward reversal of the Heiken Ashi indicator signals the beginning of an upward correction.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair continues to move down. Thus, now we should stay in short positions with targets of 1.0409 and 1.0376 until the Heiken Ashi indicator turns upwards. Long positions should be opened with a target of 1.0864 if the price is fixed above the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.