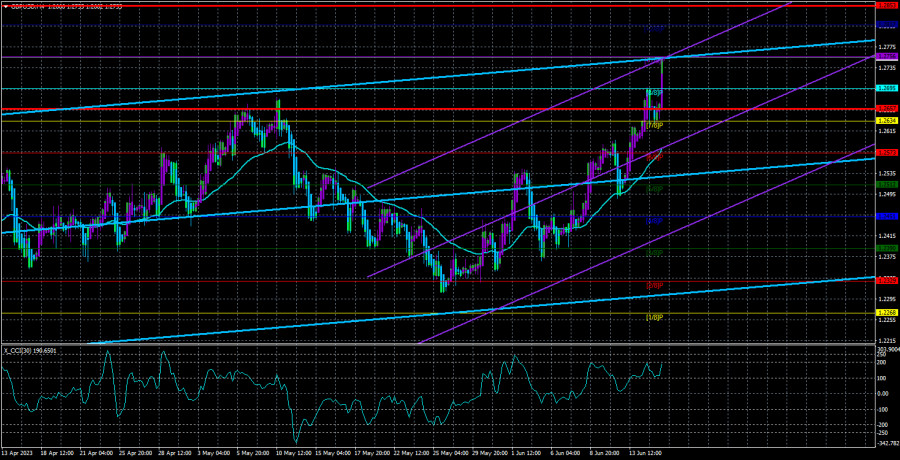

Despite a slight pullback immediately after the meeting results announcement, traders will find it difficult to discern in the above illustration, which shows the 4-hour timeframe. In other words, the pullback could have been stronger, and not only did the price update its last local peak from yesterday, but it also struggled to make a proper correction to the moving average. Therefore, the conclusion remains the same: the pound continues to grow, mostly without reasonable grounds and heavily overbought. We still believe that the fundamental backdrop does not support the British currency, but we are facing a situation similar to two or three months ago when the pair was rising both with and without reason.

Essentially, the market is difficult to blame for bias. It buys when there is support for the pound and sells when there isn't. Everything was as usual. However, on weak news or while waiting, the pound can rise by 100 points and fall by 20 when a strong report is released in the United States. In other words, the market's reaction to most events is illogical. For example, the pound rose vigorously on Wednesday from the morning onwards. However, there was no basis for it because the macroeconomic statistics in the UK turned out to be rather mediocre and certainly did not support it in any way. Nevertheless, the pound had risen another 100 points by evening, even though it had already shown excellent growth.

Based on what grounds could the market buy again? Based on the fact that the Federal Reserve might pause in tightening? That has been known for a long time. The Bank of England also cannot constantly raise rates and is close to the tightening cycle's end. Moreover, the Federal Reserve has sent clear signals that the rate may increase twice in 2023, which the market could not anticipate (we will discuss this further below). Thus, the pound continues to rise too strongly and fall too weakly.

The Federal Reserve sent "hawkish" signals, and the market believed it, but the dollar did not react.

Essentially, the Federal Reserve implemented the most anticipated scenario. The rate remained unchanged, as did all other parameters of monetary policy. Therefore, the main attention was focused on Jerome Powell's speech. If we exclude all the "fluff," all that remains is that "the decision on the rate will be made from meeting to meeting in the future, and inflation will continue to be closely monitored." This rhetoric from the head of the Federal Reserve means that it is still too early to end the rate hike question. However, Powell also did not guarantee a rate hike in 2023. Forecasts for the final rate value immediately jumped to 5.6%, whereas previously, they were only 5.1%. However, the market is already overly optimistic in its interpretation of signals from the Federal Reserve.

To begin with, inflation in the United States has already slowed to 4% and is declining rapidly. Why raise rates further if inflation is already decreasing without it? Of course, it may stop doing so over time, but even a 5.25% rate should be sufficient to bring inflation down to 2%. The Federal Reserve wants to solve this problem as quickly as possible, but is it worth risking economic growth? We believe the market can count on a maximum of one more rate hike, an "emergency" one. But at the same time, the expectation of two more tightenings should have prompted a sharp strengthening of the US currency, which we naturally did not see. As for the Bank of England, there has yet to be any information. The meeting will occur next week, and forecasts favor another 0.25% rate hike, which could be the last.

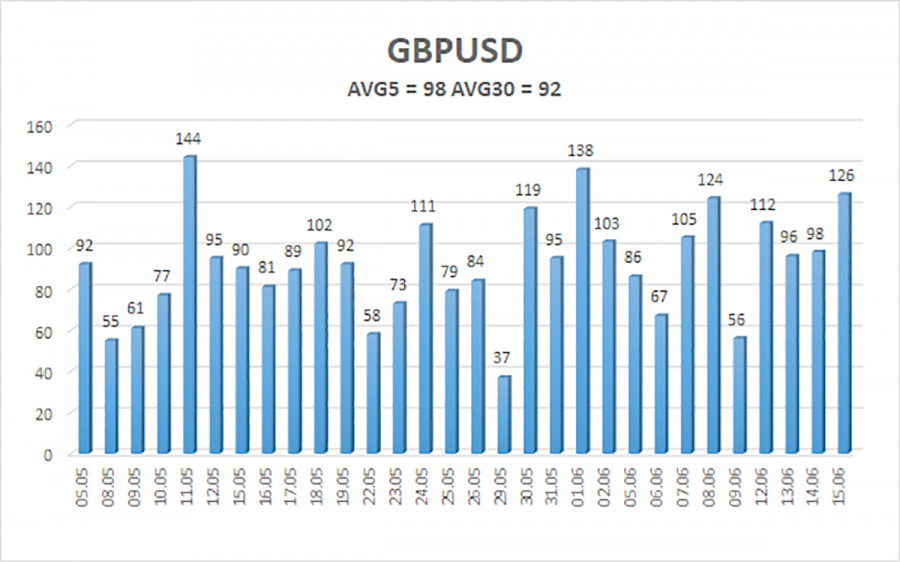

The average volatility of the GBP/USD pair over the past five trading days is 98 points. For the GBP/USD pair, this value is considered "average." Therefore, on Friday, June 16th, we expect movements within the range limited by the levels of 1.2657 and 1.2853. A reversal of the Heiken Ashi indicator downwards will signal a corrective move.

Nearest support levels:

S1 - 1.2695

S2 - 1.2634

S3 - 1.2573

Nearest resistance levels:

R1 - 1.2756

R2 - 1.2817

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair stays above the moving average line. Therefore, long positions with targets at 1.2817 and 1.2853 remain relevant and should be held until the Heiken Ashi indicator reverses downwards. Short positions can be considered if the price consolidates below the moving average with targets at 1.2573 and 1.2512.

Explanation of the illustrations:

Linear regression channels - help determine the current trend. It indicates a strong trend if both channels are in the same direction.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair is expected to move in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an approaching trend reversal in the opposite direction.