Details of the economic calendar for August 22

Monday was traditionally accompanied by a blank macroeconomic calendar. Important statistics in Europe, the United Kingdom, and the United States were not released.

Despite the lack of statistical data, the market behaves speculatively. There is an assumption that market participants, working ahead of the curve, include in the price all sorts of conjectures regarding Jerome Powell's Friday speech at the economic symposium in Jackson Hole.

In simple words, market participants are pouring into the US dollar, but a reversal will occur only during the symposium.

The above words are only a theory, but in this case, when the economic calendar is empty and the dollar is overbought, the theory looks quite realistic.

Analysis of trading charts from August 22

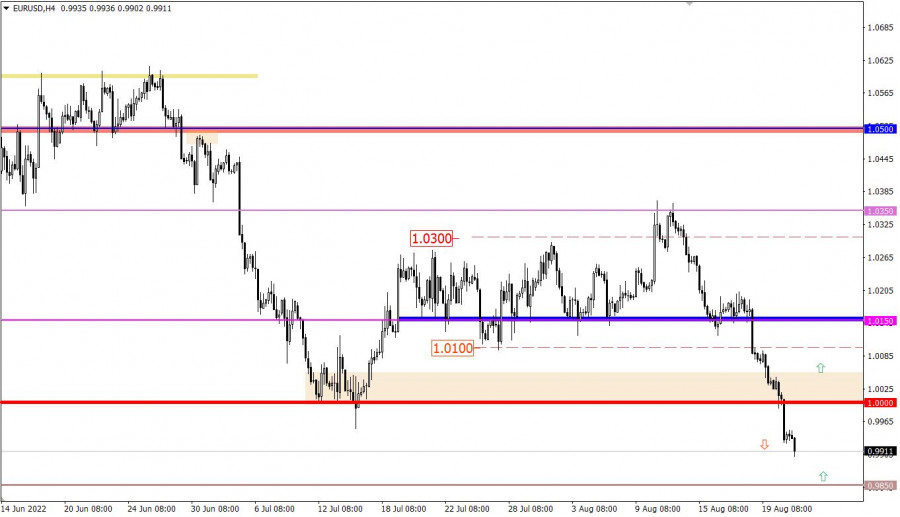

The EURUSD currency pair, during the inertial movement, managed not only to overcome the parity level, but also updated the local low of the medium-term trend. As a result, the quote was again at the levels of 2002.

The GBPUSD currency pair, following the EURUSD, also rushed down. As a result, the local low of the medium-term trend was updated. The area of 1.1750 served as variable support on the way of sellers, relative to which there was a temporary reduction in the volume of short positions in the pound sterling, which led to a regrouping of trading forces.

Based on the analysis of a basket of currencies (EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NZDUSD), there is a general increase in dollar positions in the market.

Economic calendar for August 23

Today, preliminary data on business activity indices in Europe, the United Kingdom, and the United States are to be released, where only positive statistics are expected for the United States. Thus, the dollar may still be of interest to investors despite its overbought status.

Time targeting:

EU Manufacturing PMI - 08:00 UTC (Previous: 49.8 points ---> Forecast: 48.0 points)

EU Services PMI - 08:00 UTC (Previous: 51.2 points ---> Forecast: 50.5 points)

UK Manufacturing PMI - 08:30 UTC (Previous: 52.1 points ---> Forecast: 51.0 points)

UK Services PMI - 08:30 UTC (Previous: 52.6 points ---> Forecast: 52.0 points)

US Manufacturing PMI - 13:45 UTC (Previous: 52.2 points ---> Forecast: 52.0 points)

US Services PMI - 13:45 UTC (Previous: 47.3 points ---> Forecast: 49.2 points)

Trading plan for EUR/USD on August 23

In this situation, much will depend on the speculative mood of market participants since technical instruments indicate overheating of short positions in the euro. This should lead to a technical pullback. Note that this is only a theory of technical analysis because, in practice, these signals can easily be ignored by traders, and the quote will continue to decline.

We concretize the above:

The parity level (1.0000) no longer plays a proper role in the market. Traders simply do not pay attention to it in terms of reducing the volume of short positions. Now there are a number of important marks on the way of sellers—these are 0.9850 and 0.9650. Previously, it was a side channel located below the parity level.

In our case, these are coordinates relative to which market participants can interact with the price. In simple words—possible levels of support.

Trading plan for GBP/USD on August 23

Stable price retention below 1.1750 for at least a four-hour period may lead to a subsequent decline in the value of the British currency. In the work, it is worth considering that the pound is already losing about 500 points in value in just 1.5 weeks. This indicates an overheating of short positions, which allows the formation of a pullback or price stagnation.

What is shown in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.