The dollar went on the offensive immediately after the opening of today's trading day. During today's Asian trading session, the dollar strengthened but then gave up some of its positions at the beginning of the European trading session. Such dollar dynamics will probably last until the announcement of the results of the Fed meeting, which will end on Wednesday with the interest rate decision at 19:00 GMT.

However, volatility could spike even before that event: an update on the US inflation data will be released on Tuesday (13:30 GMT). Inflationary pressures are expected to ease in November. Economists forecast that annual consumer inflation in the U.S. fell to 7.3% in November from 7.7% a month earlier. Previous annual CPI readings were: 8.2%, 8.3%, 8.5%, 9.1% in June 2022. As we can see, the Fed's tight monetary policy is paying off as U.S. inflation is slowing. Meanwhile, the U.S. labor market continues to be strong, while the unemployment rate is at its pre-pandemic minimum of 3.7% (vs. 3.7% in October, 3.5% in September, 3.7% in August, 3.5% in July, 3.6% in June, May, April and March, 3.8% in February, 4.0% in January 2022).

In other words, the stage is set for the Fed to slow down its policy tightening. Moreover, the threat of recession in the U.S. is still high (economists estimate that the combination of high inflation, which reduces the purchasing power of the population, and aggressive rates of tightening of monetary policy will lead to a recession in the economy, which will begin in the second quarter of 2023). To continue to raise interest rates in a recession is suicidal for the economy.

It is likely that strategic investors who make trading plans with long cycles have already begun to prepare for at least a slowdown in the Fed's tightening cycle, and at a maximum, the reverse process, i.e. the easing of monetary policy in the United States.

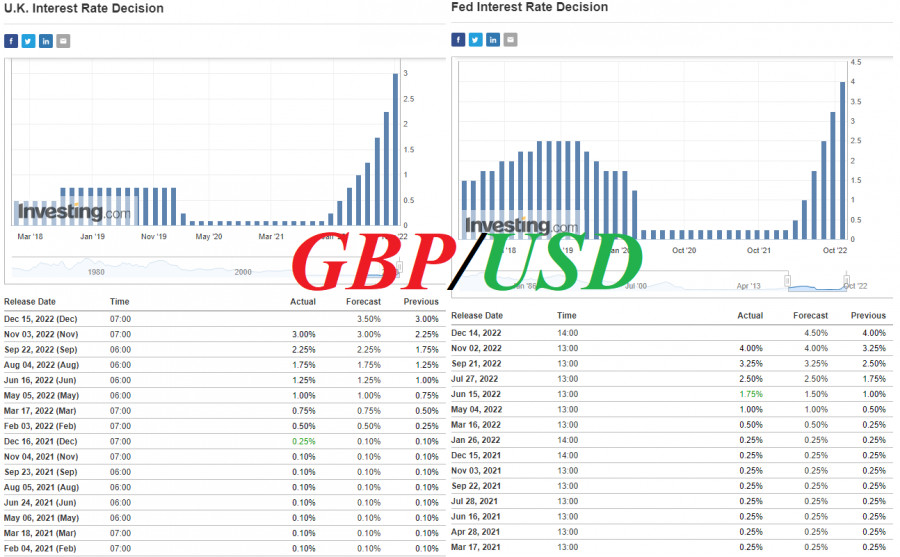

Now, it is widely expected that at the meeting on December 13–14, the Fed policymakers will again raise the interest rate, but not by 0.75% as it was in June, July, September and November, but by 0.50%. Recall that the Fed's decision will be published at 19:00 (GMT). At the press conference, which will start half an hour later, Fed Chairman Jerome Powell will explain the central bank's decision and probably hint at the future plans of his agency.

Of the events today, it is worth highlighting the publication (at 07:00) of macro data from the UK. Among other data—GDP, which rose significantly (+0.5% after falling -0.6% in September). The data also pointed to a slowdown in the negative dynamics in the volumes of industrial production and in the manufacturing sector of the UK (on a monthly basis, UK manufacturing output grew in October by +0.7% against zero growth in September and a negative forecast of a -0.1% contraction).

The Bank of England is also making its interest rate decision this week, which will be published on Thursday. GDP growth means improving economic conditions, which makes monetary tightening possible (with a corresponding rise in inflation), which, in turn, is usually positive for the local currency.

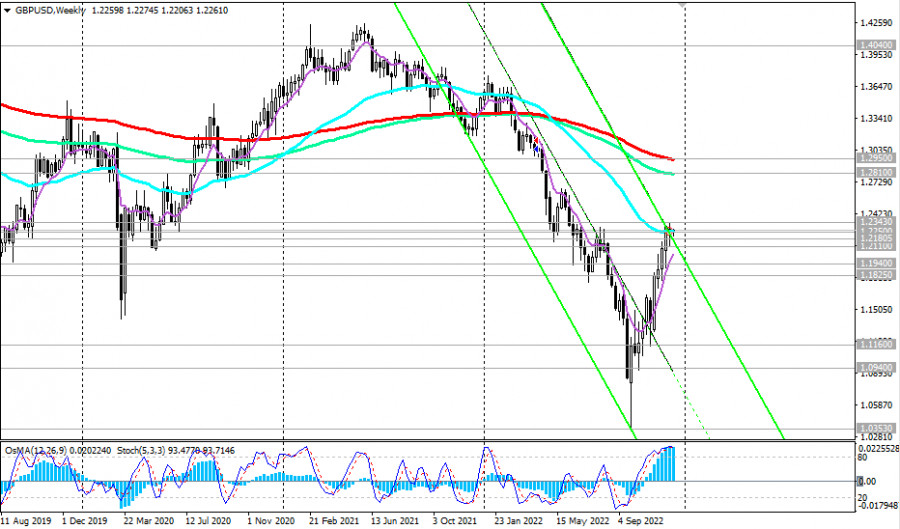

The Bank of England is expected to raise its interest rate again (as well as the Fed, by 0.5%) to 3.5% at the meeting on December 15. Theoretically, it should have a positive effect on GBP quotes. Time will show how the currency and GBP/USD pair will behave after this decision. In the meantime, we should note that the pair is developing positive dynamics, trying to break above the 1.2250 long term resistance level. In case of a breakout of the 1.2343 local resistance level, further growth towards the key resistance levels 1.2810, 1.2950, separating the long-term bull market from the bear market, is not excluded.

Regarding the pound and the GBP/USD dynamics, in addition to the above events, it is also worth paying attention to the publication on Wednesday (at 07:00 GMT) of fresh inflation data in the UK (for November). Assessing the level of inflation is important for the central bank in determining the parameters of the current monetary policy. A slowdown is also expected. Economists forecast an annual CPI of 10.9% in November (versus 11.1% in October). Note that the November CPI remains much higher than in the period up to October. In other words, it is too early for the Bank of England's leaders to relax in their fight against high inflation.

Now, after active intervention at the end of September in trading with a record volume of purchases of British government bonds, the Bank of England, according to economists, will have to go for a much larger increase in rates than previously planned, driving the British economy even deeper into recession. And this does not exclude a new round of declining quotes for British government bonds and, with them, the pound. But this story is not today.