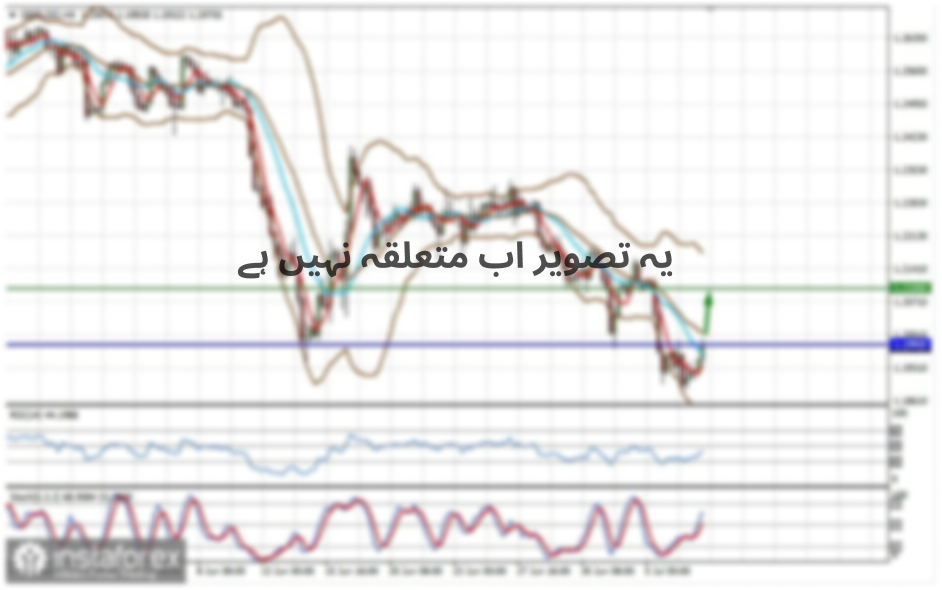

The past trading day was a kind of slowdown stage after a four-day fluctuating price rally. Based on the current dynamics and price fixing points, the sellers' desire can be seen to keep the previously set downward pace, where the area of 1.3050/1.3070 plays the role of interaction of trading forces, which leads to a slowdown in activity and as a result, to the reversal course of the price.

A consistent slow down and rebound of the price from the 1.3050/1.3070 area indicates a variable support, the breakdown of which will lead to an acceleration in the market, where the lower border of the flat formation is likely to reach the area of 1.2985 (1.3000) // 1.3085 // 1.3185.

The tactics of conducting local operations are still relevant in the market, which means that the prospect for a position can last a day or two, after which there will be an adjustment to the situation.

Traders adopted this tactic of conducting transactions since the beginning of this year.

Analyzing the Friday trading day minute by minute (M30), you can see a round of short positions from 12:00 to 18:30 UTC+00. The price movement returned the quotes to the low (1.3058) of August 21, where another slowdown occurred.

Volatility on the daily dynamics slowed down by 17% relative to the average level. It is noteworthy that there has been an acceleration for four days in a row, and the existing slowdown can balance the positions of speculators by clearly determining where the movement will go.

Based on the previous review, traders considered the stagnation as a starting point for the upcoming jump, but the quote did not manage to entirely change the fluctuations levels, even if the positions (buy/sell) were open. At the moment, the positions are at zero, you can either develop them, correct or close them.

Considering the trading chart in general terms (daily period), the turbulence at the peak of the upward movement can be seen, signaling that the pound is overbought and the US dollar is oversold.

The previous news background did not have any significant statistical data on Britain and the United States, thus, the market worked on technical fluctuations in prices.

For the information background, we have a forecast from the Bank of England regarding the growth of unemployment in the country. So, following the report, the regulator records a decline in the number of vacancies in the labor market by 59% compared to last summer. By the end of 2020, approximately 2,500,000 Britons may be unemployed.

The pound is pressured both from the coronavirus crisis and from the controversial Brexit deal.

Today, in terms of the economic calendar, we have data on new home sales in the United States, where growth is expected. So, sales for July may grow from 776 thousand to 785 thousand. The dollar may receive support if the forecast is confirmed.

Further development

Analyzing the current trading chart, price fluctuations can be seen within the previous day's boundaries 1.3052/1.3147, which is almost the same from the dynamics at the start of the slowdown. In this situation, the method of breaking through the boundaries of the amplitude, that is, the boundaries of 1.3052/1.3147 will be considered as the most relevant approach. In this case, a local jump of activity will be received, where we can earn money.

At the same time a breakdown of the lower value of 1.3052 will complete the cycle of movement in the side channel 1.3185 ---> 1.2985(1,3000).

Speculation is a method of breaking the price of stagnation, which will lead to local jumps in the market.

Here's our trading recommendations based on the above information:

- Buying at a price above 1.3150 is recommended, with the prospect of moving to the area of 1.3180 - 1.3200.

- Selling at a price below 1.3050 is recommended, with the prospect of moving to the area of 1.2985/1.3000.

Indicator analysis

Analyzing the different sectors of time frames (TF), it was shown that the indicators of technical instruments on minute intervals have a variable signal due to price fluctuations in the range. On the other hand, hourly and daily TFs signal a sell due to a gradual change in trading interest.

Weekly volatility / Volatility measurement: Month; Quarter; Year

The volatility measurement reflects the average daily fluctuations, calculated per Month/Quarter/Year.

(August 25 was built considering the time of publication of the article)

The volatility of the current time is 57 points, which is 50% lower than the daily average. A rise in activity will lead to a clear breakdown with stagnation.

Key levels

Resistance zones: 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support zones: 1.3000 ***; 1.2885 *; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1.1000; 1.0800; 1.0500; 1.0000.

* Periodic level

** Range level

*** Psychological level