The EUR/USD currency pair continued its not too strong, but stable and confident decline on Wednesday. As a result, the level of 1.0808 was worked out, which is the 15-month minimum of the euro/dollar pair. This means that in the long term, the downward trend continues, and the level of 1.0808 is highly likely to be overcome. And overcoming this level will open the way for bears to $ 1.06 and $ 1.05. As we said earlier, we will not be surprised at all if by the end of the year we see price parity between the euro and the dollar. We have also already drawn the attention of traders to the fact that the euro has not had such a difficult situation for a long time. Although the euro has been falling for 15 months, about half of this period the fall looked like a simple correction against a much stronger uptrend. Then the fundamental background began to change in favor of the dollar, and now it has become such that it is very difficult to find at least one possible growth factor for the EU currency. Therefore, from day to day, you can, in principle, just list all the reasons why the European currency may continue to fall.

After all, the problem lies in the fact that we are talking about global factors that do not leave the information space and the consciousness of traders for a day or two. We are talking about geopolitics, macroeconomics, and the difference in monetary policy between the ECB and the Fed. Such factors can have an impact for a very long time. Therefore, we believe that the European currency may well continue its decline for several more months. Its prospects now depend on when and how the geopolitical conflict in Europe will end, whether the Kremlin will conduct new "special operations" in Europe, how bad the European economy will feel because of the military conflict in Ukraine, and the sanctions imposed against Russia. So far, the answers to all these questions are such that nothing good can be expected of the euro. However, if information begins to arrive tomorrow that the de-escalation of the military conflict between the Russian Federation and Ukraine has begun, this may give optimism to buyers of the EU currency. Unfortunately, most likely it will be the other way around. In the near future, almost all military experts expect a new offensive by Russian troops in the East and South-East of Ukraine.

Inflation in the States has already ceased to impress traders.

The whole news chain has been looking like this lately: inflation in the States is growing, the Fed is tightening its hawkish rhetoric, new talks are starting about 5-10-15 rate hikes of 0.25%-0.5%-0.75%, geopolitics in Ukraine is deteriorating, the ECB is talking about the weak state of the European economy, and inflation in the United States is rising. We walk in a closed information circle. All the news from day to day, from week to week, is essentially the same. Therefore, practically nothing changes in the foreign exchange market. The European currency continues to fall, as it did two months, 4 months, or 6 months ago. From time to time, of course, it is adjusted, because no trend is complete without corrections, so from time to time the euro even shows growth. This causes surprise among traders since there is no reason to see the growth of the euro now. But these are purely technical corrections, they have no fundamental grounds.

Therefore, according to the results of Wednesday, by and large, there is nothing to say. There were no important macroeconomic statistics or fundamental events on this day. Markets don't even pay much attention to such news as the speech of another member of the Fed's monetary committee, who declares his readiness to raise rates and reduce the balance sheet. No one doubts that the Fed will now raise rates at a high pace. Thus, for the time being, we can only watch the dollar rise in price, wait for the next Fed meeting, wait for inflation to slow down. In geopolitical terms, it is to wait for developments in Ukraine, to hope that the Kremlin does not launch a "special operation" in Finland and Sweden, which want to join NATO this summer.

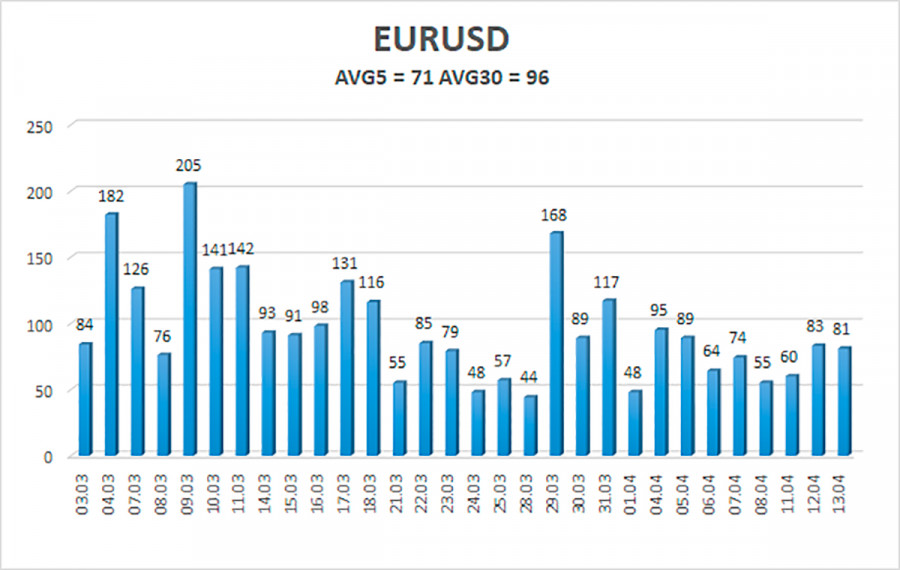

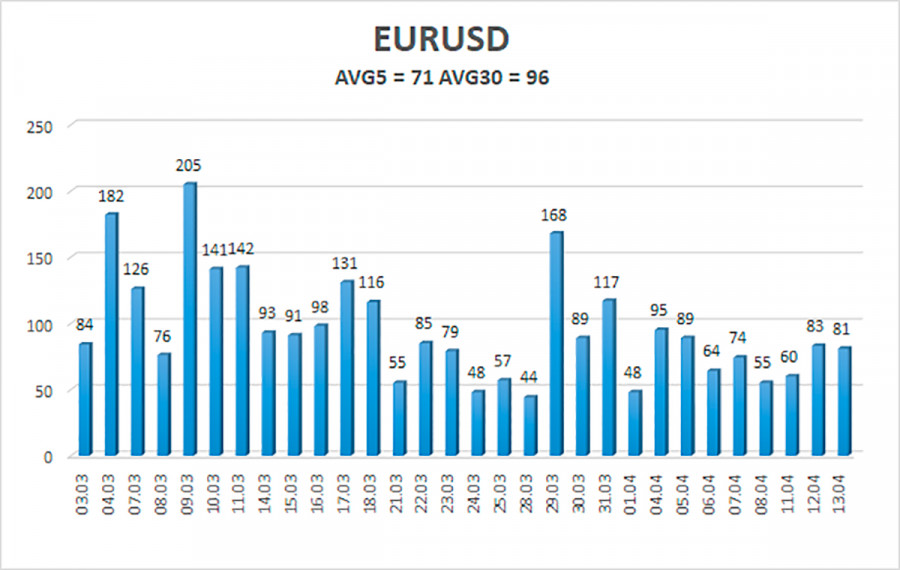

The volatility of the euro/dollar currency pair as of April 14 is 71 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0806 and 1.0948. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, new short positions with targets of 1.0804 and 1.0742 should now be considered in case of a rebound from the moving average. Long positions should be opened with a target of 1.0986 if the pair is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.