To open long positions on GBP/USD, you need:

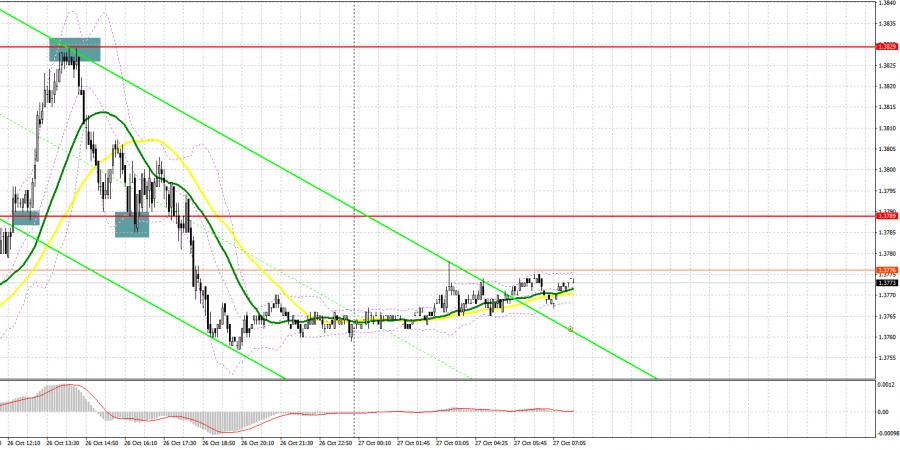

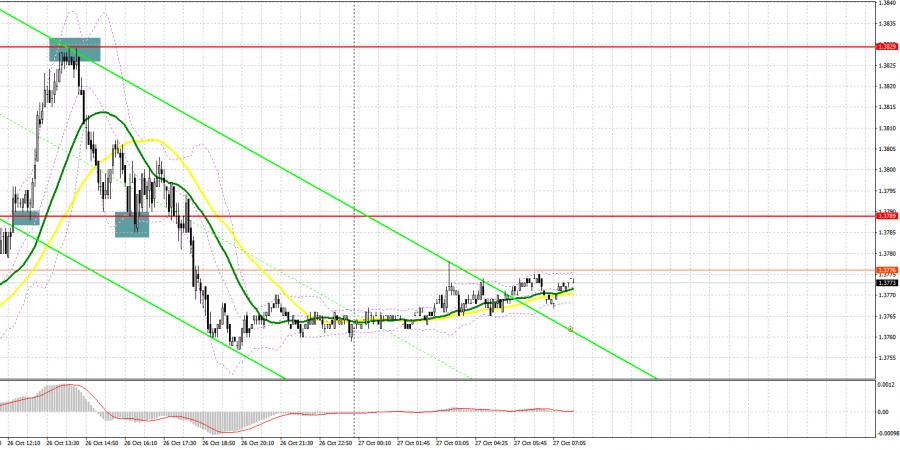

Yesterday there were a lot of interesting signals to enter the market. Let's take a look at the 5 minute chart and understand the entry points. In my morning forecast, I paid attention to the level 1.3789 and recommended making decisions from it. Breakthrough and consolidation above 1.3789 with a reverse test from top to bottom - all this resulted in creating a good entry point into long positions. As a result, the upward movement amounted to more than 40 points and ended at the resistance area of 1.3829. There, closer to the US session, a false breakout was formed and an excellent signal to sell the pound in the opposite direction to the support of 1.3789 was formed, which made it possible to take about 40 more points from the market. False breakout and forming an entry point into long positions from 1.3789 did not bring a good result, as the pair did not grow again.

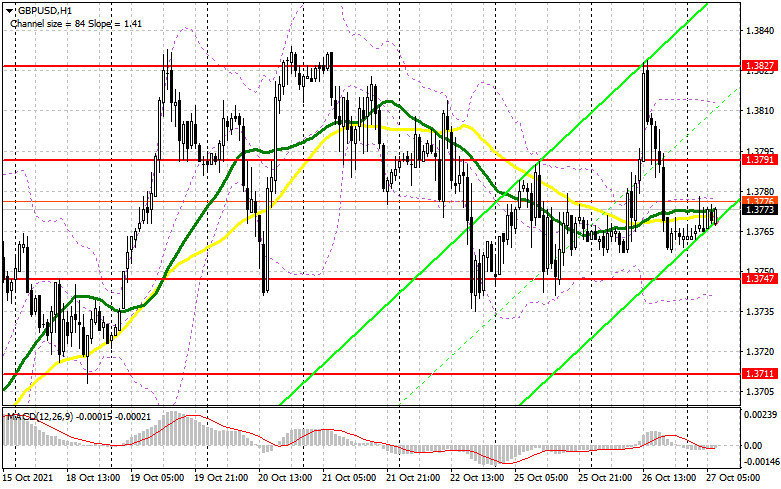

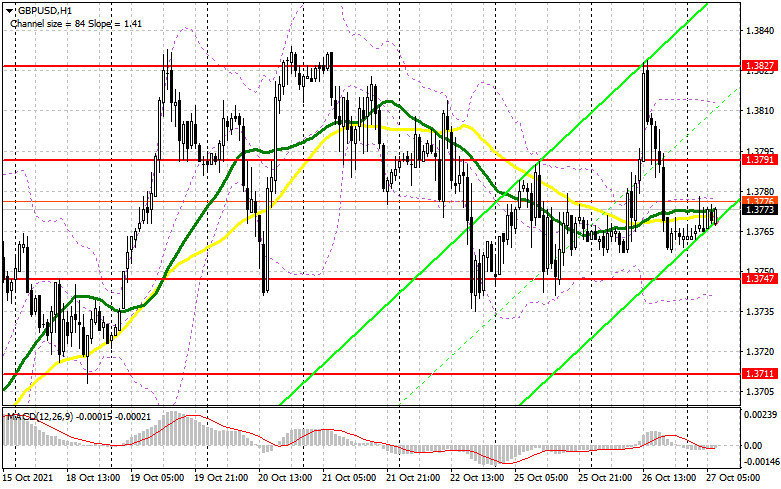

The UK's annual budget will be published today, which has been talked about quite a lot by Treasury Minister Rishi Sunak lately. It is unlikely that its publication will seriously affect the pound, but the pressure on the pair may persist. For this reason, the main task of the bulls is to protect support at 13747, which, in addition to everything, acts as the lower border of the horizontal channel. The pound has been in it since October 19. A fairly large number of bulls' stop orders can be concentrated below this range, and only the formation of a false breakout can create a good entry point into long positions. In this scenario, the bulls' target will be the middle of the channel - 1.3791. Only a reverse test from top to bottom of this level will give a new entry point into long positions and make it possible to get to the upper border of the horizontal channel at 1.3827, which coincides with last week's highs. A breakdown of this range will open up the opportunity to update 1.3864 and 1.3910, where I recommend taking profits. In case the bulls are not active in the area of 1.3747, the best option for buying the pound will be the test of the next support at 1.3711. However, I advise you to open long positions there only after a false breakout. I advise you to watch buying GBP/USD immediately for a rebound only from a low like 1.3676, or even lower - from support at 1.3632, counting on a correction of 25-30 points within the day.

To open short positions on GBP/USD, you need:

The bears have a real chance to break the upward trend, but for this they need to try to protect the middle of the 1.3791 channel. Only the formation of a false breakout there after the publication of the annual budget of Great Britain and the speeches of important political figures in this regard will lead to forming a sell signal, which will push the pair to the lower border of 1.3747, below which it was not possible to break below it yesterday. A breakthrough of 1.3747 and the reverse test from the bottom up will create a signal to open new short positions, expecting a decline to 1.3711, and the next target will be the area of 1.3676, which will finally finish off the bulls. I recommend taking profit there. In case GBP/USD recovers and the bears are not active at 1.3791, I advise selling the pound right away on a rebound from a larger resistance at 1.3827, or even higher - from a high of 1.3864, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) report for October 19 revealed that short positions decreased while long positions increased, which reflects the upward trend in the pound, observed in the middle of this month. This resulted in the return of the net position of a positive value. Speeches and statements of representatives of the Bank of England claiming that it is necessary to take inflationary pressures more seriously also add to the bulls' confidence. BoE Governor Andrew Bailey's speech last week was well received in the market as he reiterated his stance on changing monetary policy. However, a slight slowdown in monthly and annual inflation growth in the UK limited the pair's upward potential in the middle of the week, which resulted in it being locked in the horizontal channel. I advise you to count on further strengthening of the pound and take advantage of any short-term decline that may occur in case of weak fundamental statistics. The COT report indicated that long non-commercial positions rose from 46,794 to 49,112, while short non-commercials dropped from 58,773 to 47,497. This led to a change in the non-commercial net position from negative to positive. The delta was 1615, against 11,979 a week earlier. The closing price of GBP/USD increased significantly: from 1.3591 to 1.3735.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates the sideways nature of the market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator in the area of 1.3815 will act as a resistance. In case the pair falls, support will be provided by the lower border of the indicator in the area of 1.3740.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.