The GBP/USD currency pair continues to trade within a limited price range. On the 4-hour timeframe, it may not be so noticeable, but on the daily chart, the flat movement is evident even from a distance. A few weeks ago, the price reluctantly left the sideways channel of 1.2611-1.2787, and after that, practically nothing has changed in the character or direction of the pair's movement. Thus, from a technical point of view, absolutely nothing has changed. The pair is still in a flat, which on lower timeframes looks like alternating trends. For example, since February 5th (a whole month), the British currency has been rising. However, movements in either direction are currently so weak that in one month, the pound has managed to appreciate by only 200 points in a trending movement. Currently, the price is near the upper boundary of the sideways channel at 1.2787, and overcoming it will allow us to expect a more powerful and even more logical rise of the British currency.

In the article on EUR/USD, we dedicated several paragraphs to explaining illogical movements. All this information is even more applicable to the pound than to the euro. If the European currency has at least slightly declined in recent months (which is absolutely logical), the pound has deemed such maneuvers unnecessary and has been trading in a flat for three months now, near its local (for the 24-hour timeframe) highs. Therefore, if illogicality is present in the current market, it is precisely with the pound.

This week, the British currency has increased by 100–120 points, but what reasons did it have for this? In the UK, there were no events or publications. In the US, JOLTs, ADP, and ISM reports were not disastrous enough to provoke a daily decline in the dollar. And Jerome Powell was leaning more "hawkishly" than otherwise. Let's briefly analyze the Fed chairman's speech to make sure of this.

In essence, the entire meaning of what was said in the US Congress boils down to a few phrases. If we omit all the "water," we are left with the following. The key rate is likely to remain at its maximum value. Inflation has decreased significantly in the past year but is still not close enough to 2%. It would be appropriate to begin easing monetary policy at some point in 2024. Economic prospects are unclear, and further progress in reducing inflation is not obvious or guaranteed. The Fed will move towards easing monetary policy only when it is confident in achieving the long-term inflation target of 2%.

In other words, Powell essentially indicated that the Fed is not ready to lower rates in the near future. Inflation has not only failed to decrease over the past seven months but has even increased by 0.1% in annual terms. If inflation has not been decreasing for more than half a year, what kind of monetary policy easing can be talked about at all? Thus, Powell's speech should have triggered a rise in the American currency, as the Fed can potentially keep the rate at a maximum for even longer now. Currently, the market consensus is June. In reality, the first rate cut may happen even later. But the market interpreted Powell's words in its own way, so we saw another rise in the British currency.

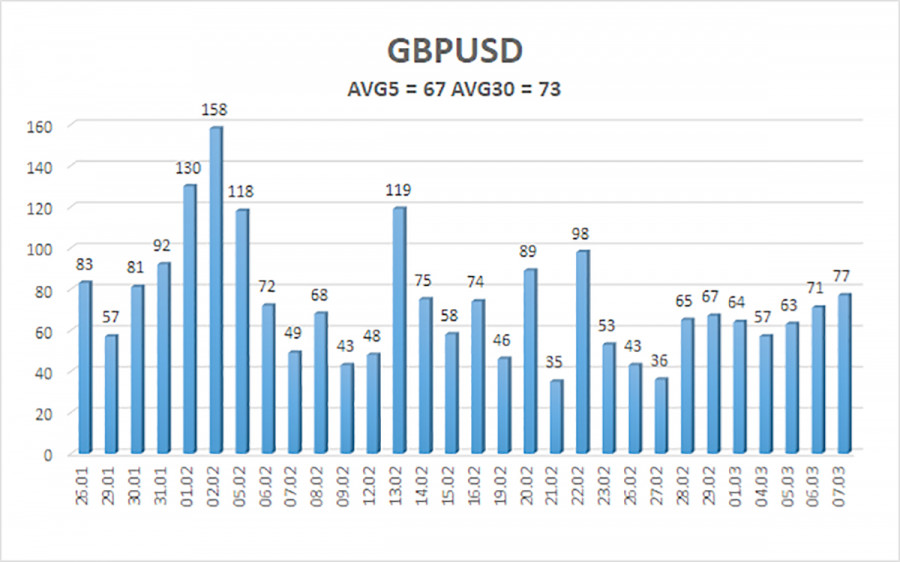

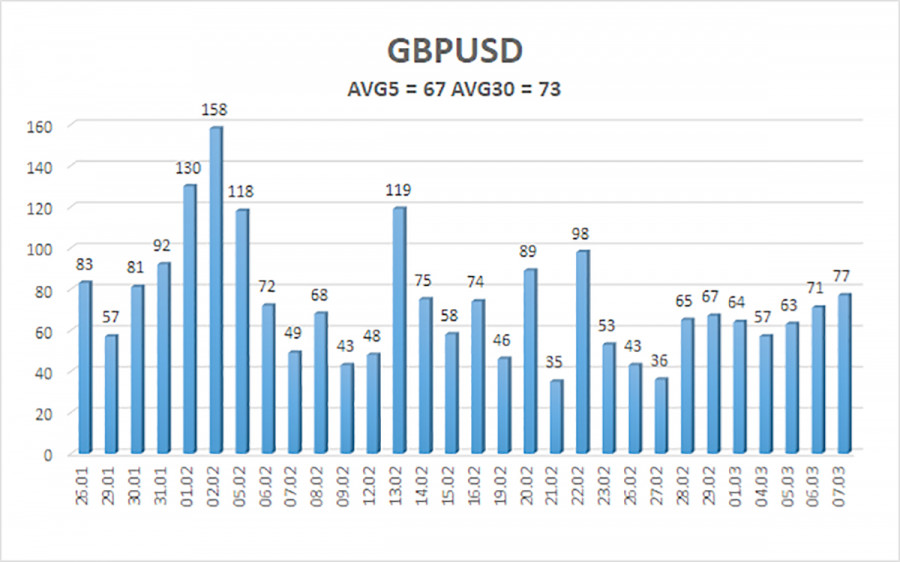

The average volatility of the GBP/USD pair over the last 5 trading days is 67 points. For the pound/dollar pair, this value is considered "average." On Friday, March 8th, we expect movement within the range limited by levels 1.2733 and 1.2867. The senior linear regression channel is still sideways. Thus, there are no questions about the current trend. The CCI indicator has not entered the oversold or overbought zone lately. We do not expect a strong rise in the pair, but within the sideways channel, the movement can be in any direction.

Nearest support levels:

S1 – 1.2787

S2 – 1.2756

S3 – 1.2726

Nearest resistance levels:

R1 – 1.2817

R2 – 1.2848

Trading recommendations:

The GBP/USD currency pair continues to trade in a global flat. We expect a resumption of the movement to the south with targets at 1.2543 and 1.2512, but it is difficult to say how much time will pass before the pound realizes it has no grounds for growth. Long positions can formally be considered when the price is above the moving average, with targets at 1.2848 and 1.2867. A reversal down may occur in the near future, but for this, not only strong statistics from the US will be required but also the common sense of market participants.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20.0, smoothed) determines the short-term trend and direction, in which trading should currently be conducted.

Murray Levels are target levels for movements and corrections.

Volatility levels (red lines) are the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI Indicator – its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.