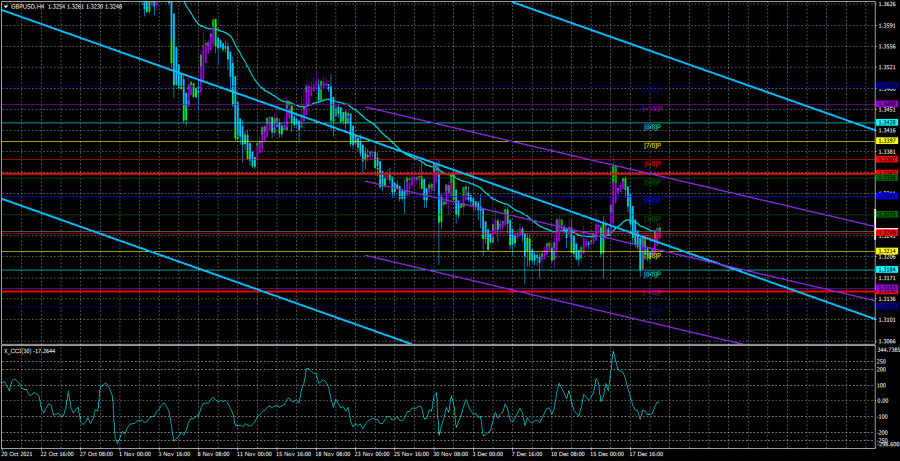

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

The GBP/USD currency pair also traded quite calmly on Tuesday. Although there is no clear side channel on the 4-hour timeframe, as in the case of the EUR/USD pair, this does not mean that there is no side channel. We have already said in previous articles that the pound/dollar is now also flat, but it was violated by the decision of the Bank of England to raise the key rate last week. It was thanks to this unexpected decision for many that the pair gained a foothold above the upper limit of this channel - the level of 1.3275. At the same time, the quotes are again inside the designated range, so the movement of the two main pairs practically does not differ from each other. What are the prospects for the British currency in the last two weeks of the outgoing year? We believe that there is a high probability that the pair will continue to stay inside the channel 1.3184-1.3275. Although, given the epidemiological situation around the world, as well as in the UK, it is impossible to exclude that the currency market will receive panic instead of gifts on New Year's Eve. Recall that in March 2020, when the first "wave" of the pandemic began, all currency pairs "flew". The pound/dollar then fell by 1,700 points in just 10 trading days. If panic comes to the market, then you can forget about quiet holidays. Of course, while the situation with Omicron is not critical. The number of diseases is growing in almost all countries of the world, but there are very few fatal cases. Thus, the main danger of the new strain is that the healthcare system may not cope with the influx of patients. However, we are talking about an epidemic, so it is impossible to predict for sure what situation the whole world will be in in a month.

The Prime Minister of Great Britain allowed the tightening of quarantine restrictions, but not now.

Meanwhile, in the UK on Monday, new 91 thousand cases of coronavirus were announced, most of which already account for the omicron strain. Thus, this strain becomes dominant. A state of emergency has been declared in London, and Boris Johnson is not coping with the crises and the criticism that has befallen him in recent weeks. We have already written that Boris Johnson's ratings are falling day by day. The British cannot forgive him for the fact that on the eve of last New Year when the lockdown was introduced in the country, the government itself was having fun at 10 Downing Street. Boris Johnson clearly could not even explain this situation, promising only to sort everything out. It seems that the promise to sort everything out is already becoming Johnson's calling card. But this explanation no longer suits either the British, the Labor Party, or even the Conservatives. At the moment, many in Parliament insist on the introduction of a "lockdown", but many oppose such measures. For example, Brexit Minister David Frost resigned at the beginning of the week, explaining his action by disagreement with the current vector of the UK's movement. In particular, Frost said that he did not agree with the tightening of quarantine restrictions introduced by Boris Johnson a week earlier. By the way, there were no serious and strict restrictions. The British were only obliged to wear masks in public places again, and COVID-passports were also introduced. In general, the situation with the "coronavirus" and its new strain in the UK is as incomprehensible as possible. As for macroeconomic events, there were none in the first two days of the week. GDP reports in the UK and the US will be published today, but they are unlikely to interest anyone at least since these will be the third estimates for the third quarter. That is, the markets are ready for the figures of +1.3% q/q in Britain and +2.1% q/q in the USA. And the figures themselves are unlikely to differ much from past estimates. Therefore, we expect that by the end of this week, traders will not be able to withdraw the pair from the flat. One can only be afraid of a sharp deterioration in the epidemiological situation, which can lead to panic in the markets.

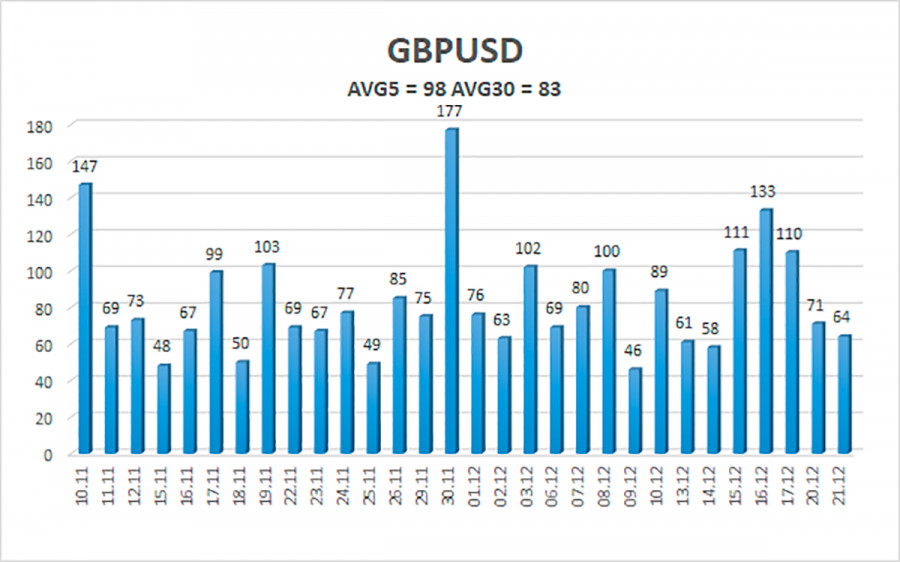

The average volatility of the GBP/USD pair is currently 98 points per day. For the pound/dollar pair, this value is "average". On Wednesday, December 22, thus, we expect movement inside the channel, limited by the levels of 1.3148 and 1.3343. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement inside the side channel.

Nearest support levels:

S1 – 1.3245

S2 – 1.3214

S3 – 1.3184

Nearest resistance levels:

R1 – 1.3275

R2 – 1.3306

R3 – 1.3336

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to be located inside the side channel. Thus, at this time, you should trade for a rebound from any of the boundaries of this channel of 1.3184 - 1.3275. Or wait for the pair to exit it to form a new trend.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.