The GBP/USD currency pair resumed its upward movement on Wednesday. It is worth noting that several reports have already been released in the UK this week, which, despite all efforts, cannot be considered positives for the pound. Additionally, an extremely important inflation report was published in the US, which supported the American currency. However, all we saw was a mundane and weak technical correction of the GBP/USD pair after it had been rising groundlessly for several weeks. Thus, we continue to believe that the market is currently completely ignoring the macroeconomic and fundamental background. Yes, there is a local reaction to the reports, but the global technical picture remains unchanged. The pound sterling continues to rise, although it has no reason to do so.

Recall that at the beginning of the year, the market expected the Fed to cut rates in March and the Bank of England - sometime later. According to the market, this "later" was supposed to come much later. We cannot deny that market participants indeed had the right to think so because inflation in the UK at that time was much higher than in the US. It remains higher now as well. And most importantly, it is twice as high as the target level of 2%. Thus, based solely on this factor, it is reasonable to say that the Bank of England will start easing its policy much later than the Fed.

However, we want to remind you that the later the Fed cuts rates, the better the dollar should feel. The earlier the Bank of England cuts rates, the worse the pound should feel. The timing of the first Fed easing has moved several months forward over the past two months, while the timing of the first Bank of England rate cut has moved several months back. This information alone should have provided worthy support for the American currency. But instead of the expected decline in the pair, we saw another rise.

Furthermore, it is far from certain that the Fed will start easing even in June because inflation in the US refuses to decrease just as the market refuses to buy the dollar. Either market makers urgently need billions of pounds or they no longer pay attention to the central banks' monetary policies. As we have already said, if major players do not start selling the GBP/USD pair, then there can be no decline a priori under any fundamental background.

On Wednesday, the market eagerly seized upon the GDP report for January, which showed an unexpected growth of 0.2%. At the moment, the pound slightly decreased but failed to overcome the moving average line and again headed upwards. Traders again did not notice that industrial production in the UK had decreased in volumes and was below experts' forecasts. But what does it matter if the market interprets all news in favor of the pound? If the economy grew by 0.2% in January, it means there is no recession. Everything is logical and simple. Thus, logically, the pound sterling should start falling and remain there for at least a few months. But we will not see anything like this until market makers start paying attention to global factors. There are no technical sell signals at the moment, either.

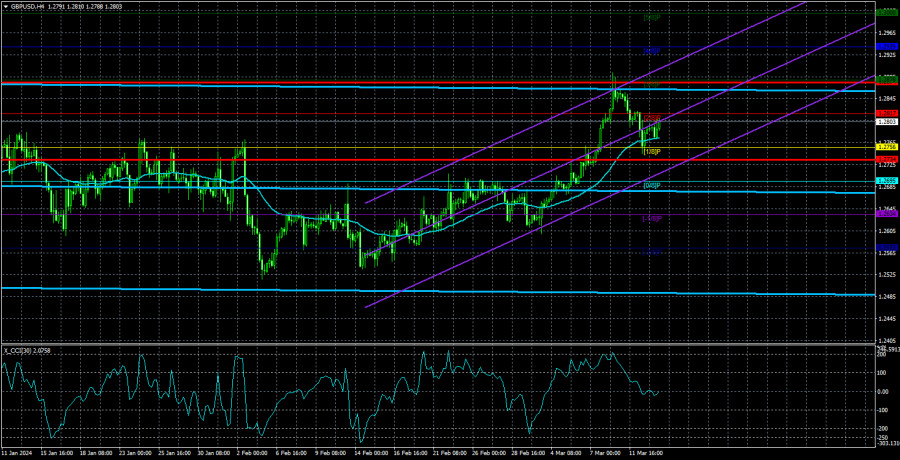

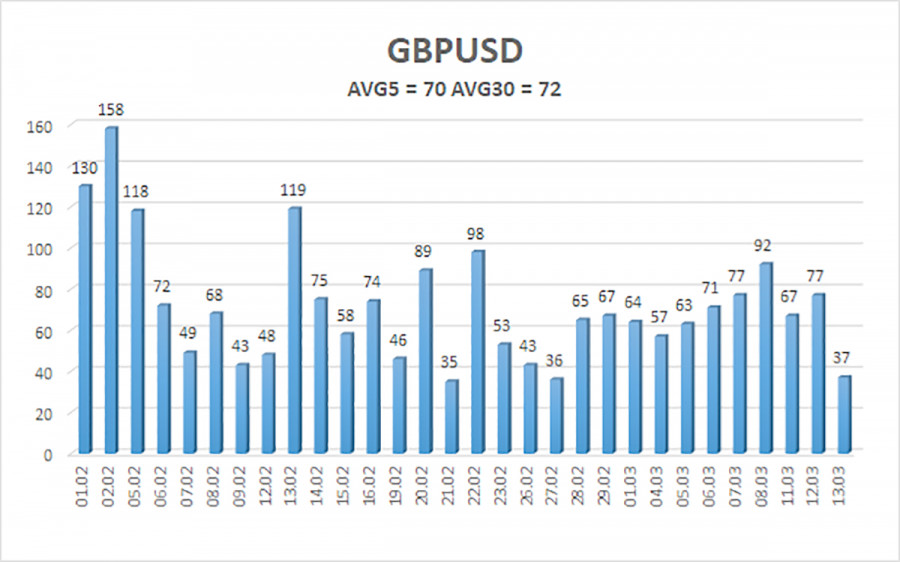

The average volatility of the GBP/USD pair over the last 5 trading days is 70 points. For the pound/dollar pair, this value is considered "average." Therefore, we anticipate movement within the range defined by the levels of 1.2734 and 1.2874 on Thursday, March 14. The senior channel of linear regression is still sideways. Thus, there are no questions about the current trend. The CCI indicator has not entered the oversold area recently, nor has it entered the overbought area. The market is currently trading illogically.

Nearest support levels:

S1 - 1.2756

S2 - 1.2695

S3 - 1.2634

Nearest resistance levels:

R1 - 1.2817

R2 - 1.2878

R3 - 1.2939

Trading recommendations:

The GBP/USD currency pair has broken out of the flat and is trying to resume the upward trend. We still expect the movement to resume to the south with targets at 1.2543 and 1.2512; however, the market still refuses to sell the pound and buy the dollar, completely ignoring the fundamental and macroeconomic background. Long positions can formally be considered when the price is above the moving average line, with the target at 1.2878. However, there are no sell signals at the moment for any timeframe.

Explanations for illustrations: Linear regression channels - help determine the current trend. If both are directed in the same direction, it means the trend is strong at the moment.

Moving average line (settings 20,0, smoothed) - determines the short-term trend and the direction in which trading should be conducted at the moment.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.