Bitcoin is increasingly gaining upward momentum and is testing the $23k resistance zone. However, the price cannot rise beyond this level due to the large volumes of sellers. Cryptocurrency is also hampered by fundamental factors that limit the investment opportunities of market participants. As a result, Bitcoin implements upward spurts within a narrow range of fluctuations.

The key factor in the inability of the cryptocurrency to go beyond the current area is the negative fundamental background. Bitcoin cannot realize its best qualities in an environment of tight monetary policy due to rising inflation, as well as an energy and liquidity crisis. The correlation with stock indices also prevents BTC from developing, as seen from the current upward momentum. It was provoked by a local correction and a weakening of the Fed's grip due to the crisis in other world currencies. The market provides a passive accumulation of cryptocurrency but does not provide volumes for strong growth.

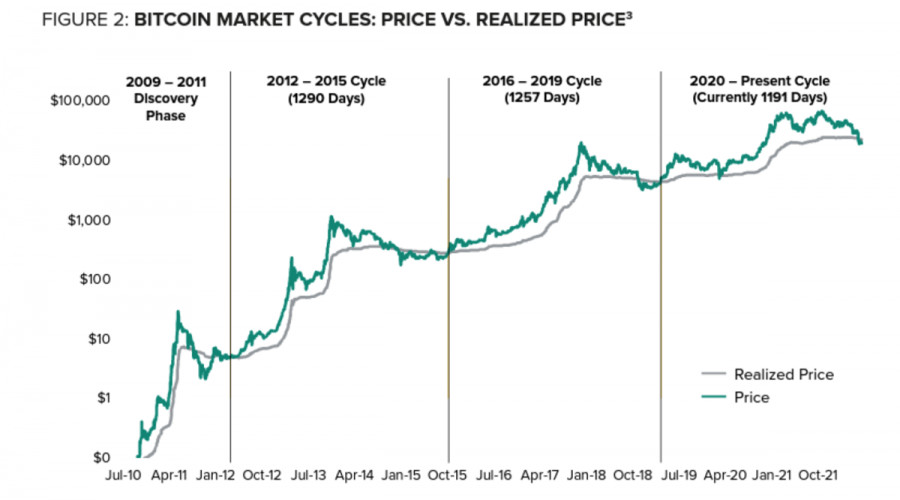

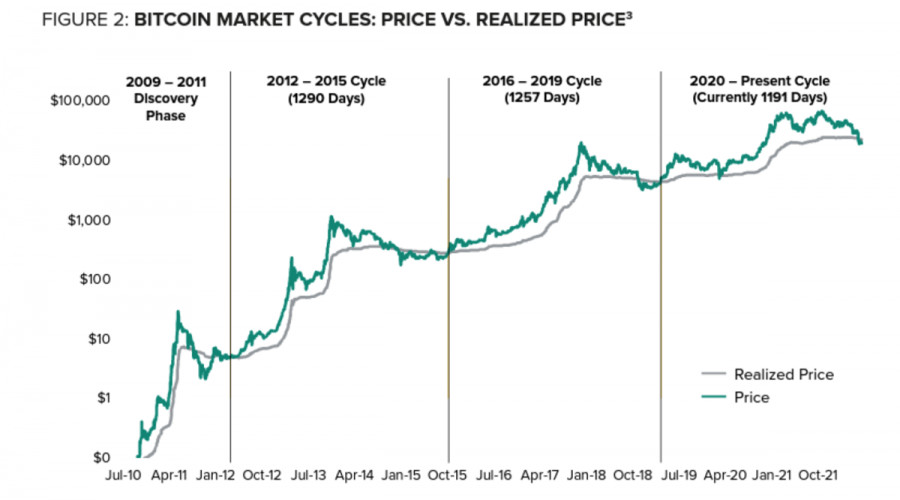

This is partly because the market just a month ago experienced the largest capitulation since 2011, and a few weeks in consolidation is clearly not enough. Grayscale is pessimistic and believes the crypto winter will last another 250 days. As an argument, the company's experts cite the MVRV metric, which reflects the ratio of the realized value of BTC and the market value. A decrease in the level of realized value in relation to the market serves as a signal for the beginning of a bear market. Grayscale analysts believe that the last time this happened was on June 13, which means that the crypto-winter phase has just begun.

The main theory of the company is based on a four-year cycle of Bitcoin movement. We are now in the middle of the 2020–2024 period. If we take the recovery of the cryptocurrency price above the level of the previous high as the beginning of the bull market, then the conclusion of Grayscale makes sense. However, it would be wrong to say that the market has recently moved into the crypto winter stage since the main indicators indicate the formation of a local market bottom right now.

The Fear and Greed Index hit a multi-year low of 6 and stayed there for more than a week. The bottoming of market sentiment and the subsequent recovery of the indicator to 20 indicates a restoration of faith in Bitcoin. We see the first results of this thaw in the form of the local upward momentum of the cryptocurrency. In addition, the RSI index on the weekly timeframe, for the third time in the history of Bitcoin, fell below 30, which is typical for the onset of an overbought period. Historically, after reaching this level, an upward recovery movement followed.

The cryptocurrency managed to break through the three-month downward resistance level. It is an important trigger in the medium term for a further recovery in the BTC/USD price. The sellers did not have enough volumes to push the price back and create prerequisites for a reversal by forming a "false breakdown" pattern. However, this did not happen due to the aggressive actions of buyers and large volumes. In the medium term, the breakdown of the three-month downward trend means that the key resistance level of $23k is approaching a successful assault.

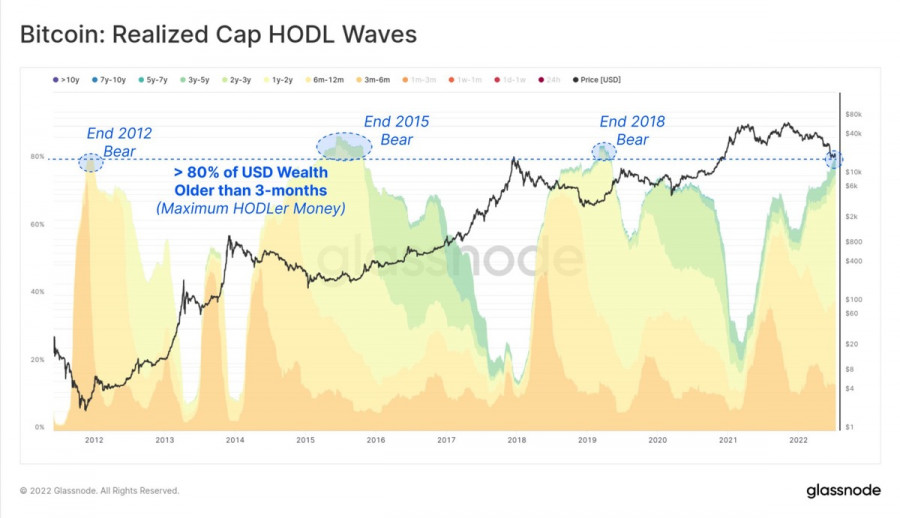

In addition, at the end of June, the market saw the largest capitulation in history. As a result, speculative investors and large amounts of borrowed funds washed out of the market. Some long-term investors who bought BTC above $40k also started selling their coins, which signals a bottom formation. Glassnode also indicated that 80% of all Bitcoin investments have been inactive for three months. If we compare this situation with what we saw in 2012, 2015, and 2018, we can conclude that this meant the end of the bearish trend.

Grayscale's statement is largely based on the use of one or more metrics. Technically, Bitcoin has already reached the bottom, and the worst period of crypto winter has passed. The asset is at the stage of forming a local low, which requires a long consolidation and a gradual flow of capital into the hands of long-term investors.

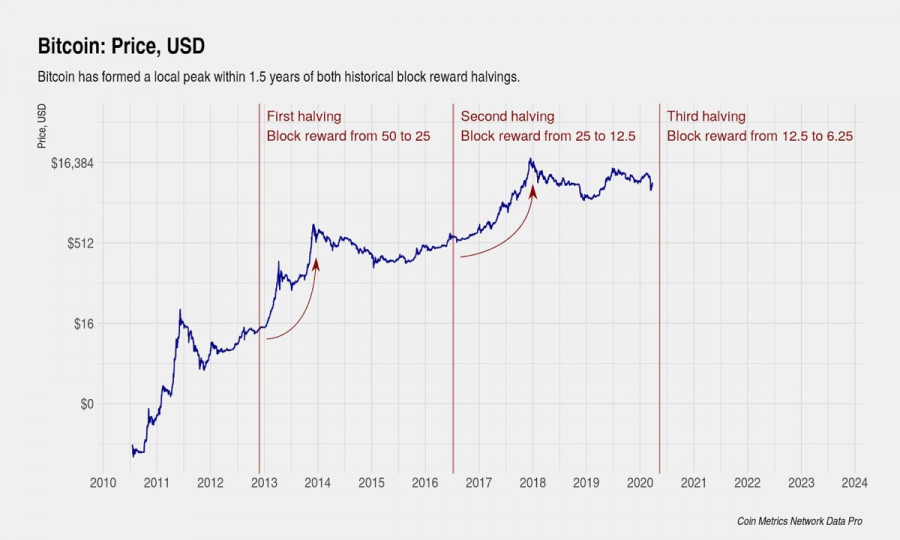

At the same time, the emergence of a full-fledged upward trend in the cryptocurrency, which will lead to an update of the historical high, is really likely in 2024. The main catalyst for the growth of BTC quotes will be halving, which will provide a shortage and increased value of coins on the market. However, until then, there will be several significant upward trends ahead of us, which will provide an exit beyond strong price ranges.