The fundamental background on EUR/USD is mixed. In general, the demand for the US dollar increased. The US dollar index has again surpassed 90, reflecting strong demand for the greenback among traders. Still, it is too early to talk about a new US dollar rally as cautious behaviour of market participants is affecting the major currency pairs. At the start of the last trading day of the week, we can observe a widespread flat even despite the fact that the last couple of days were rather eventful.

Thus, the greenback received support from Joe Biden's American Rescue Plan yesterday. The $1.9 trillion plan is aimed to revive the country's economy and combat the coronavirus and to do so at the cost of national debt, which will only increase. On top of that, Democrats intend to change the tax policy by raising wealth taxes.

As for Biden's plan, around $400 billion will be allocated to combat the coronavirus pandemic and $1 trillion will be devoted to support the population. Americans will receive $1,400 per person. Thus, these payments will reach $2,000, taking into account $600 approved by Congress at the end of last year. The minimum wage is likely to increase to $15 per hour. Today, it is $7.25 per hour. In addition, weekly unemployment benefits are also expected to be raised.

Notably, Biden proposed to allocate $350 billion to support state, local, and territorial governments. Last year, this initiative became a stumbling block between Democrats and Republicans. As a result, Democrats were forced to compromise. However, the situation has changed dramatically. Democrats took control of both the lower and upper chamber of Congress. Most likely, Biden's proposal will be approved in the near future.

When the President-elect revealed his plan, it did not surprise the market as rumors about it appeared on Thursday during the Asian session.

On top of that, Jerome Powell made it clear yesterday that speculations about curtailing the Federal Reserve's emergency program amid the rollout of vaccination and major fiscal stimulus at the end of this year are premature. Some analysts even assumed that the regulator would consider raising the rate at the beginning of 2022. Powell also said that the regulator is ready to tolerate inflation above the 2% rate, without tightening monetary policy.

Overall, Powell did not say anything new. But in the light of optimistic rumors, his speech sounded rather pessimistic. Against this background, growth of the greenback was limited. The US dollar index was near 90.00.

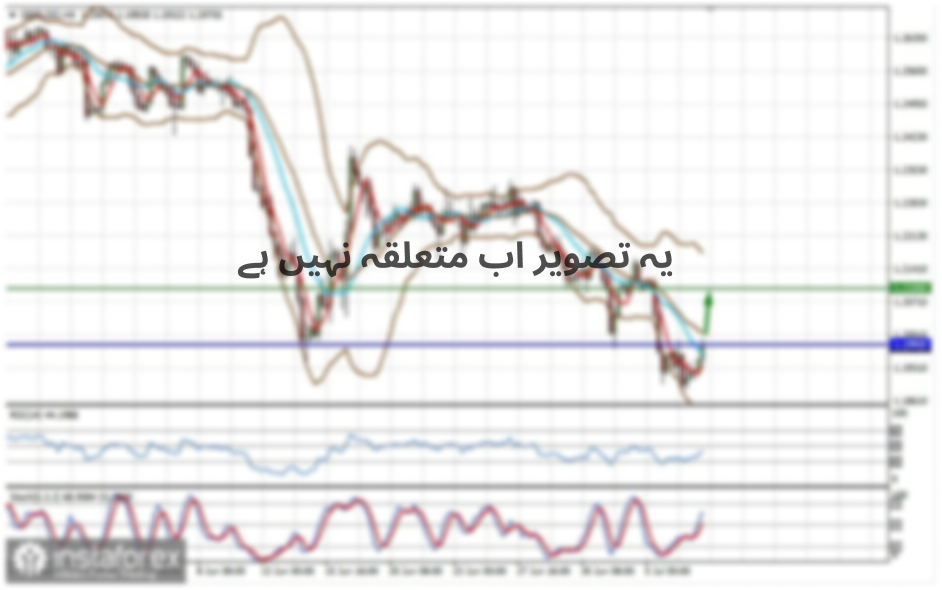

As for EUR/USD, there is a confrontation between bulls and bears. Amid the news about a new fiscal stimulus package to support the US economy, EUR/USD returned to the level of around 1.2100. At the same time, Jerome Powell's speech did not allow bears to consolidate below the support level of 1.2110, the lower line of the Bollinger Bands indicator on the daily chart.

Meanwhile, the euro is also under certain pressure. The political crisis in Italy, as well as rumors concerning a mega-lockdown in Germany are severely affecting EUR/USD. Thus, in Italy, the government is about to resign. Former premier Matteo Renzi withdrew his party from the ruling coalition. Renzi quit the government, complaining about Prime Minister Giuseppe Conte's plans over how to spend billions of euros promised by the European Union to relaunch the economy. If the ruling coalition does not restore the majority, then the new election will be inevitable. In this case, the euro will be under strong pressure, since it is difficult to imagine a more unfortunate moment for a political crisis in one of the key countries of the European Union.

Also, traders worried about the so-called "mega-lockdown", which may be introduced in Germany in the very near future. According to preliminary data, it may happen already next week. The mega-lockdown will include the introduction of a curfew, full transfer of employees to remote work, and a complete suspension of public transport. Such restrictions will apply for about 5 weeks until the end of February.

Thus, neither bears nor bulls can boast of a clear advantage. In the mid-term, the bearish scenario remains a priority. The euro will not be able to compete with the greenback. All this suggests that sellers will not only test the lower line of the Bollinger Bands indicator on the daily chart (1.2110) in the near future, but will also enter the area of the 1.2000 level. The first bearish target is seen at 1.2050. The support level is located slightly lower at 1.2000, which corresponds to the upper border of the Kumo Cloud on the daily chart.