To open long positions on GBP/USD, you need:

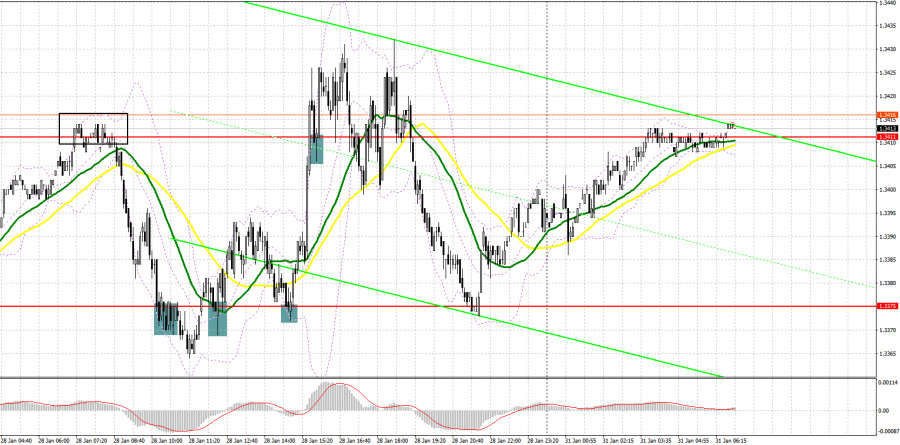

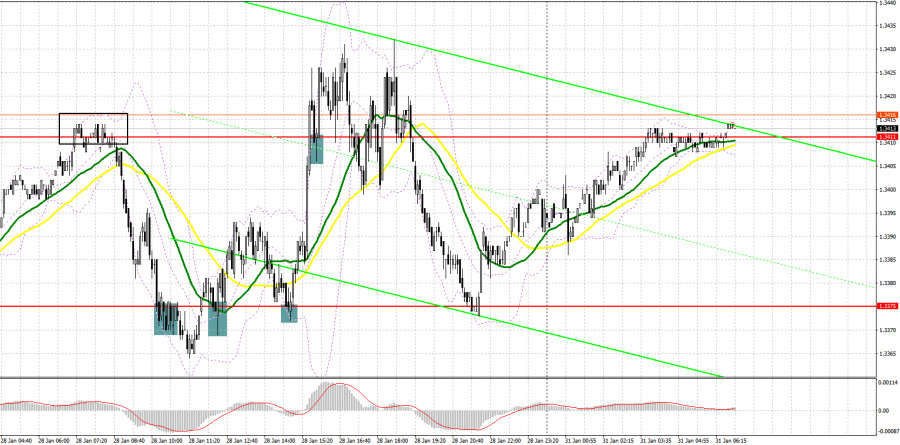

Last Friday, a huge number of profitable signals were formed for the pound to enter the market. Let's take a look at the 5-minute chart and figure out what happened. A false breakout at 1.3411 at the very beginning of the European session led to a sell signal for GBP/USD, as a result of which the pair collapsed by more than 30 points. Then the bulls managed to protect the level of 1.3375, but a major increase in the pair occurred only in the middle of the day, when the third false breakout was formed in this range. As a result, the growth was more than 60 points. A breakthrough and consolidation above 1.3411 with a reverse test from top to bottom is a buy signal and growth by another 20 points.

Data on the US economy, as well as on the incomes and expenses of Americans forced us to close long positions on the dollar at the end of the week, as the reports failed to surprise traders, completely coinciding with the forecasts of economists. Today there are no important statistics on the UK, so bulls will have a real chance of building an upward correction before the next increase in interest rates from the Bank of England.

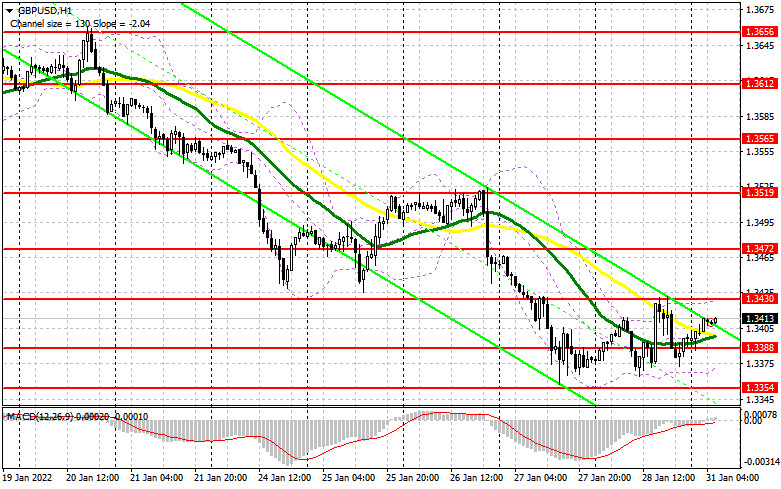

An important task for today is to protect the support of 1.3388, from which it is possible to build a new upward correction for the pair after another fall, which we have been observing since January 13 this year. It is important to form a false breakout at 1.3388. Only this forms the first entry point into long positions against the trend. An equally important task is a breakthrough and test of 1.3430 from top to bottom, which will give an additional signal to buy the pound in order to return to 1.3472. A more difficult task will be to update the 1.3519 area, but this is clearly not for the beginning of this week, since such an increase is possible only in the case of aggressive changes in the central bank's policy in the middle of this week. I recommend taking profits there.

In case GBP/USD falls during the European session and a lack of activity at 1.3388, and there are moving averages playing on the bulls' side now, it is better not to rush into buying risky assets. I advise you to wait for the test of the next major level of 1.3354 - this month's low. Forming a false breakout there will provide an entry point to long positions. You can buy the pound immediately on a rebound from 1.3322, or even lower - from a low of 1.3301, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

Bears continue to control the market, even though bulls seem to think that they have found the low. Much will depend on the degree of the BoE's hawkish policy, so it is unlikely that anyone will be in a hurry to buy the pound from current lows.

The primary task is to protect the 1.3430 level. Forming a false breakout in this range, by analogy with what I discussed above, creates the first entry point into short positions, counting on the continuation of the bear market and the pair's decline to the intermediate support area of 1.3388, formed by last Friday's results. A breakthrough and a test of 1.3388 from the bottom up will provide another entry point for short positions on the pound with the goal of pushing it to 1.3354 and 1.3322, where I recommend taking profits.

If the pair grows during the European session and bears are weak at 1.3430, and as we know, there are no important statistics today, it is best to postpone short positions until the next major resistance at 1.3472. I also advise you to open short positions there only in case of a false breakout. You can sell GBP/USD immediately for a rebound from 1.3519, or even higher - from the high in the area of 1.3565, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

According to the Commitment of Traders (COT) report from January 18, traders increased long positions and cut on short positions. It means that the sterling retains the speculative interest after the Bank of England raised the key policy rate at the end of the last year. Currently, traders have high expectations that the regulator could increase interest rates again by 0.25% at the nearest policy meeting. Such expectations are bullish for the pound sterling.

At the same time, the fundamental picture contains some factors that cap the pound's upside potential. First, soaring inflation that has been raging for almost half a year negates strong employment in the UK. Despite high wages and a decline in the jobless rate, rampant inflation erases households' incomes. Besides, elevated energy prices and costly services make a dent in the people's well-being so that living standards are currently below the ones during the COVID pandemic. By and large, the outlook for the pound is bright. Moreover, the ongoing downward correction makes it more attractive. The Bank of England's intention to continue rate hikes this year will push the pound to new highs.

This week, traders are anticipating the crucial event: the FOMC policy meeting. The policymakers are widely expected to clear up the timeline for monetary tightening. Some analysts assume that the US central bank could decide in favor of raising interest rates at this policy meeting in January without delaying this question until March. The rate-setting committee is likely to announce tapering the Fed's balance sheet.

The COT report from January 18 reads that the number of non-commercial positions rose from 30,506 to 39,760 whereas the number of short non-commercial positions decreased from 59,672 to 40,007. This leads to a change in negative non-commercial net positions from -29,166 to -247. GBP/USD closed at 1.3647, higher than 1.3570 a week ago.

Indicator signals:

Trading is conducted around 30 and 50 moving averages, which indicates an attempt by the bulls to build an upward correction for the pair.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Crossing the upper limit of the indicator in the area of 1.3430 will lead to an increase in the pound. A breakthrough of the lower limit in the area of 1.3375 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.