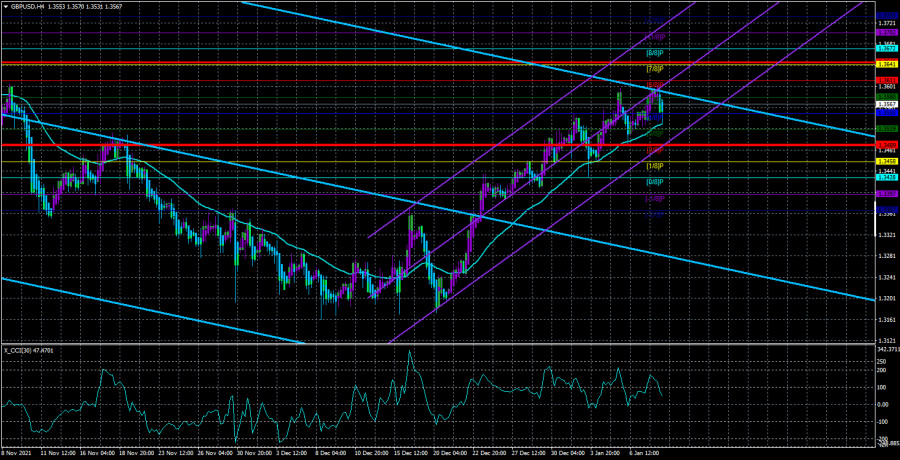

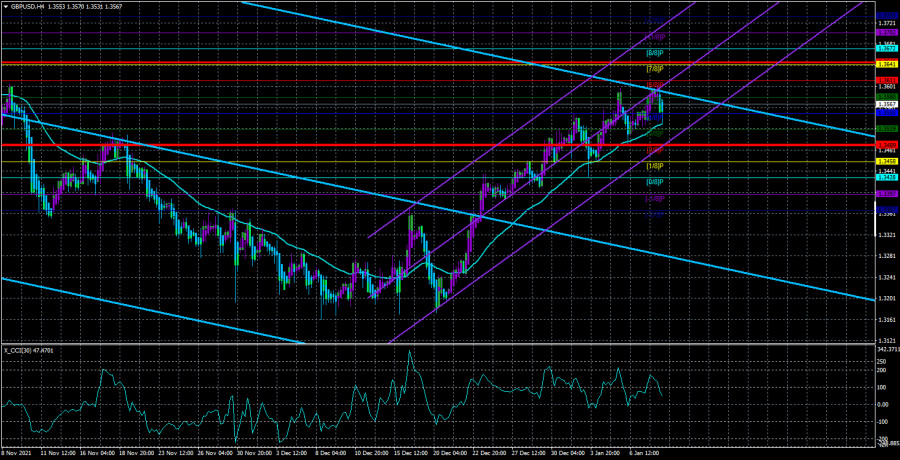

The GBP/USD currency pair on Tuesday again updated its local highs and, thus, maintains an upward trend. But at the same time, it can be seen with the naked eye that the upward movement is slowing down, which indicates the retreat of bulls from the market. However, at the same time, the pair cannot gain a foothold below the moving average line, which does not give reason to conclude that the local upward trend has ended. Thus, the pound sterling continues to rise in price almost unreasonably from a fundamental point of view. We have already said earlier that formally there are reasons. After all, at the end of 2021, the Bank of England raised the key rate. However, since then, the pound has been growing for more than three weeks, so we can say that this factor has been fully worked out by the market. It's time to adjust at least a little, but the bulls are not getting rid of the pound, so the correction does not begin. We draw attention to the fact that the two main currency pairs have been moving quite differently in the last 6-8 weeks. If the euro currency is in one place, then the pound sterling first tried to overcome the level of 1.3175, and then abruptly began an upward trend, which continues to this day. Thus, we continue to expect a downward correction and consolidation below the moving average.

Losses from Omicron could amount to $ 50 billion.

In the UK, meanwhile, the omicron strain continues to rage. Recall that the authorities refused at the end of last year to introduce a "lockdown", which could at least slightly reduce the incidence rate. Therefore, now the country has 150-200 thousand new cases every day. The military has already been sent to help the doctors, as many hospitals simply do not have enough medical personnel. In addition, many Britons who became infected with omicron were forced to go into self-isolation, that is, on sick leave. Given the number of patients currently in the UK, it is not difficult to conclude that many companies and enterprises are experiencing a shortage of staff these days. The Center for Economic and Business Research of Great Britain estimated that two months of 2022 could cost the country $ 50 billion. According to experts, this amount is commensurate with 20% of the losses from Brexit. The center estimated that at some point in time up to 25% of the UK population may be isolated at the same time, although the mortality rate will remain low, as well as the percentage of complications of the disease. However, because a huge number of people are infected with omicron, hospitals may face problems not only due to staff shortages but also due to a large influx of patients, because with a lower percentage of cases with complications, the number of patients is several times higher than before. With the most pessimistic forecast, the UK economy could lose up to 25% of the consequences of Brexit in the early years. It is also reported that the British government is familiar with these figures and some politicians are already ready to change their original point of view and support the introduction of "quarantine".

Thus, although business activity in the services and manufacturing sectors of Britain did not decrease in December, this can be expected by the end of January. At the same time, Boris Johnson's political ratings may suffer even more if the British economy starts to slow down or shrink again. Recall that the latest social studies show that Boris Johnson's popularity is falling not only among voters but also among his fellow party members, many of whom believe that Rishi Sunak, who is now finance minister, would be a better Prime Minister than Johnson. A certain part of respondents even believes that Boris Johnson will leave his post before the end of 2022, that is, ahead of schedule. Therefore, now any wrong decision of a politician who recently became a father for the seventh time is under the microscope, and any deterioration in the epidemiological or economic situation can play a decisive role in Johnson's career.

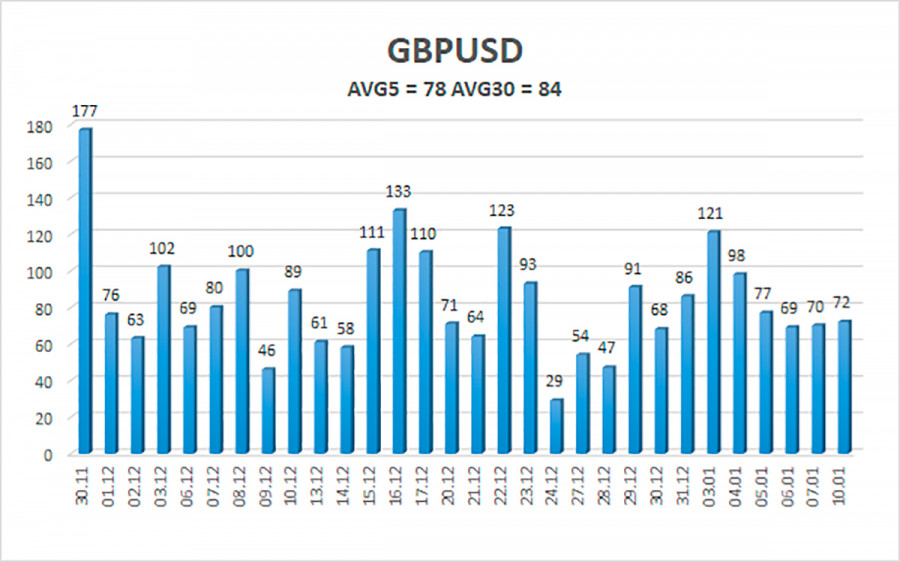

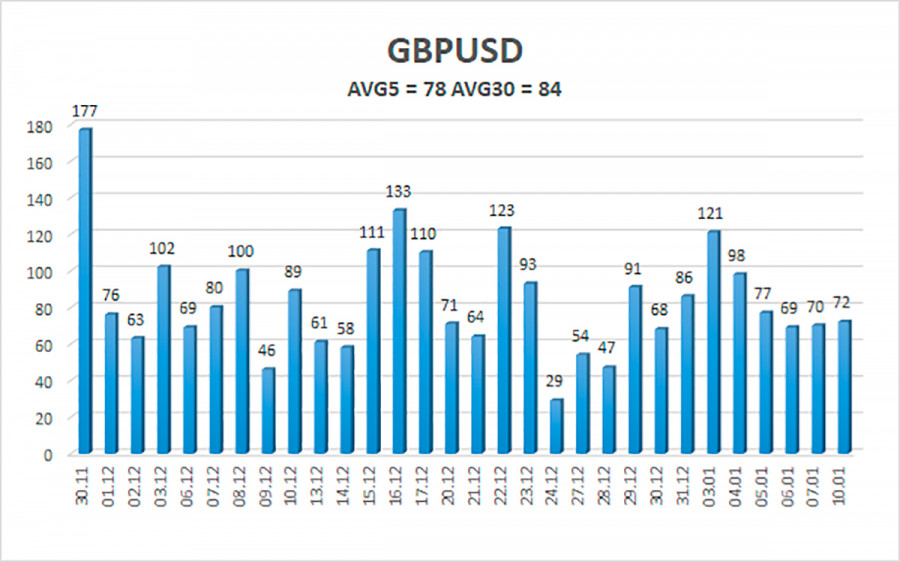

The average volatility of the GBP/USD pair is currently 70 points per day. For the pound/dollar pair, this value is "average". On Wednesday, January 12, thus, we expect movement inside the channel, limited by the levels of 1.3545 and 1.3685. The reversal of the Heiken Ashi indicator downwards signals a possible new round of downward correction.

Nearest support levels:

S1 – 1.3580

S2 – 1.3550

S3 – 1.3519

Nearest resistance levels:

R1 – 1.3611

R2 – 1.3641

R3 – 1.3672

Trading recommendations:

The GBP/USD pair continues a strong upward movement on the 4-hour timeframe. Thus, at this time, it is recommended to stay in the longs with targets of 1.3672 and 1.3685, since the price is still located above the moving average line. It is recommended to consider short positions if the pair is fixed below the moving average with targets of 1.3519 and 1.3489, and keep them open until the Heiken Ashi indicator turns upwards.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.