The GBP/USD currency pair began a significant decline on Monday, which is logical for a single day. It is worth noting that the British pound again shows unjustified growth in the medium term, which is difficult to explain even with assumptions from the realm of fantasy. The pound is experiencing the strongest growth among the G10 countries this year. For example, at the end of last week, it was trading around the 1.2580 level, which is only 100 points below the highest point in the past year. In other words, we are once again witnessing only a weak correction after the pound rose by more than 23 cents against the dollar.

The British currency is still trading too high and is unreasonably expensive. Therefore, we can only forecast its further decline. Despite all efforts, we cannot find any factors supporting its growth. In previous articles, we have already suggested that the market is counting on a more significant rate hike ("market scenario") than what is included in the "base scenario." The "base scenario" suggests that there will be, at most, one more rate hike of 0.25%. The regulator could have paused at the May meeting, despite the soaring inflation that cannot be "extinguished."

It is worth noting that headline inflation has decreased by 1.4%, but core inflation has increased by 0.7% annually. How should we interpret these figures? Is inflation increasing or decreasing? Will the Bank of England disregard core inflation? We believe not. Both indicators should decrease for the regulator to have grounds for ending the tightening cycle. However, the British economy has shown zero growth for several consecutive quarters. The labor market and unemployment are deteriorating, so the Bank of England must keep tightening. However, the market seems to believe that the rate will continue to rise, which could theoretically explain the pound's high position.

UK statistics may disappoint once again.

Considering the completely unjustified and unfair positioning of the pound against the dollar, the outcomes of the Federal Reserve and Bank of England meetings do not carry much significance. It all depends on the market itself and what it believes. If the Bank of England does not raise the rate next week, it could trigger a significant decline in the British currency, indicating the approaching end of the entire tightening cycle. This week, the Federal Reserve is likely to pause until the next meeting, with a probability of 75%, so the dollar is unlikely to receive support from the market. More precisely, it may start rising against the euro again (as practically all factors and types of analysis indicate). Still, it will need substantial grounds to buy it against the pound. Therefore, the GBP/USD pair should be approached differently. It is not necessary to closely examine British economic statistics. It is worse than the American data, which has no impact on the dollar or pound positions. Therefore, we can only wait for the market to become saturated with further pair purchases or for the Bank of England to pause.

Today, important reports on unemployment, jobless claims, and wages will be published in the UK. The last report is secondary but still significant. The main focus will be unemployment, which may rise to 4-4.1%, and jobless claims, which may exceed the forecast by 22,000. However, the pound, already rolling on the "swings" with an upward bias, has little movement logic. On Monday, we saw its decline, unrelated to "fundamentals" or macroeconomics. Today, when weak data may be published in the UK, the pound is quite capable of showing a new surge in growth.

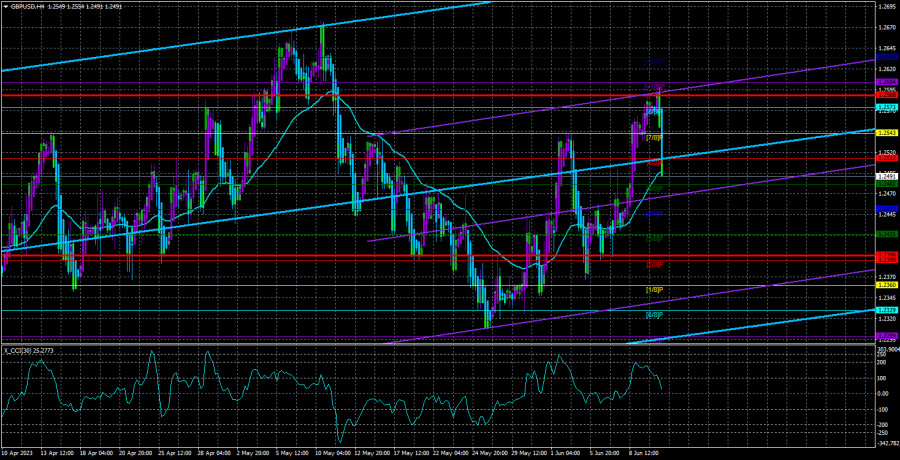

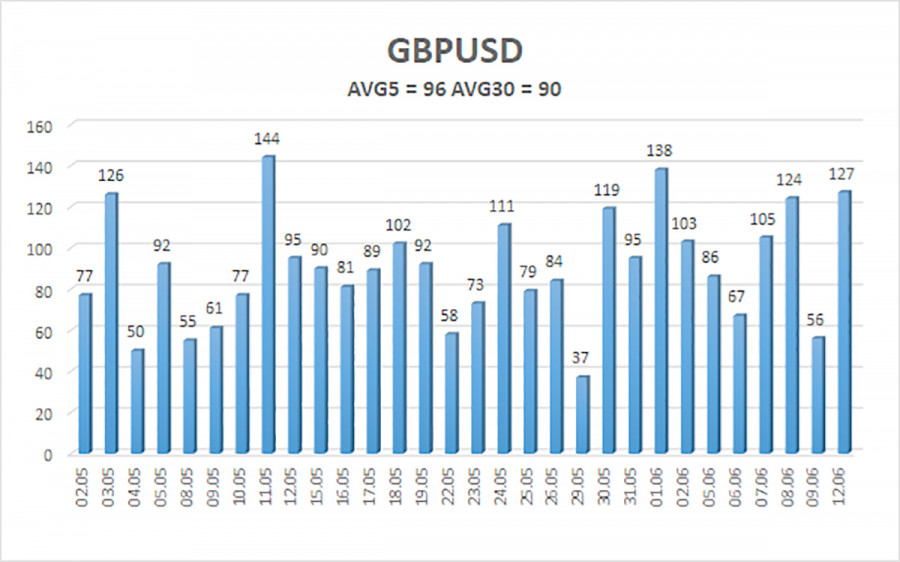

The average volatility of the GBP/USD pair over the past five trading days is 96 pips. For the pound/dollar pair, this value is considered "average." Therefore, on Tuesday, June 13th, we expect movements within the channel to be limited by the levels of 1.2396 and 1.2588. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 - 1.2482

S2 - 1.2451

S3 - 1.2421

Nearest resistance levels:

R1 - 1.2512

R2 - 1.2543

R3 - 1.2573

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair stays above the moving average line, so long positions with targets at 1.2543 and 1.2588 remain relevant. These positions should be opened if the price bounces off the moving average. Short positions can be considered if the price consolidates below the moving average with targets at 1.2451 and 1.2396. There is also a high probability of "swings."

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair is expected to move in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold region (below -250) or overbought region (above +250) indicates a potential trend reversal in the opposite direction.