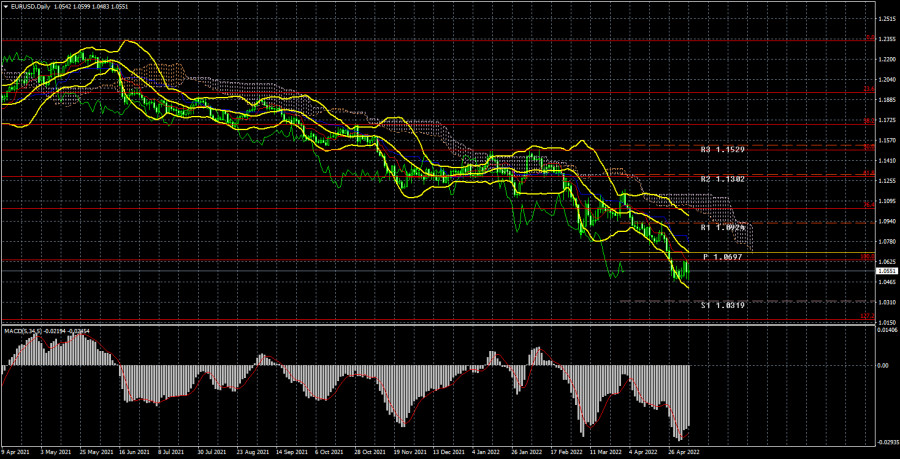

Long-term perspective.

The EUR/USD currency pair has not even tried to start an upward correction again this week. There was no new collapse, but when there is no collapse and there is no correction, it means that there will be a new fall sooner or later. Maybe next week, but the point is that bears don't close short positions, and bulls don't open long ones. In this situation, it is very difficult to count on the strengthening of the euro currency. Needless to say, all the indicators on the 24-hour TF are pointing downwards? Needless to say, the pair has already updated its 5-year lows and is racing towards its 20-year lows at full speed? Needless to say, over the past week, there has not been a single factor that could provide significant support to the euro currency? At the moment, we rely only on one moment when we assume that the "nightmare" for the euro may end in the near future. This moment is the impossibility of the constant movement of the pair in one direction. There must be corrections and sooner or later they will be. The problem is that the correction depends entirely on the mood of traders, and what it is, we have already figured out above. Therefore, theoretically, the pair may well fall to 20-year lows and price parity before an upward pullback begins. We also draw attention to the fact that, despite the factors that openly oppose the euro and the dollar, the currency of the European Union has already fallen in price quite a lot. And therefore oversold. Nevertheless, this justification cannot be considered a starting point for the growth of the euro/dollar pair. This week, the situation for the euro currency could get much worse. Jerome Powell's rhetoric was frankly "hawkish", and the Fed raised the rate by 0.5% and almost openly stated that in June and July the rate would also increase by 0.5%. Thus, the fact that the dollar did not rise at the end of the week is even more surprising.

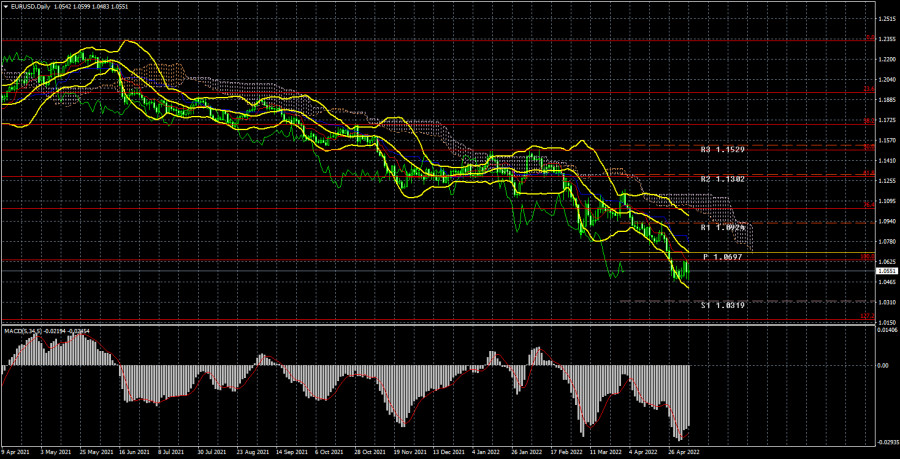

COT analysis.

The latest COT reports on the euro currency raised more questions than they answered. But at last, the situation began to change, and now COT reports more or less reflect the real picture of what is happening in the market, as the mood of the "Non-commercial" group has become "bearish". During the reporting week, the number of buy contracts decreased by 14.5 thousand, and the number of shorts from the "Non-commercial" group increased by 14 thousand. Thus, the net position decreased by 28.5 thousand contracts per week. This means that the "bullish" mood has changed to "bearish" since the number of sell contracts now exceeds the number of buy contracts from non-commercial traders by 6 thousand. However, what happened during the last reporting week is a double-edged sword. On the one hand, COT reports now reflect what is happening in the market. On the other hand, if the demand for the euro currency has also started to fall now, then we can expect another new fall in this currency. Recall that in recent weeks, professional traders, oddly enough, maintained a "bullish" mood and bought euros more than they sold. And even in this scenario, the euro fell like a stone. What will happen now that major players have started selling the euro currency? Demand for the dollar remains high, and demand for the euro is falling. Thus, it is quite reasonable now to expect a new decline in the euro/dollar pair. Moreover, the reaction to the "hawkish" Fed meeting was not quite adequate.

Analysis of fundamental events.

During the current week, the most important event was the Fed meeting. We have already said that we consider him completely "hawkish". However, the market was fully prepared for the fact that the rate would be raised, and in the coming months, the Fed's balance sheet would begin to shrink. Thus, after the publication of these results, it even sold the American currency and did not buy it. But the very next day everything fell into place and the dollar rose against the euro. At the moment, the fundamental factor remains not in favor of the euro. The monetary policy of the Fed is tightening, and the monetary policy of the ECB continues to be "out". We still believe that the ECB will not decide to raise the rate in the near future, but even if this happens, to what level will the rate be raised if the deposit rate is negative now? The Fed may raise its rate to 2% in July, and to 3% by the end of the year. That is, the ECB still cannot keep up with the Fed. Consequently, the US currency will have a fundamental advantage until the end of the year.

Trading plan for the week of May 9-13:

1) On the 24-hour timeframe, the pair continues its downward movement and headed for the level of 1.0340 - the minimum for the last 20 years. Almost all factors still speak in favor of the growth of the US dollar, but still, we believe that the fall of the euro currency is already too strong. The price is below the Ichimoku cloud, so there is still little chance of growth for the euro currency. At the moment, sales remain the most relevant.

2) As for purchases of the euro/dollar pair, it is not recommended to consider them now. There is not a single technical signal that an upward trend may begin. The "foundation" and "macroeconomics" continue to exert strong pressure on the euro. "Geopolitics" can continue to put pressure on traders and investors who still believe that in any unclear situation, you need to buy the dollar. Europe is on the verge of an energy and food crisis. Only overcoming the Senkou Span B line we would consider as the basis for a new upward trend.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.