The currency pair EUR/USD ended last week as it started. The pair have been virtually flat for several weeks but with a minimal upward slope. In other words, the upward trend is maintained but continues to weaken, and the pair still cannot correct downward. Thus, we still believe the bulls control the market with their last strength. Recently, many experts have stated that the European currency may continue to rise as the Fed is effectively ready to end its monetary policy tightening cycle. But for some reason, these same experts forget that the Fed's rate is higher than the ECB's and will remain so, that the American economy is slowing down but still feeling better than the European one. The ECB may also end tightening soon. Such forecasts look like an attempt to explain what is happening in the market.

Market movements are not always logical, and this needs to be understood. The task of various economists is not just to explain the current movement post-factum but to make the correct conclusion. Suppose the movement does not correspond to the current fundamental background. In that case, this is the conclusion that needs to be made rather than trying to explain the uncorrected growth of the euro currency by the end of the Fed's rate hike cycle. Other factors in the market affect exchange rate formation, and many of them support the dollar. But the dollar cannot even grow on strong macroeconomic statistics. It cannot correct even for purely technical reasons. How often have various economists explained this or that movement as a "correction"? Where is this correction now if the pair has grown for two months?

Therefore, it is appropriate to refer to things by their proper names. No one denies the growth of the pair. It can be worked on and earned. But it is important to understand that such a "fairytale" will not last forever for the euro currency. All possible factors can indicate that it will collapse downward. COT reports, the CCI indicator, the absence of a correction, the lack of a clear background in favor of the euro, and the market's ignoring positive news for the dollar.

The ECB will continue to raise rates, which is no secret.

The results of this or that central bank meeting are often reduced to a couple of simple theses. Monetary policy is like the Titanic in the Atlantic Ocean, and it isn't easy to turn around. There are one and a half months between the meetings of the central banks. What should the representatives of the central bank talk about during these one-and-a-half months? Naturally, they repeat the same rhetoric over and over again. French central bank governor Francois de Galhau said last week that the ECB rate would continue to rise, but he advocates for less tightening. He did not explain what he meant by "less than." Therefore, the essence of his rhetoric is absolutely zero. De Galhau noted that there will likely be several more rate hikes. Most experts believe that rates will rise by another two times after Thursday's meeting by 0.25%.

Mr. de Galhau also noted that the ECB's goal is to reduce inflation without provoking a recession, and from our point of view, this is an important point. The European Union is currently experiencing zero economic growth rates, but as representatives of many central banks have stated, rate hikes have a long-term impact on the economy. If inflation can continue to fall for some time after the end of the tightening cycle, then the economy can continue to contract for some time. Thus, we still believe that the ECB will not bring its rate to the level of the Fed's rate. The European regulator will increase the rate in 2023 by a maximum of 0.5% more than the Fed. And most likely, the market has already worked out these increases several times, as the euro has been growing for two months in a row. And before that, it could not properly correct the strong growth in the second half of last year.

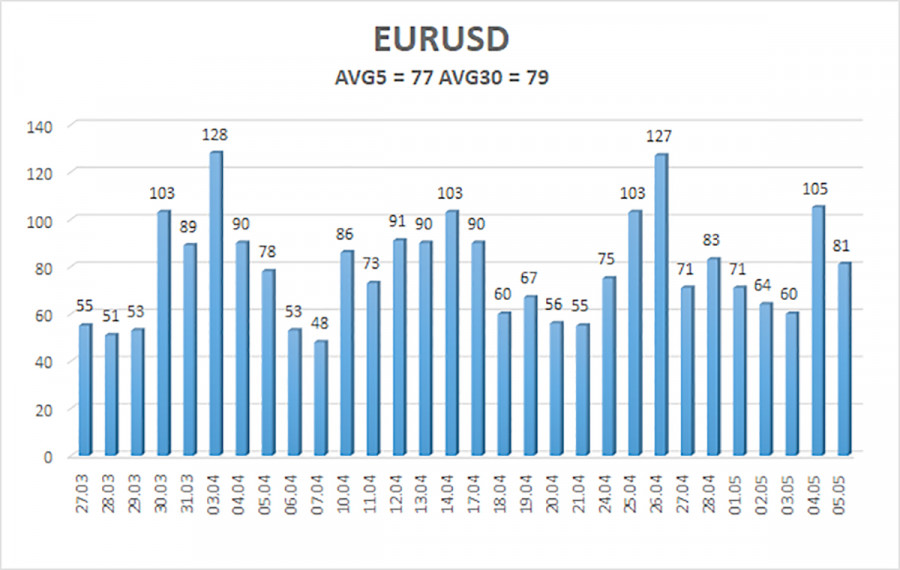

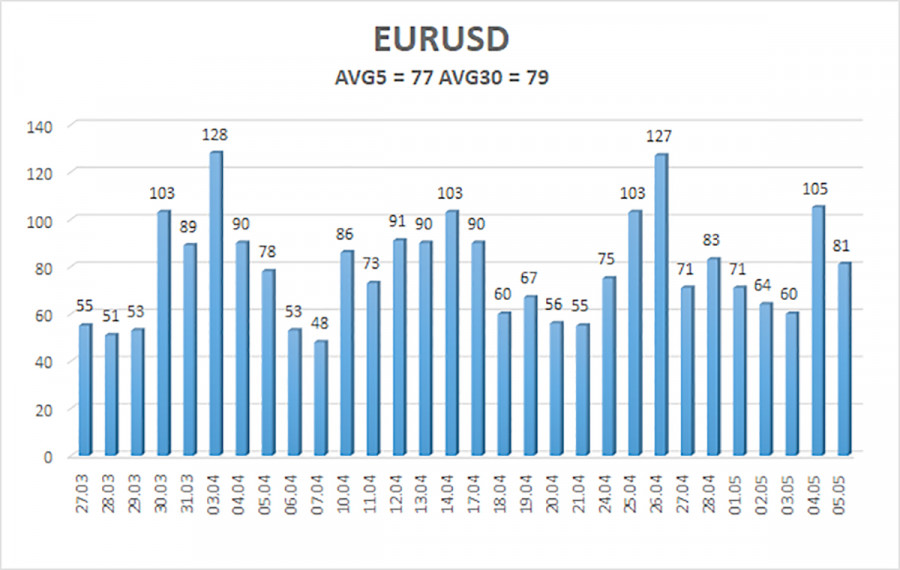

The average volatility of the euro/dollar currency pair over the last five trading days as of May 7 is 77 points and is characterized as "average." Thus, we expect the pair to move between levels 1.0942 and 1.1096 on Monday. A reversal of the Heiken Ashi indicator back down will indicate a new round of downward movement within the flat.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair is again trying to resume its upward movement, but it is more flat. Currently, the movement is virtually sideways, so trading can only be based on reversals of the Heiken Ashi indicator. Or on the youngest timeframes, where at least intraday trends can be captured.

Explanations for illustrations:

Linear regression channels help determine the current trend. If both are directed in one direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.