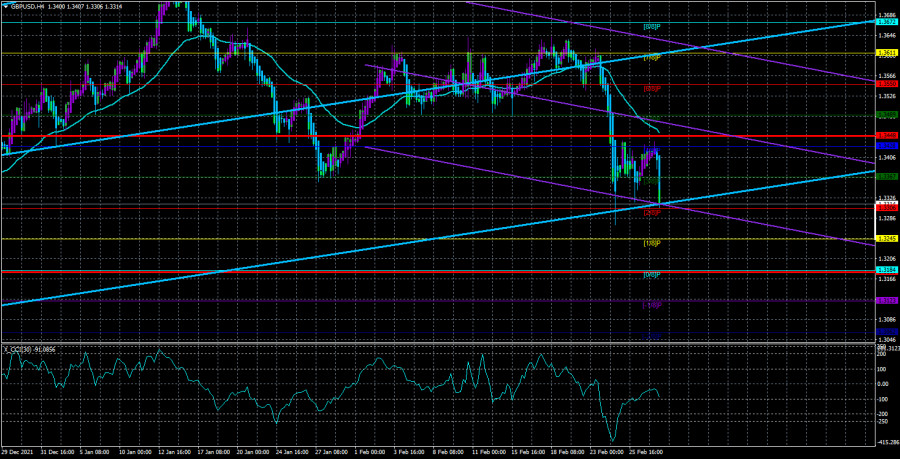

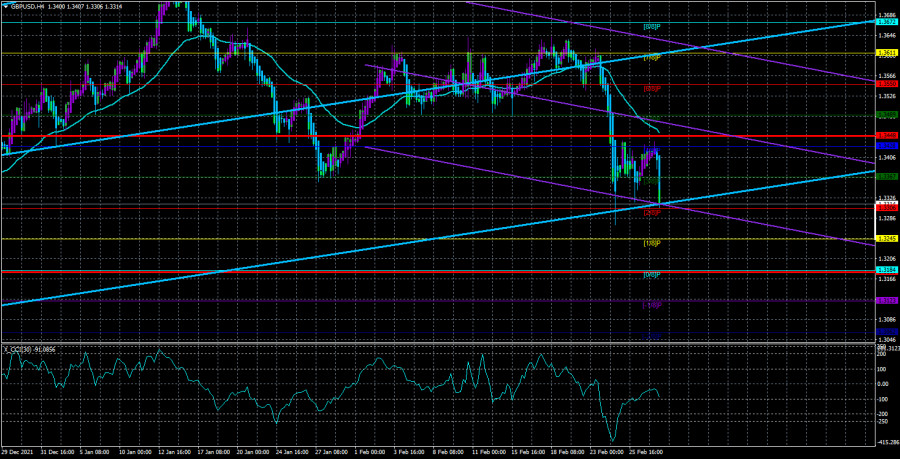

The GBP/USD currency pair traded as calmly and even boring as possible on Tuesday. There were no sharp and strong movements during the day. The pair remains below the moving average line, so the fall of the British currency may resume at any moment. Recall that the recent falls of the euro and the pound were associated exclusively with geopolitics. Now all traders and all markets pay attention only to it. Another thing is that they do not always react. However, on Tuesday, neither Christine Lagarde's speech nor the business activity indices in the EU, the UK, and the US had any effect on the movement of the euro/dollar and pound/dollar pairs. As we warned in previous articles. So what do we have? The macroeconomic background is ignored or completely absent. The fundamental background is either ignored or completely absent. The geopolitical background creates pressure on risky currencies and contributes to the strengthening of the dollar, but it is not practiced by traders every day. The technical picture is now much lower in importance than the geopolitical background. Any important news, even if it does not concern the UK or the US, can lead to a new fall in the British or European currency. Of course, it won't be like this every day. And in general, even the technical picture now corresponds to the general background of the news. Thus, we still believe that the pound sterling will continue to decline, and any negative geopolitical news will only finish it off.

Only the Bank of England can save the pound.

Unfortunately, attention is now diverted even from the central banks of the United States and Great Britain. If a couple of weeks ago traders were actively discussing and arguing about how many times the Fed will raise the rate in 2022 and how the Bank of England is going to fight inflation, now it doesn't matter. The dollar is still growing, which fully corresponds to market expectations regarding the Fed and the increase in the key rate. The Bank of England has raised the rate twice already, but does anyone see the pound rising? Yes, the local growth of the British currency was. However, such local periods of strengthening will occur even if the BA does not tighten monetary policy. At least because any pair needs to be adjusted from time to time. On the 24-hour TF, it is now best seen that despite fairly frequent and deep corrections, the downward trend persists. This means that the pair may drop to the 32nd level in the near future and update its annual lows. Even if the Bank of England raises the rate again in March, the probability of which is very high.

Returning to the topic of geopolitics. We now believe that it is not even the situation in Ukraine that can put further pressure on the markets, in particular on the Russian markets. As already mentioned, the Finnish Parliament received a petition from the citizens of this country with a request to join NATO. Recall that Finland is a "friendly" country for NATO, but is not a member of it. However, it has the right to do so at any time. Thus, at present, this issue will be resolved at the government level. The State Duma of the Russian Federation has already stated that they consider this step by Helsinki as "dangerous for the security of the country" and "they will have to respond." What does this mean? Another military operation? After all, it is not the expansion of NATO that is Moscow's main goal.

The State Duma openly stated that they have excellent relations with Finland, no one is going to attack it, and then why should it join NATO at all if there is no threat from Russia, even hypothetical. However, 10 years ago no one could have imagined that Russia and Ukraine would start a war with each other, so the Finns can be partly understood. But will the Finns be understood in the Kremlin? From our point of view, this is a potentially new geopolitical conflict that could aggravate the situation of the Russian Federation in the international arena even more, as well as create additional pressure on markets and risky assets, which now include the pound sterling. The situation in Europe continues to escalate.

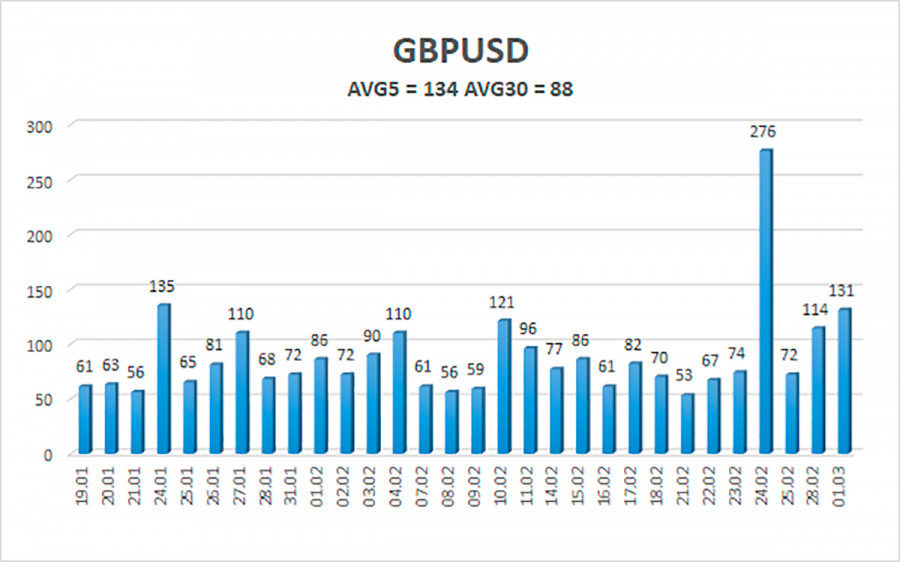

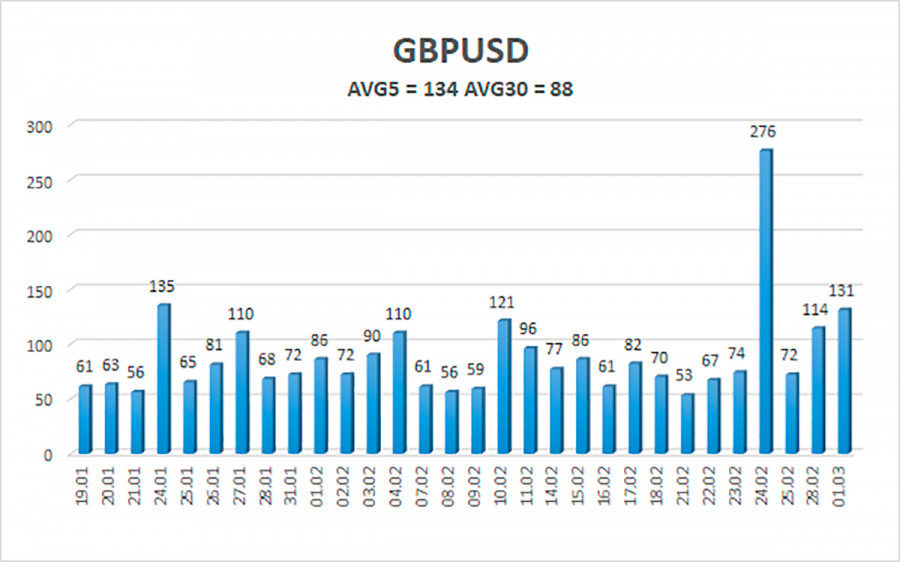

The average volatility of the GBP/USD pair is currently 134 points per day. For the pound/dollar pair, this value is "high". On Wednesday, March 2, thus, we expect movement inside the channel, limited by the levels of 1.3182 and 1.3448. The upward reversal of the Heiken Ashi indicator will signal a new attempt to correct.

Nearest support levels:

S1 – 1.3306

S2 – 1.3245

S3 – 1.3184

Nearest resistance levels:

R1 – 1.3367

R2 – 1.3428

R3 – 1.3489

Trading recommendations:

The GBP/USD pair continues to fall on the 4-hour timeframe and the "bearish" mood persists. Thus, at this time, it is possible to maintain sell orders with targets of 1.3245 and 1.3184 until the Heiken Ashi indicator turns up. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3489 and 1.3550.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.