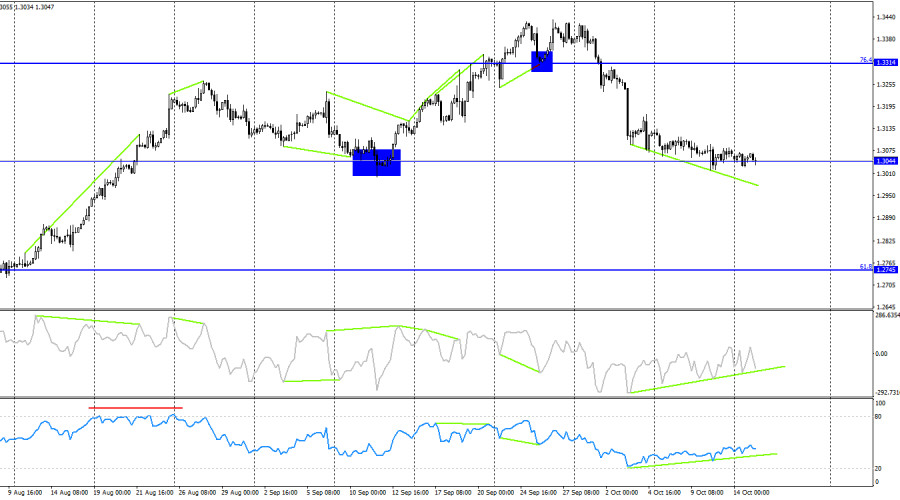

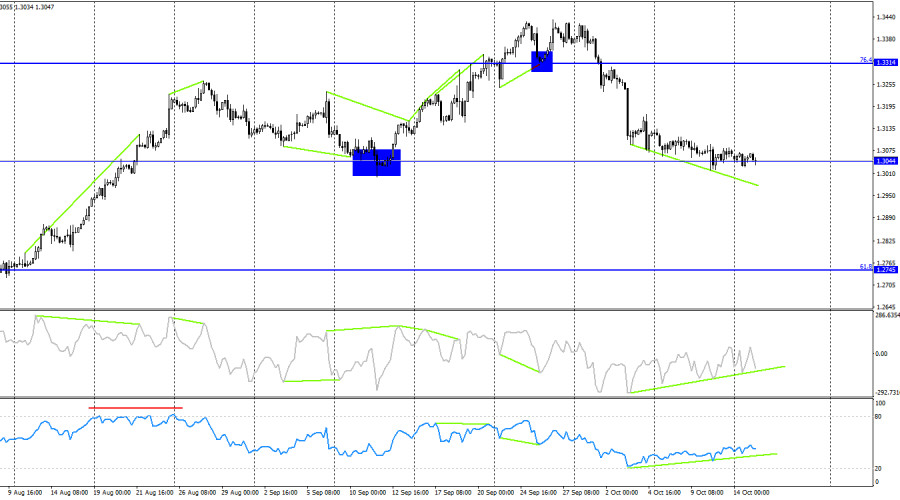

Hi, dear traders! On the 1-hour chart, the GBP/USD pair is still trading sideways along the 127.2% correction level at 1.3054 on Monday, completely ignoring this level. Thus, we should not expect a rebound from it or a consolidation below it in order to open positions. At this time, trading has come to a halt.

There are no questions regarding the wave situation. The last completed upward wave (September 26) did not break the peak of the previous wave. The downward wave, which had been forming for 13 days, easily broke the low of the previous wave, which was located at 1.3311. Therefore, the bullish trend is now considered to be over, and the formation of a bearish trend has begun. A corrective upward wave can be expected from the 1.3054 level, but there are no signals for its start.

On Monday, three high-impact reports were released in the UK, but they had no influence over the movement of the GBP/USD pair. The unemployment rate fell from 4.1% to 4.0%, average wages dropped from 4.1% to 3.8%, and the number of unemployed increased by 28K in the UK. Overall, this statistical package can be viewed as positive for the pound sterling, but the market remains at a standstill, and traders are not willing to open any trades. What could move the GBP/USD pair from its deadlock? Only actions from a major player or strong news background. Tomorrow, the UK will release its inflation report, which could trigger a new drop in the British pound. If inflation falls below 2% (the Bank of England's target level), the chances of a sharper rate cut will increase. For the pound, this would mean that it could continue its decline. The bulls have been attacking for too long, ignoring many factors that are not positive for the pound. Now, market sentiment has shifted to bearish.

On the 4-hour chart, the GBP/USD pair has dropped to the level of 1.3044. For more than a week, a bullish divergence has been building up on both indicators, warning of a potential rebound from the 1.3044 level. A rebound from 1.3044 would signal some growth, but I do not expect a significant rise in the pound sterling. Consolidation below 1.3044 would suggest a continuation of the decline towards the 61.8% Fibonacci level at 1.2745, despite the divergences. By doing so, the bears will showcase their readiness to continue their attacks.

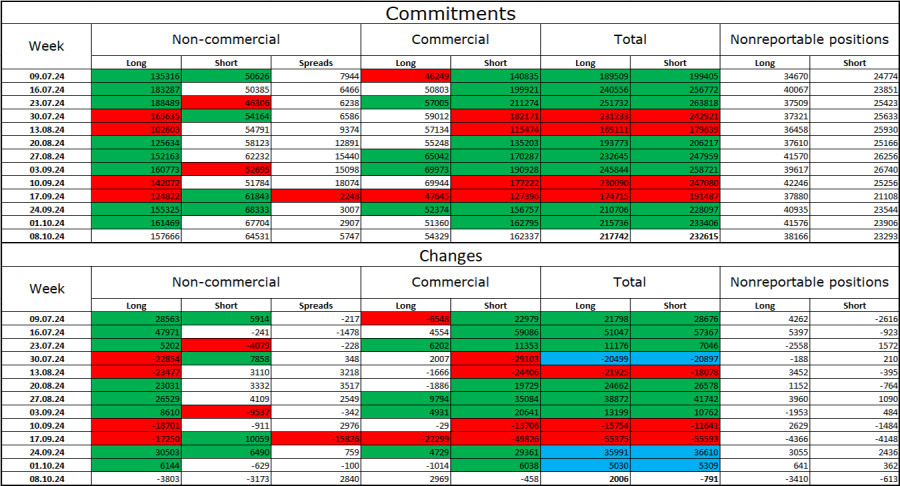

Commitments of Traders (COT)

The sentiment of the Non-commercial trader category has not changed over the past reporting week and remains bullish. The number of long contracts held by speculators decreased by 3,803, while the number of short contracts decreased by 3,173. Thus, for two weeks, professional players have been cutting on long positions and adding short ones, but now they have resumed buying the pound. The bulls still hold a solid advantage. The gap between the number of long and short contracts is 93K: 158K versus 65K.

In my opinion, the pound still has enough room for a decline, but the COT reports suggest otherwise. Over the last three months, the number of long contracts has increased from 135K to 158K, while the number of short contracts has risen from 50K to 65K. I believe that over time, professional players will begin to reduce their long positions or increase their short positions, as all possible factors for buying the pound have already been priced in. Chart analysis indicates that this process may start soon.

Economic calendar

UK: unemployment rate due at 06-00 UTC

UK: number of unemployment due at 06-00 UTC

UK: average wage due at 06-00 UTC

On Tuesday today, the economic calendar contains three important reports that have already been released and had no impact on the pound sterling. The influence of the information background on market sentiment for the rest of the day will be zero.

GBP/USD forecast and trading tips

Sell positions on GBP/USD were relevant after a rebound from 1.3425 on the 1-hour chart, with targets at 1.3357, 1.3259, 1.3151, and 1.3054. All targets have been already hit. I believe that short positions can be closed. New short positions can be planned if the instrument closes below 1.3044 on the 4-hour chart with a target of 1.2931, but preferably after a correction. I don't see any potential buy signals at the moment.

The Fibonacci grid levels are spotted between 1.2892 and 1.2298 on the 1-hour chart and between 1.4248 and 1.0404 on the 4-hour chart.