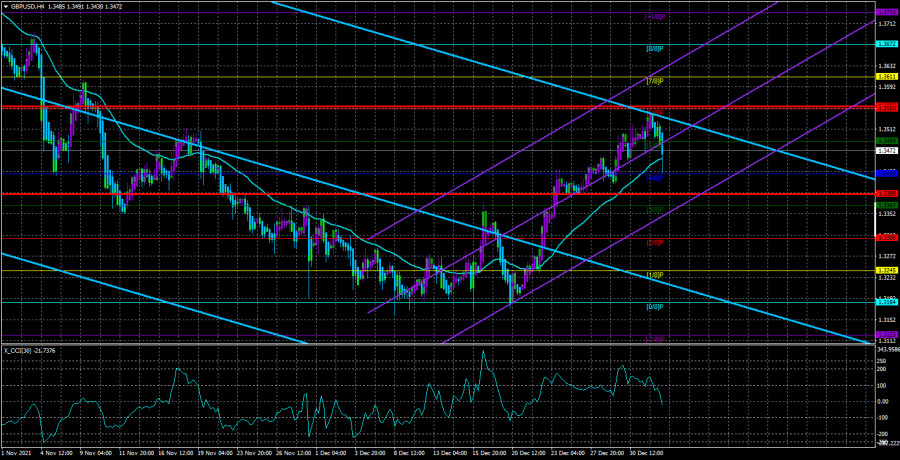

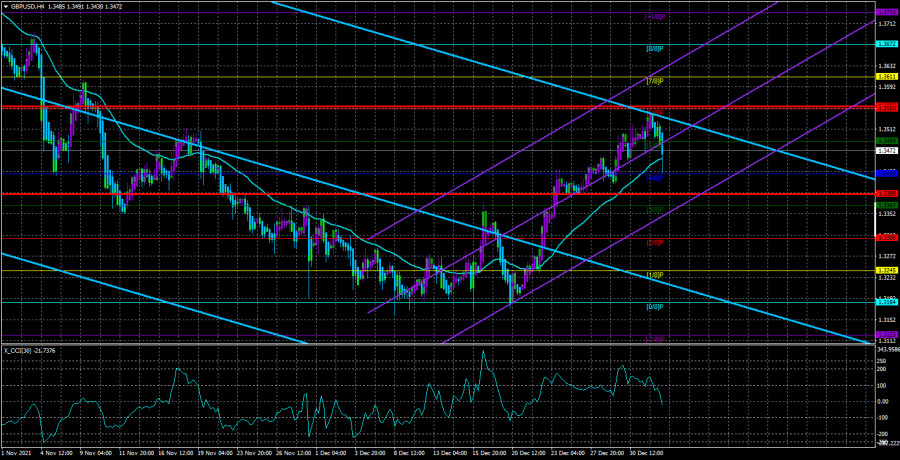

The GBP/USD currency pair maintained an upward mood on Friday and Monday. Recall that at the end of 2021, the British pound quite unexpectedly began to grow in tandem with the US dollar. "Quite unexpectedly" - because there were no fundamental reasons for this. At least, it is during the period of growth. Because at that time, in principle, there were practically no fundamental events or macroeconomic ones. However, from a technical point of view, this movement has been brewing for several months. If you look at the older timeframes, it is obvious that the entire movement of 2021 was as corrective as possible. Each segment of the decline was followed by an almost the same-sized segment of the pair's growth. Of course, the downward trend was still maintained, but still it looked more like a correction against the global trend of 2020. Thus, the growth of the pound that we are seeing now may be a simple correction against the downward trend, which, in turn, may be a correction against the upward trend of 2020. We have already said that we believe the main reason for the growth of the US currency in the second half of 2021 is the high expectations of the market regarding the tightening of the Fed's monetary policy. However, this factor can be worked out several times already. Therefore, the pound, like the euro, may rise in price in the next few months simply on the basis that the dollar no longer has fundamental support. Recall that the Bank of England raised the key rate at the end of 2021, that is, it also embarked on the path of tightening. Accordingly, the British currency has economic grounds for growth.

Omicron still raises concerns. The states are no exception.

At the end of 2021 and the beginning of 2022, the main topic on the foreign exchange market remains the omicron strain and its spread around the world. More talk is going on around the UK and the European Union, but everyone seems to have forgotten about the USA, although it is the States that have been and remain in first place in the world in terms of the number of cases of the disease since the beginning of the pandemic. Anthony Fauci, the country's chief infectious disease specialist, believes that the positive effect of a less severe course of the disease in humans can be offset by a higher amount of the disease from omicron. "If you have a lot more cases, this can negate the positive effect of a lighter course of the disease. We are especially worried about unvaccinated people. They are the most vulnerable category when you have an extremely contagious virus," Fauci said. The chief virologist of the USA also noted that in the near future omicron will become dominant in the country, and the number of infected will continue to grow.

As you can see, the news at the beginning of the year continues to arrive. After all, even if the number of hospitalizations does not grow, the new strain will still affect the country's economy. At least because too many people get infected and go into self-isolation. It's good if you have the opportunity to work from home, but not all professions imply the ability to work remotely. If all the waiters are sick in your cafe, then there will simply be no one to work with. This is the main danger of omicron, which with such a rate of spread can simply infect most people in any country. Of course, sooner or later people will recover, but there are no guarantees that they will not get infected with omicron for the second or third time. There is no guarantee that a new strain with new "surprises" will not appear in a few months. Thus, it is still definitely too early to say that humanity is defeating the "coronavirus". This means that the economy of any country may suffer from a pandemic more than once.

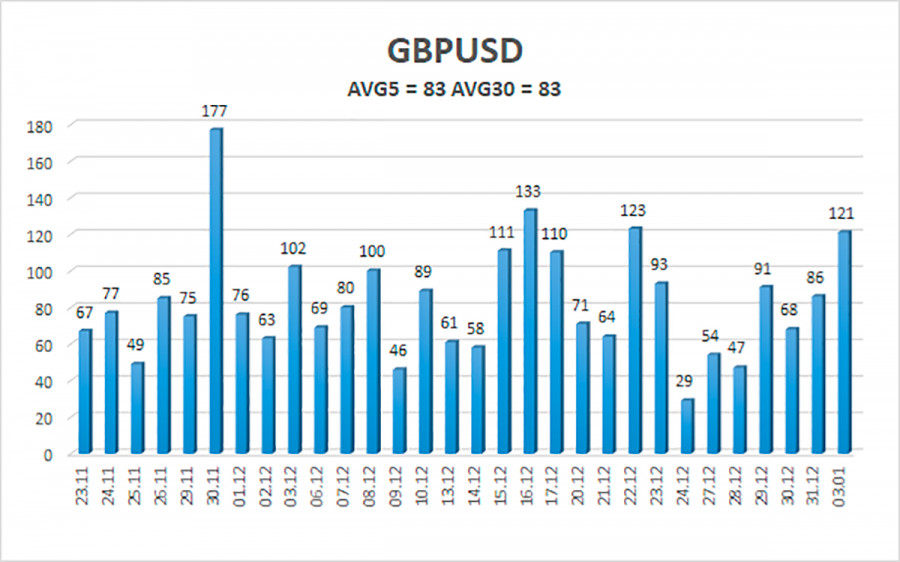

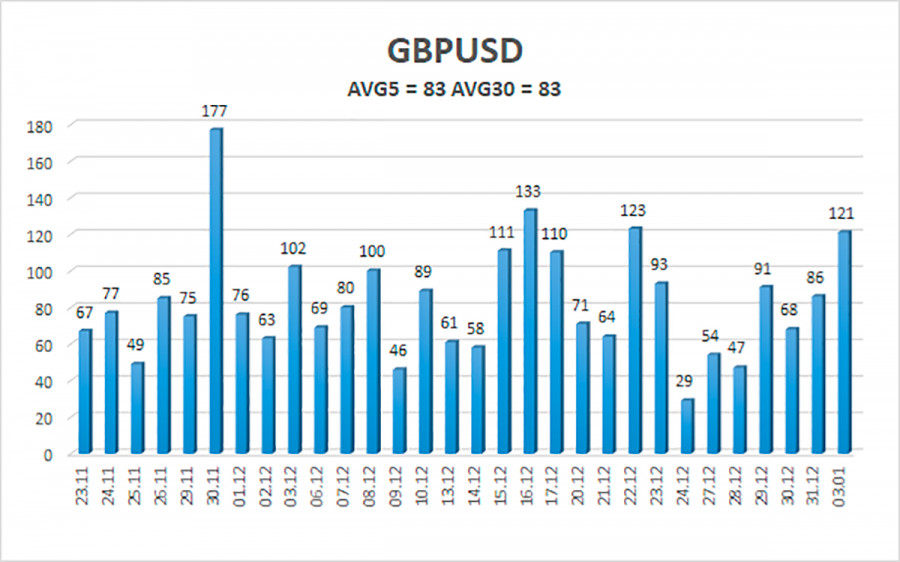

The average volatility of the GBP/USD pair is currently 83 points per day. For the pound/dollar pair, this value is "average". On Tuesday, January 4, therefore, we expect movement inside the channel, limited by the levels of 1.3389 and 1.3555. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest resistance levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading recommendations:

The GBP/USD pair continues its strong upward movement on the 4-hour timeframe. Thus, at this time, we can consider the possibility of opening new longs with a target of 1.3550 if the price bounces off the moving average line. It is recommended to consider short positions if the pair is fixed back below the moving average with targets of 1.3389 and 1.3367, and keep them open until the Heiken Ashi indicator turns up.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.