The pound/dollar pair tried to start a correction this week, but already on Friday the quotes of both major currency pairs collapsed, so the correction is being postponed to a later date. And the movement that we observed after the meetings of the Fed and the Bank of England pulls the maximum back. By the way, Friday's downward movement of the pair is still surprising, if we talk about the fundamentals. After all, there were no interesting fundamental events or important macroeconomic publications on Friday. It is unlikely that the report on retail trade in the UK could even theoretically provoke a fall in the British currency by 80-90 points. Moreover, the European currency also fell by 100 points on Friday, but the British data had nothing to do with it. Thus, we believe that after two days of reflection, the markets have returned to the previous trading strategy - buying the US dollar. Both major pairs over the past two or three weeks have not been able to demonstrate a tangible correction. This means that the bears were clearly in no hurry to close short positions. Consequently, the demand for the dollar is not decreasing, and the euro currency is not growing. In part, this assumption is confirmed by the COT report on the pound. Recall that the number of short positions of major players in the British currency is growing, so it is not surprising that the currency itself continues to remain near its annual lows. By the way, it's quite strange, but at the same time, professional traders in the euro currency do not increase sell contracts.

What awaits us next week in terms of the foundation and macroeconomics? As already mentioned in the article on EUR/USD, next week can be safely called a holiday, because Christmas will be celebrated on Friday and some markets will be open only formally, and many will be closed. Thus, there may simply be no volatility on Friday. As for the first four trading days of the week, they will be as half-empty as in the USA and the European Union. In other words, there will be practically no macroeconomic events. Only on Wednesday will the GDP report for the third quarter be published, but again not in the first estimate, so traders are already ready for the value of +1.3% q/q. However, it is still from the UK that news and messages can come that can theoretically affect the mood of traders. Recall that Britain continues to be the number one supplier of negativity in the foreign exchange market. Boris Johnson regularly gets into various scandals, London and Paris cannot find a common language on the "fish issue" and the "migration problem", London and Brussels are ready to continue negotiations on the "Northern Ireland protocol" for half of next year, and the "coronavirus" and its latest strain "omicron" continue to terrorize the UK. Therefore, the pound sterling as a whole has quite a lot of reasons to continue falling. Another thing is that they are not entirely economic.

However, if the situation with the "coronavirus" continues to deteriorate, then there may be economic reasons for the pound to fall. The fact is that Britain traditionally ranks first in Europe and the world in terms of the number of diseases with the "coronavirus" or any of its strains. Boris Johnson has already ordered not to wait for Omicron to take over the whole country and tighten quarantine measures, but this practice does not help in the fight against the spread of the new strain. Scientists and doctors say that the number of people infected with omicron may well double every few days. Currently, only in the USA, the number of daily recorded cases of the disease is higher than in the UK. However, in the States, the population is much larger. Thus, in the UK, theoretically, a new "lockdown" is very possible, and Boris Johnson needs to be very careful with holding Christmas and New Year's parties since it just recently became known that last year when a strict quarantine was introduced in the country, 10 Downing Street had fun and had fun in a large, friendly and noisy company of representatives of the authorities.

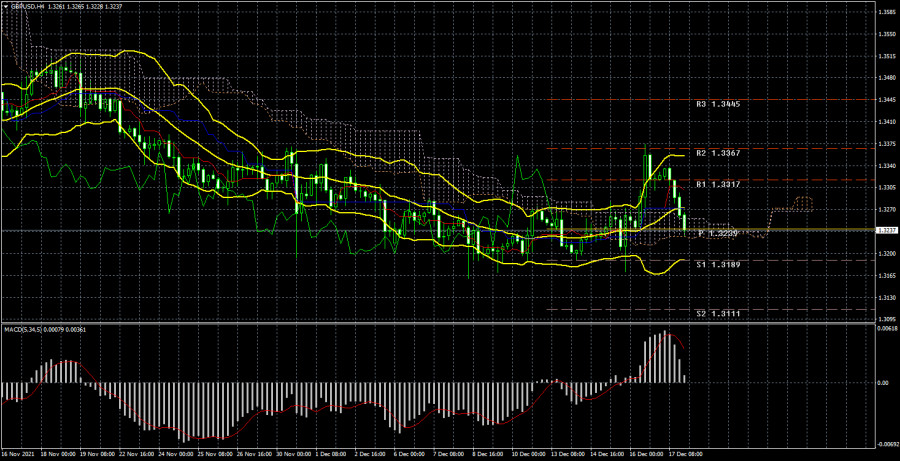

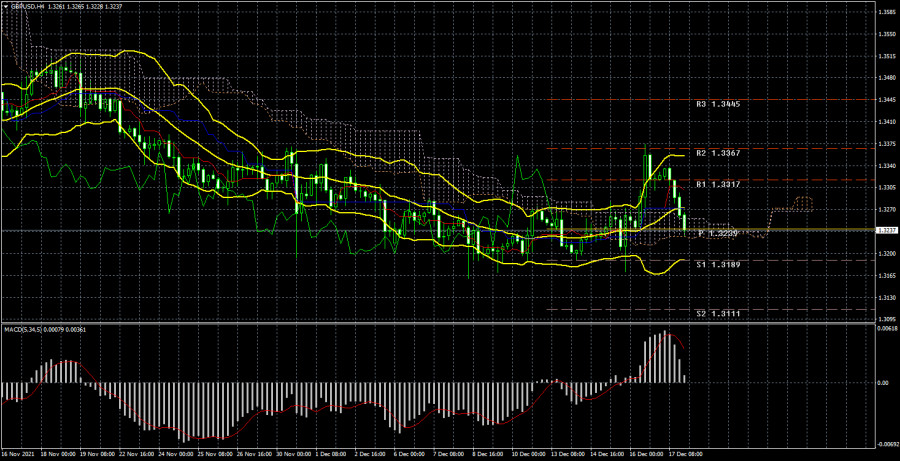

Recommendations for the GBP/USD pair:

The pound/dollar pair tried to start an upward trend on a 4-hour timeframe, but this attempt failed the next day. Thus, at this time it is completely unclear whether buyers are ready to continue to support the British currency. It looks more like the downward movement will be resumed. Moreover, both major currency pairs almost synchronously collapsed on Friday. It should also be noted the level of 1.3192, from which the quotes have already bounced at least 4-5 times. And next week and the New Year's week, volatility may noticeably decrease, and the trend movement may come to naught. This is normal for the festive season.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).