GBP/USD

Analisis Ringkas:

Sejak akhir Ogos, pasangan GBP/USD telah mengikuti gelombang penurunan. Dalam jangka masa yang lebih besar, bahagian ini membentuk satu pembetulan mendatar yang panjang. Harga telah mencapai sempadan atas zon sokongan kuat pada jangka masa harian. Struktur gelombang nampaknya lengkap, tetapi tiada tanda pembalikan segera pada carta.

Ramalan Mingguan:

Dalam beberapa hari yang akan datang, pound British dijangka meneruskan aliran menurun, beralih kepada pergerakan mendatar berhampiran zon rintangan. Pada separuh kedua minggu, peningkatan aktiviti, pembalikan, dan permulaan pergerakan harga menaik dijangka. Penembusan sementara pada sempadan bawah zon sokongan yang dikira tidak boleh diketepikan semasa perubahan hala tuju.

Zon Pembalikan Berpotensi:

- Rintangan: 1.2820/1.2870

- Sokongan: 1.2580/1.2530

Cadangan:

- Beli: Selepas isyarat pembalikan disahkan berhampiran zon sokongan, peluang membeli boleh dipertimbangkan.

- Jual: Disebabkan potensi yang terhad, penjualan adalah berisiko dan mungkin mengakibatkan kerugian.

AUD/USD

Analisis Ringkas:

Pada carta AUD/USD, pergerakan harga menurun yang bermula pada akhir September berterusan. Dalam skala yang lebih besar, bahagian ini sedang melengkapkan pergerakan mendatar berterusan menurun. Struktur gelombang masih belum lengkap.

Ramalan Mingguan:

Pergerakan mendatar dengan vektor ke atas dijangka dalam beberapa hari akan datang. Pembalikan dan pemulangan aliran menurun mungkin berlaku berhampiran zon rintangan. Aktiviti pasaran yang meningkat dijangka pada separuh kedua minggu ini.

Zon Pembalikan Berpotensi:

- Rintangan: 0.6480/0.6530

- Sokongan: 0.6350/0.6300

Cadangan:

- Jualan: Dibenarkan selepas isyarat pembalikan yang bersesuaian diperhatikan dalam sistem perdagangan anda.

- Pembelian: Tiada keadaan yang sesuai untuk pembelian dijangka minggu ini.

USD/CHF

Analisis Ringkas:

Pada penghujung trend penurunan dalam carta USD/CHF sejak awal Ogos, satu gelombang kenaikan telah terbentuk. Gelombang ini telah melebihi tahap pembetulan yang dijangkakan dan hampir kepada penamatannya. Tiada tanda pembalikan segera pada carta. Sebut harga hampir kepada sempadan atas zon pembalikan potensi.

Ramalan Mingguan:

Pergerakan kenaikan pasangan ini dijangka akan tamat dalam satu atau dua hari akan datang. Selepas itu, dalam zon rintangan yang dikira, pergerakan mendatar dijangka, menyiapkan keadaan untuk perubahan arah. Penurunan harga berkemungkinan pada penghujung minggu. Zon sokongan yang dikira akan mengehadkan julat pergerakan mingguan pasangan ini.

Zon Pembalikan Berpotensi:

- Rintangan: 0.8910/0.8960

- Sokongan: 0.8750/0.8700

Cadangan:

- Jualan: Pertimbangkan menjual hanya selepas terdapat isyarat pembalikan yang disahkan berhampiran zon rintangan.

- Beli: Potensi terhad; pembelian mungkin mengakibatkan kerugian.

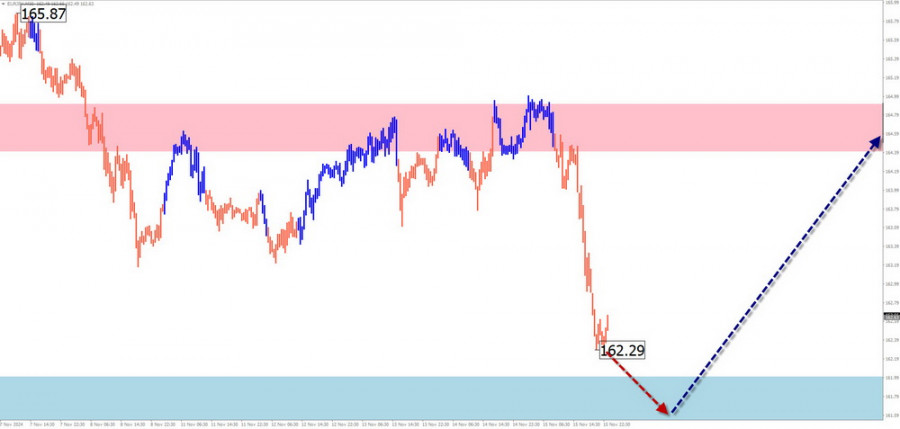

EUR/JPY

Analisis Ringkas:

Sejak Oktober tahun lepas, pasangan EUR/JPY telah mengikuti gelombang penurunan. Bahagian akhir gelombang (C) sedang berkembang dan hampir siap. Harga telah mencapai sempadan atas zon pembalikan berpotensi yang kuat.

Ramalan Mingguan:

Pada permulaan minggu, pergerakan mendatar am dijangka. Trend penurunan mungkin berlaku, tetapi harga dijangka kekal di atas sempadan sokongan. Pembalikan dijangka menjelang akhir minggu. Zon rintangan yang dikira menunjukkan sempadan atas julat harga mingguan yang dijangka.

Zon Pembalikan Berpotensi:

- Rintangan: 164.40/164.90

- Sokongan: 162.00/161.50

Cadangan:

- Jualan: Lot kecil boleh digunakan semasa sesi tertentu, mensasarkan zon sokongan.

- Pembelian: Pertimbangkan untuk membeli hanya selepas isyarat pembalikan yang disahkan diperhatikan.

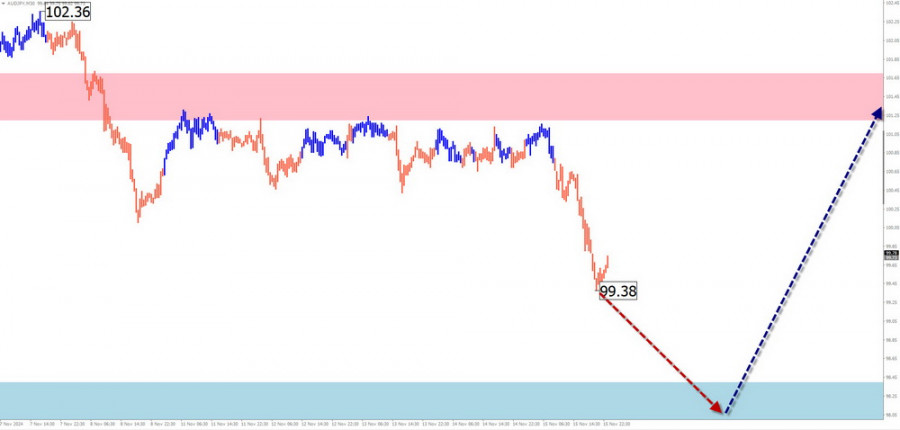

AUD/JPY

Analisis:

Sejak Ogos, turun naik harga AUD/JPY telah mengikut gelombang menurun. Sejak 3 Oktober, harga telah membetulkan dalam pergerakan mendatar, membentuk struktur mendatar yang panjang. Gelombang ini berada dalam fasa akhirnya.

Ramalan:

Penurunan harga berterusan dijangka dalam beberapa hari akan datang. Berhampiran zon sokongan yang dikira, penstabilan mendatar dijangkakan, mewujudkan keadaan untuk pembalikan. Pergerakan harga ke atas berkemungkinan disambung semula menjelang akhir minggu ini atau minggu depan. Zon yang dikira menunjukkan julat harga mingguan yang dijangkakan untuk pasangan ini.

Zon Pembalikan Berpotensi:

- Rintangan: 101.20/101.70

- Sokongan: 98.40/97.90

Saranan:

- Penjualan: Potensi terhad; penjualan berjumlah kecil mungkin digunakan dalam sesi tertentu.

- Pembelian: Pertimbangkan untuk membeli selepas isyarat pembalikan disahkan berhampiran zon sokongan.

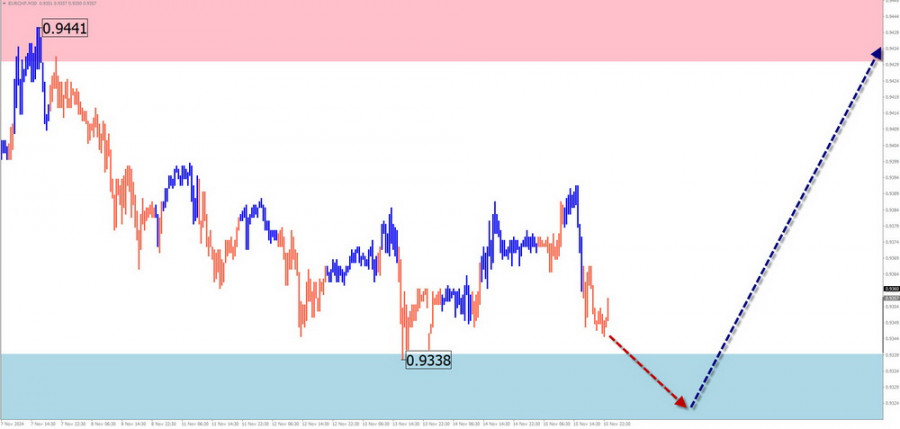

EUR/CHF

Analisis Ringkas:

Sejak Januari, turun naik harga EUR/CHF telah mengikuti gelombang penurunan. Baru-baru ini, harga telah membetulkan dan bergerak mendatar. Harga kini berada berhampiran sempadan atas zon pembalikan berpotensi yang kuat pada jangka masa harian.

Ramalan Mingguan:

Pergerakan mendatar am dijangkakan minggu ini. Tekanan ringkas pada sempadan bawah zon sokongan boleh berlaku pada hari-hari awal. Kemungkinan kembali kepada aliran kenaikan menjelang hujung minggu. Zon yang dikira menunjukkan jangkaan julat harga untuk minggu ini.

Zon Pembalikan Berpotensi:

- Rintangan: 0.9430/0.9480

- Sokongan: 0.9340/0.9290

Cadangan:

- Pembelian: Pertimbangkan untuk membeli selepas terdapat isyarat pembalikan yang disahkan berhampiran zon sokongan.

- Jualan: Berisiko dan boleh membawa kepada kerugian.

Indeks Dolar AS

Analisis Ringkas:

Sejak akhir September, Indeks Dolar AS berada dalam aliran kenaikan. Struktur gelombang kelihatan lengkap. Indeks kini menghampiri had atas zon pembalikan potensi pada skala mingguan. Namun, tiada tanda pembalikan yang akan berlaku dengan serta-merta pada carta.

Ramalan Mingguan:

Aliran mendatar dalam Indeks Dolar AS dijangka berterusan pada separuh pertama minggu ini. Menjelang hujung minggu, indeks dijangka meneruskan aliran kenaikan dan meningkat menuju zon rintangan yang dikira.

Zon Pembalikan Berpotensi:

- Rintangan: 107.50/107.70

- Sokongan: 106.30/106.10

Cadangan:

- Beli: Mata wang negara dalam pasangan utama boleh diperdagangkan dalam beberapa hari akan datang. Selepas itu, tunggu pembalikan dalam aliran USDollar dan fokus kepada jualan mata wang utama.

Ethereum

Analisis:

Sejak 5 Ogos, gelombang kenaikan pada carta Ethereum telah menentukan pergerakan harga utama. Pada carta masa harian, bahagian ini menandakan permulaan bahagian akhir gelombang (C). Baru-baru ini, pembetulan sedang dibentuk dalam pergerakan mendatar yang menyerupai mendatar meluas. Struktur ini belum lengkap.

Ramalan:

Pergerakan mendatar dijangka dalam beberapa hari akan datang, dengan kemungkinan pengujian zon rintangan yang dikira. Perubahan arah dijangka selepas itu. Peningkatan volatiliti harga dijangka pada separuh kedua minggu ini, dengan potensi penurunan ke arah zon sokongan.

Zon Pembalikan Berpotensi:

- Rintangan: 3150.0/3200.0

- Sokongan: 2880.0/2830.0

Saranan:

- Pembelian: Potensi terhad; pembelian pada jumlah kecil boleh dilakukan dalam sesi tertentu.

- Penjualan: Disarankan hanya selepas isyarat yang disahkan berhampiran zon rintangan.

Penjelasan: Dalam Analisis Gelombang Dipermudahkan (SWA), semua gelombang terdiri daripada 3 bahagian (A-B-C). Gelombang terakhir yang belum lengkap dianalisis pada setiap carta masa. Pergerakan yang dijangkakan ditunjukkan dengan garisan putus-putus.