Analysis of EUR/USD 5M

The US dollar went through another bearish performance on Friday. This is due to the disappointing US reports on unemployment and Nonfarm Payrolls. We have previously mentioned that the problem with the dollar lies in the market's overly high expectations for macroeconomic indicators. However, this does not negate the fact that the logical chain "data weaker than forecasts – the currency declines" is functioning. Thus, the dollar continued to fall throughout the past week.

In reality, the US dollar's decline was not that significant, as the pair's volatility remains low or "at zero." Nonetheless, the segments of the US dollar's growth are equally weak. Currently, a local upward trend has formed, supported by the trend line. Therefore, traders should look upward in the near future. In the new week, there will be one event that could drive another nail into the dollar's coffin. This is the US inflation report. Almost any value could provoke the US dollar's decline, as forecasts suggest that inflation remained unchanged in June. Therefore, the EUR/USD pair may slightly undergo a correction. However, traders should understand that we are talking about very weak movements, whether down or up.

One trading signal was formed on the 5-minute timeframe. Immediately after the release of US macro data, the pair rebounded from the 1.0836 level and sharply fell by about 30 pips. However, it also quickly and sharply returned to its starting position. We believe that it is not advisable to open trades during the release of crucial data. In any case, it would not have been possible to make profit from short positions, as the euro couldn't even reach the nearest target level, which was only 39 pips away.

COT report:

The latest COT report is dated June 25. The net position of non-commercial traders has remained bullish for a long time and remains so. The bears' attempt to gain dominance failed miserably. The net position of non-commercial traders (red line) has been declining in recent months, while that of commercial traders (blue line) has been growing. Currently, they are approximately equal, indicating the bears' new attempt to seize the initiative.

We don't see any fundamental factors that can support the euro's strength in the long term, while technical analysis also suggests a continuation of the downtrend. Three descending trend lines on the weekly chart suggests that there's a good chance of further decline. In any case, the downward trend is not broken.

Currently, the red and blue lines are approaching each other, which indicates a build-up in short positions on the euro. During the last reporting week, the number of long positions for the non-commercial group decreased by 4,100, while the number of short positions increased by 12,300. As a result, the net position decreased by 16,400. According to the COT reports, the euro still has significant potential for a decline.

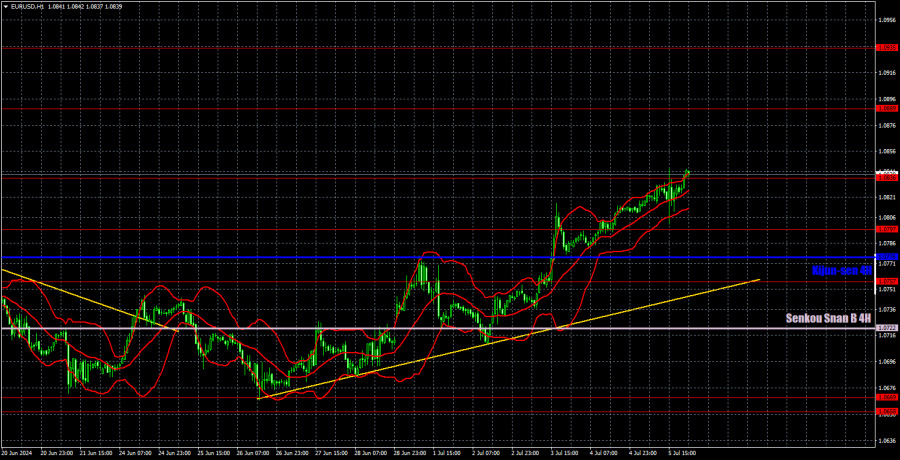

Analysis of EUR/USD 1H

On the 1-hour chart, EUR/USD failed to break through the 1.0658-1.0669 area and decided not to waste time, so it formed a new upward trend instead. We currently have an ascending trend line, above which the upward trend persists. This trend could end as early as this week, but it will take at least a few days for the price to drop to the trend line. It is impossible to confirm the end of the uptrend without breaking through this line and the Ichimoku indicator lines. Moreover, the US inflation report might exert further pressure on the dollar.

On July 8, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0797, 1.0836, 1.0889, 1.0935, 1.1006, 1.1092, as well as the Senkou Span B (1.0722) and Kijun-sen (1.0776) lines. The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

On Monday, there are no important events scheduled in the US or the Eurozone. EUR/USD may continue to rise for some time due to the current momentum, but we expect at least a slight downward correction before the inflation report is released.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;