Analysis of Trades and Trading Recommendations for the Euro

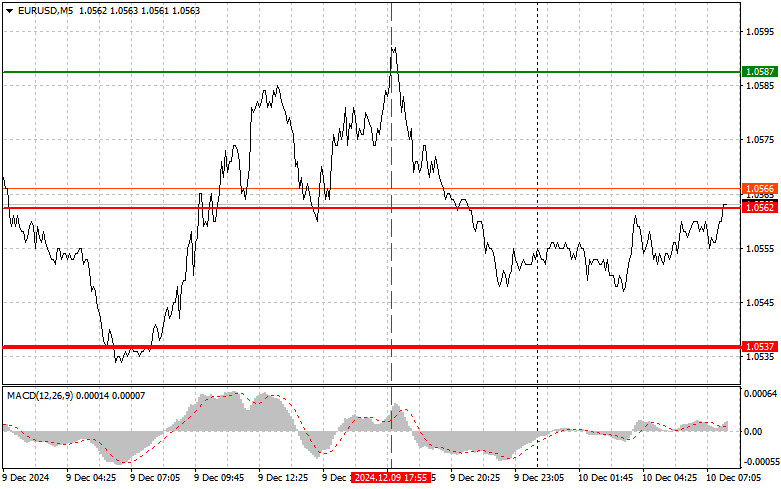

The test of the 1.0587 level occurred when the MACD indicator was significantly above the zero mark, limiting the pair's further upward potential. Therefore, I decided not to buy the euro. No other suitable entry points appeared during the day.

Today's key economic releases include Germany's Consumer Price Index and Italy's Industrial Production figures. These are the primary data points in the first half of the day. German inflation data will likely align with economists' forecasts, having little to no impact on the market. Several factors, including global economic trends, energy prices, and domestic economic indicators, generally influence German inflation. Additionally, the current macroeconomic conditions in Europe suggest relative stability, which supports market participants' confidence and demand for risk assets. However, rising consumer demand and low unemployment could provide a basis for further interest rate cuts to support economic growth.

Today's EU Finance Ministers Meeting will be an important milestone in addressing key issues related to stabilizing the region's economy. On the agenda are measures to combat inflation, which, although declining, continues to pressure households and businesses. Potential steps to improve the efficiency of fiscal policies, control price levels, and exchange views on possible strategies for vulnerable population groups. In addition, the meeting is expected to discuss initiatives for digitizing financial systems in EU member states, which have recently garnered increasing attention from market participants. The discussion will also focus on the budget policy of EU countries and the need to create resilient financial mechanisms for future crises.

For today's trading, I will rely primarily on Scenario #1 and Scenario #2 for trade execution.

Buy Signal

Scenario #1:

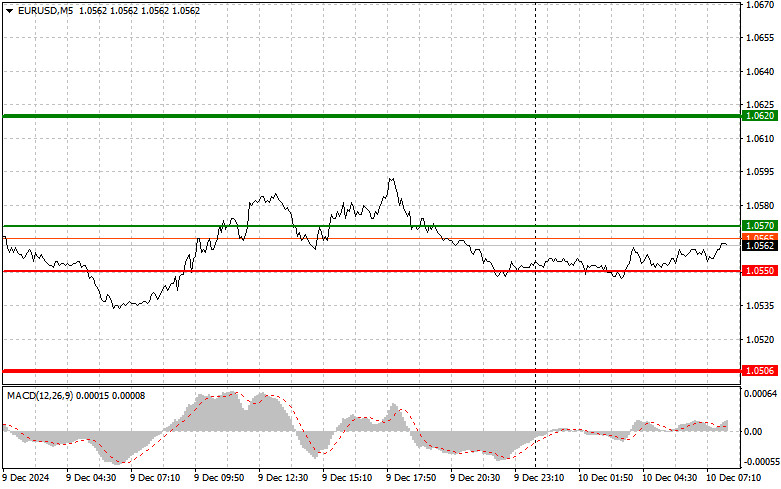

Today, I plan to buy the euro if the price reaches 1.0570 (green line on the chart) with a target of 1.0620. At 1.0620, I intend to exit the market and sell the euro in the opposite direction, aiming for a movement of 30-35 pips from the entry point. Expecting the euro to rise today in the first half of the day is feasible only if favorable data is released.

Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning its upward movement from that point.

Scenario #2:

I also plan to buy the euro today if the price tests 1.0550 twice in succession while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal to the upside. A rise to the opposing levels of 1.0570 and 1.0620 can be expected.

Sell Signal

Scenario #1:

I plan to sell the euro after it reaches 1.0550 (red line on the chart), with a target of 1.0506. At this level, I will exit the market and immediately buy in the opposite direction, aiming for a 20-25 pip movement back from the level. Selling at higher levels is preferable since pressure on the pair can return anytime.

Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning its downward movement from that point.

Scenario #2:

I also plan to sell the euro today if the price tests 1.0570 twice in succession while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal to the downside. A decline to the opposing levels of 1.0550 and 1.0506 can then be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.