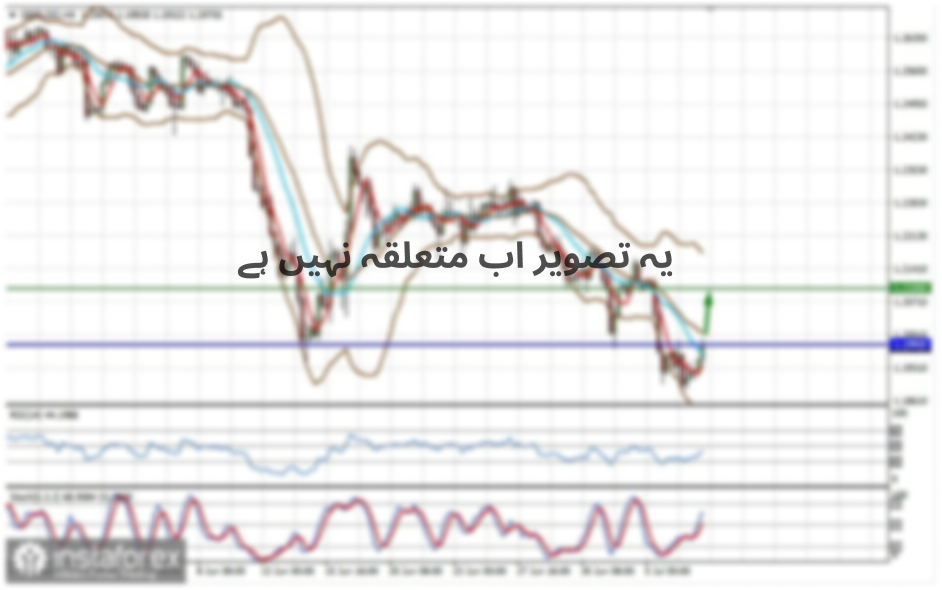

For the first time in a long time, the pound/dollar currency pair has shown low volatility of 80 points, which will lead to everything, we will analyze in the current article. From technical analysis (TA), we see a desperate attempt to restore short positions, where working out a strong psychological level of 1.3000, we ended up barely working out at 20% relative to the inertial stroke. The reluctance of sellers to return to the market is felt, and they can be understood. The emotional component that was present on the market on October 10-17, was striking in its scale. Even the most restrained traders were exposed to the symptom of FOMO (lost profits syndrome), and when the fountain of joy reached the side channel, everyone froze in ambiguity, where it is indecent to go up, the overbought level went to the limit, and it was somehow scary to sell. We got what we have. In terms of volatility, we have a rather interesting picture: for 9 trading days in a row, the extremely high amplitude of fluctuations was kept, stably exceeding the average daily indicator, and now, since Monday of the current week, the recession began. October 21 and 22 were synchronous, giving an amplitude of 137 points, which already reflected a decrease in volatility with last week's data. Volatility on October 23 for the first time fell below the daily average of 116.33 – 80 points, which can be characterized as a relief of the FOMO symptom of market participants. Thus, in the case of confirmation of the above theory, the downward recovery process may resume over time, unless, of course, the quote is fixed above the level of 1.3000.

Analyzing the hourly past day, we see a smooth upward movement, where there was not a single impulse, the course was more like a step. Theoretically, the sluggish upward move could be a temporary overflow of trading operations and the emerging ambiguity, which is just reflected in the volatility.

As discussed in the previous review, speculators working at the stage of pseudo recovery from the level of 1.3000 went into active fixation within 1.2850-1.2870 due to several factors. So, the indecision of sellers to join the recovery phase alerted many and forced the closure of trading operations. At the same time, the emotional backdrop has declined, dropping many outside the market.

The first thing that traders see when considering the trading chart in general terms (the daily period) is an inertial upward move. Then comes the fear of a trend reversal and only then the realization that the existing vertical movement is extremely unstable and is formed on the emotions of the market participants themselves. Whether the psychological level of 1.3000 will be able to restrain the emotions of buyers, time will tell. Now, we do not see a correction or even a full-fledged rollback, it is more like a stop. The prerequisites for restoring the initial movement will appear to traders only after fixing the price below 1.2770

The news background of the last day was empty, the statistics on the UK and the United States were not published. Whether it is good or bad, everyone decides for himself, I can only state the fact that the pound at the current time very indirectly reacts to statistical data and largely ignores them. The reason for the suspension lies in the strong background of information, which attracts all the attention and forms the highest fluctuations in the market.

The information background, in particular, the Brexit process, continues its daily development, saturating the news feed with interesting headlines and comments.

This time we discussed postponing Brexit. The ambassadors of the 27 EU member states met in Brussels, where each spoke about the possible delay requested by England. The Commonwealth of EU countries is generally not against granting a delay of three months with the possibility to leave before the deadline, but no official decision has been put forward. Subsequently, comments were received that a deferral decision would be made at a subsequent meeting on Friday. Market reaction to the news was not strong, but still in favor of reducing the fear of exit without a deal.

From the remaining background, there was a local noise of the split of the government due to the elections and Brexit, which was later denied by the Prime Minister's office, as well as a misunderstanding about border checks in Northern Ireland and the UK, which was also dispelled by the Brexit Minister Stephen Barclay.

Today, in terms of the economic calendar, we have a package of statistics for the United States, where data are waiting for durable goods, which are projected to decline by 0.6%. PMI data will also be released: Services sector 50.9 – 51.0; Manufacturing sector 51.1 – 51.0.

Further development

Analyzing the current trading chart, we see an interesting amplitude and local surges in the period 09:00-11:00 hours (time on the trading terminal) first threw the quote at the time of night accumulation, and then returned it to the area of fluctuations of the past day. The total amplitude was 72 points.

In turn, speculators probably fell for the accumulation of (1.2905/1.2920) Pacific and Asian trading sessions, where they worked on the breakdown. The result was probably twofold since an up/down surge could hit two orders at once.

It is possible to assume that while maintaining the same ambiguity, the process of horizontal running with wide boundaries of 1.2830/1.3000 can shut up for a few days. Thus, the work inside the corridor will be more interesting to speculators who will try to work on local fluctuations. In turn, conservative traders are in no hurry to act, and those with borders have extended even more 1.2770/1.3000, waiting for price-fixing beyond the established framework.

Buy and sell positions are arranged depending on your approach to trading (speculative and conservative], follow the material described above.

Indicator analysis

Analyzing different sector timeframes (TF), we see that the indicators in the short term will recover relative to the morning jump – an upward signal. The intraday perspective works on the morning jump. The medium-term outlook invariably holds upward interest due to the past inertia.

Volatility per week / Measurement of volatility: Month; Quarter; Year.

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(October 24 was built taking into account the time of publication of the article)

The volatility of the current time is 72 points, which is the average for this period. It is likely to assume that the effect of the slowdown is still possible in the market, as we wrote at the beginning of the article.

Key levels

Resistance zones: 1.3000; 1.3170**; 1.3300**.

Support zones: 1.2770**; 1.2700*; 1.2620; 1.2580*; 1.2500**; 1.2350**; 1.2205(+/-10p.)*; 1.2150**; 1.2000***; 1.1700; 1.1475**.

* Periodic level

** Range level

*** The article is based on the principle of conducting transactions, with daily adjustments.