The GBP/USD currency pair traded much more calmly on Monday than the EUR/USD pair. We can say that the volatility was minimal, so yesterday the main currency pairs practically did not correlate with each other. It is this moment that makes us doubt that on Monday we saw a belated market reaction to Friday's Non-Farm and unemployment in the States. If the market reacted to these reports, the dollar would rise in price across the entire spectrum of the market. But this did not happen, so it is more likely that both pairs react to geopolitics. And here it is necessary to understand what is happening. Why does the euro continue to fall, but the pound does not? The British currency continues to be located near its 15-month lows, but the overall decline over the past 15 months is twice as weak as the fall of the euro. The British pound may show greater resistance against the dollar in the future. The UK economy is not so much dependent on Russian energy resources, and Boris Johnson has already announced the refusal to purchase hydrocarbons in Russia by the end of this year. Britain has its oil fields in the North Sea, which the country will now actively develop. And gas can be imported from the States, which are considered Britain's closest ally. Therefore, the energy crisis does not threaten the UK.

Maybe this is the reason for the higher resistance of the pound? To provide the whole of Europe with oil and gas, it will be necessary to lift sanctions from Iran or Venezuela. Or ask the Saudis to extract more oil and supply it to the European market. The problem with gas is more or less solvable since US President Joe Biden has already assured Europe that his country will be able to provide them with gas. However, it should be understood that now gas costs about $ 1,500 per 1,000 cubic meters, and Europe imports gas from Russia at $ 274 per 1,000 cubic meters, as it has long-term supply contracts that were concluded at the old prices. The signing of new contracts with the United States will inflate heating prices in Europe by 5-6 times. Some EU countries are ready for such a development of events, as they do not want to sponsor the aggression of the Russian Federation. Some say that it is high time to switch to alternative energy sources, in particular to "green" energy. Germany and Hungary are mainly opposed to the embargo. And the Kingdom no longer faces these problems, since they no longer need to take into account the opinion of the 27 EU member states, and the country will be provided with oil and gas in any case.

The UK economy is in a stronger position than the EU economy.

On Monday, there was also another speech by the Chairman of the Bank of England, Andrew Bailey, who, as usual, did not tell the markets anything interesting. The British pound may also show high resistance against the dollar because BA has already raised the rate three times and is going to raise it several more times during 2022. Thus, the BA rate is now higher than the Fed rate. Indirectly, this indicates a good state of the economy. And since the economy is strong (although not as strong as the American one), this is a good reason for investment. The British economy is also not threatened by possible sanctions from the Russian Federation, since, as we have already figured out, it does not have such a strong gas and oil dependence. And Boris Johnson is not shy about making loud statements about the Kremlin, calling on the whole world to isolate Russia. London is not afraid of Moscow, since the latter has an extremely small number of trump cards in its hands in the confrontation with the British. From here we get a few more factors in favor of the pound.

However, we should not forget that the pound is a riskier currency than the US dollar, which is why it comes under pressure when it comes to the difficult geopolitical situation in the world and a foggy future. It is possible that sooner or later other countries of the world will be involved in the military conflict in Ukraine. We can already see that the Baltic countries are going to completely restrict themselves from Belarus and the Russian Federation and abandon any trade operations with them. Finland and Bosnia are going to NATO, Japan has already spoken twice about the Kuriles, and Poland and Germany are looking at the Kaliningrad region. In general, this conflict has every chance to spill out beyond the borders of Ukraine.

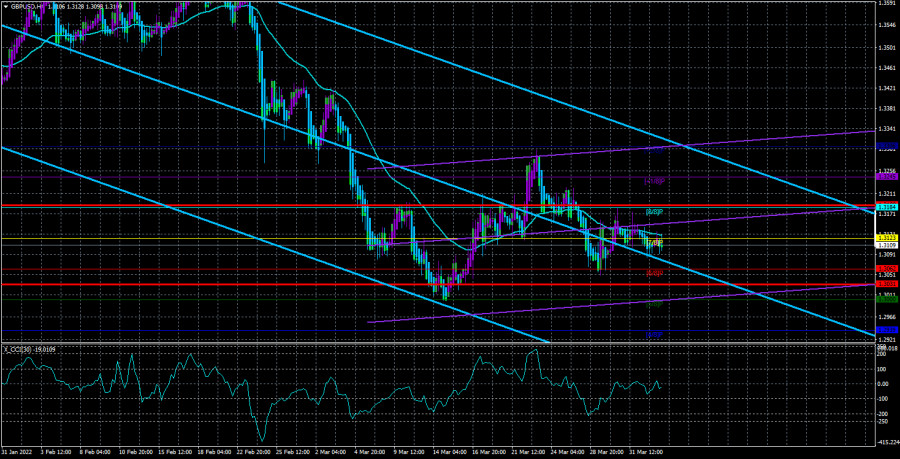

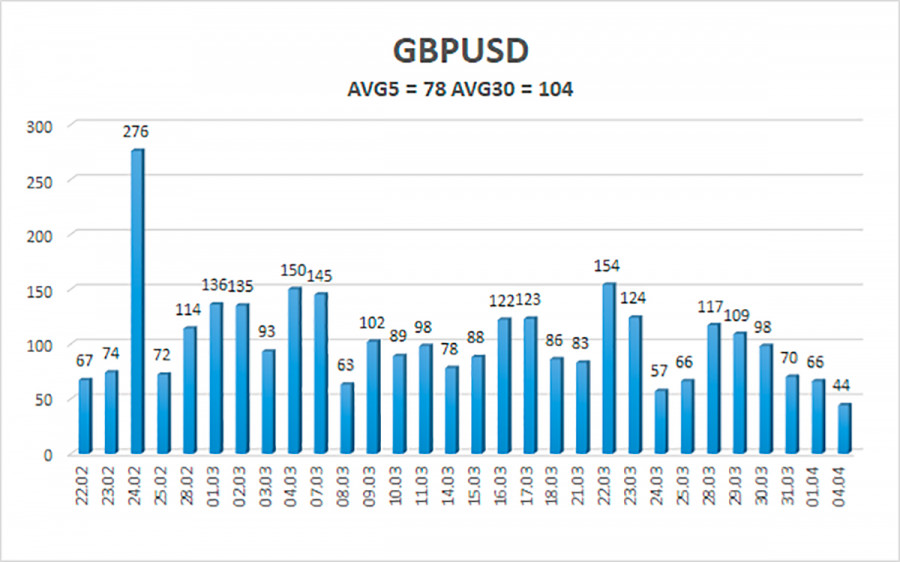

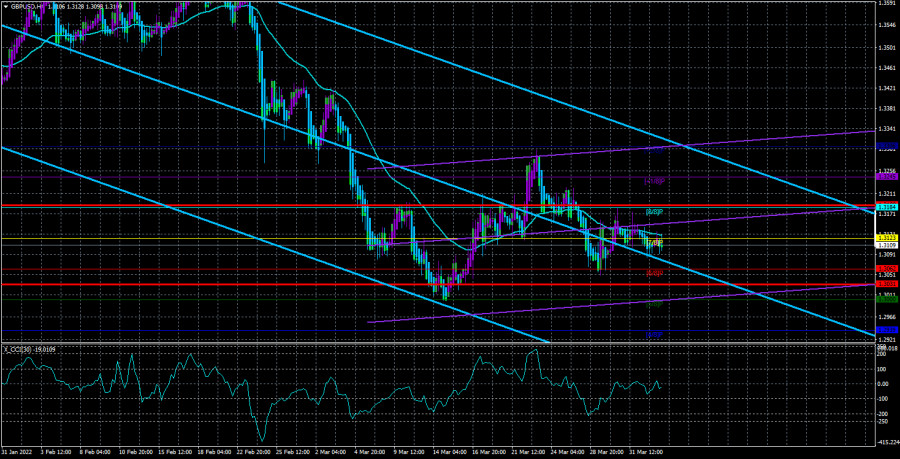

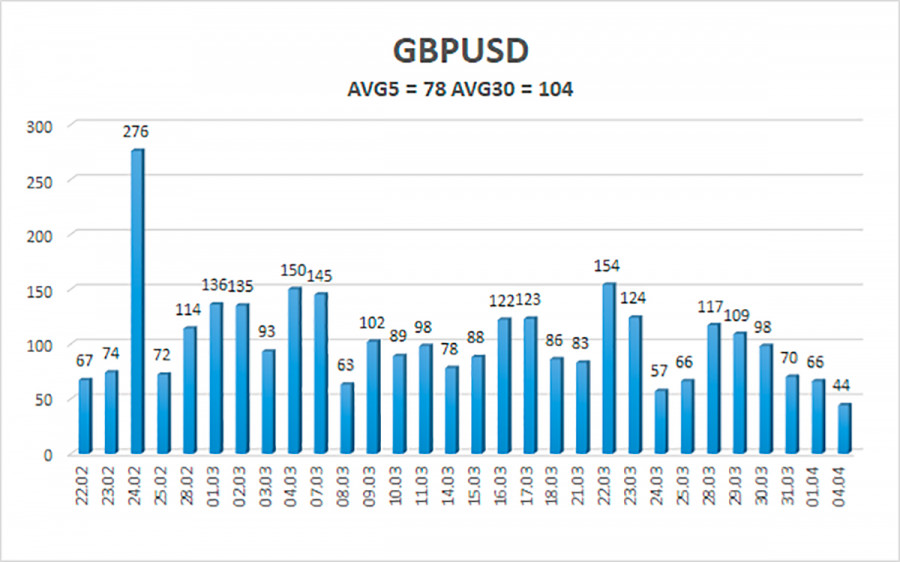

The average volatility of the GBP/USD pair is currently 78 points per day. For the pound/dollar pair, this value is "average". On Tuesday, April 5, therefore, we expect movement inside the channel, limited by the levels of 1.3031 and 1.3188. The upward reversal of the Heiken Ashi indicator signals a round of upward movement with a possible consolidation above the moving average.

Nearest support levels:

S1 – 1.3062

S2 – 1.3000

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3123

R2 – 1.3184

R3 – 1.3245

Trading recommendations:

The GBP/USD pair has started a new round of downward movement in the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.3062 and 1.3031 until the Heiken Ashi indicator turns up. It will be possible to consider long positions no earlier than fixing the price above the moving average line with targets of 1.3184 and 1.3188.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.