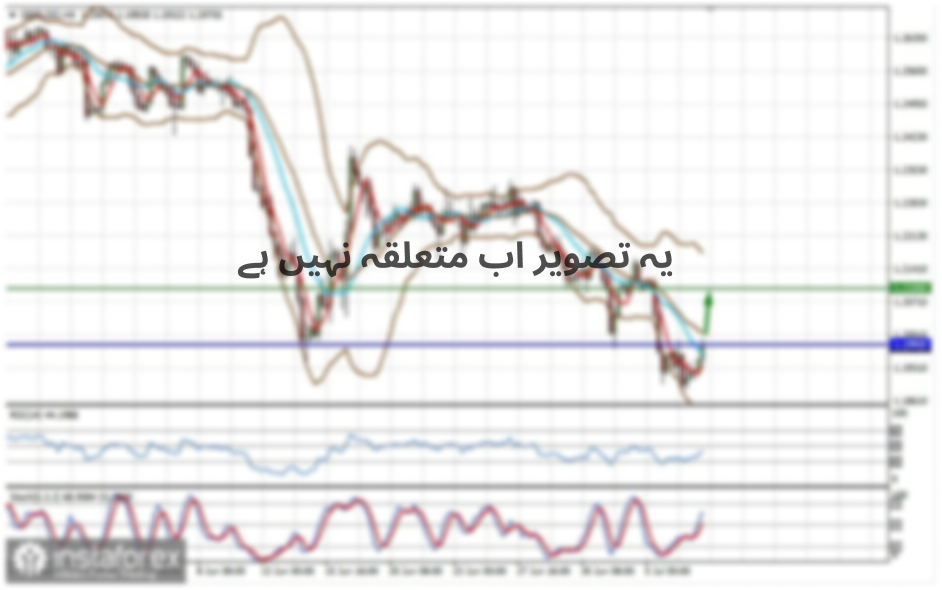

From the point of view of complex analysis, you can see the process of accumulation within a variable support, and now let's talk about the details.

The past trading day passed without impressive changes, the quote managed to stay on the previously set correction course, as a result of which there was another rapprochement with the level of 1.2500, where a support was already found on a systematic basis. In fact, we were faced with a difficult situation. The market is trying to change the clock component, from one fluctuation range to another. In turn, market participants are trying to cool the previously set speculative mood, which is currently subject to an external background. Thus, instead of switching to a fluctuation between the levels of 1.2620/1.2770, we are hanging around the level of 1.2500, wary of ambiguous splashes from the Brexit's trade negotiations, as well as decisions from the upcoming meeting of the Bank of England.

Regarding the theory of development, we closely monitor the two coordinates of 1.2500 (1.2450 - deviation) and 1.2770, since the dependence on the consolidation points will understand the course for the coming periods. That is, in the event of a breakdown of the first region, the chance of a resumption of fluctuations in the structure of the previous range of 1.2150 // 1.2350 // 1.2620 will be higher than the transition to a new range of 1.2770 // 1.3000 // 1.3300 and vice versa . At the same time, it is worth noting once again that in this difficult time, where the external background conditionally leads, the most relevant approach to trading is local operations, which have managed to bring us enormous income to the trade deposit since the beginning of 2020.

Analyzing the past trading day every minute, you can see that the short positions were poured twice from 7:30 and from 11:45 [UTC+00 time at the trading terminal]. In the remaining time sections, the stabilization process took place.

As discussed in the previous review, traders considered the option of keeping prices in the level of 1.2500, development in this direction continues.

In terms of volatility, the first slowdown in nine trading days is recorded, referring to the general dynamics of the market. It is worth considering that the concentration of trade forces in this case plays the role of a kind of accumulation, which will be expressed in acceleration in the near future.

Considering the trading chart in general terms, the daily period, it is worth highlighting that the quote is within the previous range, which means that one should not exclude the possibility of a resumption of the previous amplitude.

The news background of the past day contained inflation data in the United Kingdom, where, as expected, recorded a decline from 0.8% to 0.5%. This indicator will certainly be considered in the decision of the Bank of England at the upcoming meeting.

The pound did not react to inflation data, it is possible due to the fact that the indicators were confirmed with a preliminary estimate.

Data on construction in the United States will be published in the afternoon, which predicted that the construction of new homes could increase by 17.8%, and as a result, growth was only 4.3%. The indicators on the number of issued building permits, which recorded a growth of 14.4% with a forecast of 12.4%, slightly corrected the situation.

The market reaction to statistics on the United States still managed to locally support the US dollar.

In terms of general informational background, we continue the discussion regarding the Brexit divorce proceedings, where the noise reappeared. So the head of the European Commission, Ursula von der Leyen, casually overturned the information in the media that the EU is ready to make concessions in terms of fishing and trade policy. Once again, there is no specifics, so guess for yourself, and perhaps there's nothing else to guess, since these are just words.

In turn, Germany calls on EU countries to prepare for the absence of a trade deal, this is stated in the relevant internal document.

"Since September, negotiations have entered a hot phase. The UK is already intensifying threats against Brussels, wants to solve as many as possible in the shortest time, and hopes to achieve success in the last minutes of negotiations. Therefore, it is important to maintain the unity of 27 countries, continue to insist on parallel progress in all areas (a common package) and make it clear that there will be no agreement at all costs. Therefore, it is necessary to begin planning actions in case of unforeseen circumstances, both at the national and European levels, in order to prepare for the option without agreement 2.0," the document says.

Today, in terms of the economic calendar, the attention will be focused on the meeting of the Bank of England, from which they expect further expansion of the quantitative easing program. Regarding the refinancing rate, here, as it were, a conversation about reducing its level is conducted among the committee of the regulator, but it is considered as one of the possible tools. That is, the chance that the rate will be lowered at the current meeting is extremely small.

The results of the meeting of the Bank of England are scheduled for 11:00 Universal time.

Further development

Analyzing the current trading chart, we can see the accumulation process within the range of 1.2510/1.2565, where market participants are waiting for the results of the meeting of the Bank of England, which can give a new round of activity. In this case, you should be extremely attentive to the consolidation points, since price consolidating below 1.2500, can theoretically return the quote to the previous range of 1.2150 // 1.2350 // 1.2620.

In terms of the emotional mood of the market, the readiness of speculators for action is clearly visible here and this is indicated by the coefficient of speculative positions, since the slowdown in volatility relative to the past day.

It can be assumed that if the price consolidates below the level of 1.2500, we will have a way in the direction of 1.2450, where it is possible to extend to the average level of 1.2350. An alternative scenario should be considered if the current accumulation and the external background keep the quote above the level of 1.2500, and the quote manages to consolidate beyond 1.2585.

Based on the above information, we derive trading recommendations:

- Consider buy deals in case of price consolidation above the level of 1.2585, in the direction of 1.2620-1.2650.

- Consider sale trades if the price is consolidated below the level of 1.2500, with the goal of moving to 1.2450-1.2350.

Indicator analysis

Analyzing a different sector of time frames (TF), we see that the indicators of technical tools on hourly periods signal a sale, due to the concentration of the price within the level of 1.2500. Daily intervals still work in an upward trend, giving a buy signal, but if the price is consolidated below 1.2500, the trading signal may change from buy to sell.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(June 18 was based on the time of publication of the article)

The volatility of the current time is 41 points, which is 68% lower than the daily average. It is worth considering that volatility can increase at times due to the upcoming meeting of the Bank of England, as well as speculative sentiment.

Key levels

Resistance Zones: 1.2620; 1.2770 **; 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Zones: 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1.1000; 1.0800; 1.0500; 1.0000.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustment