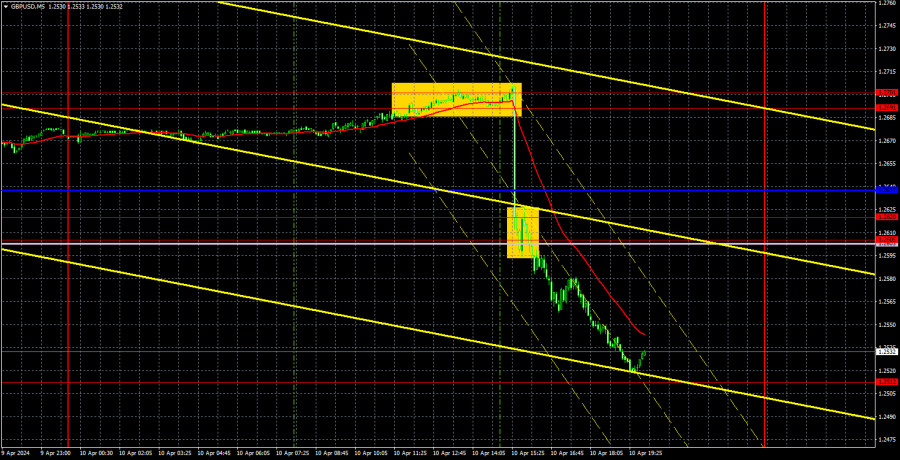

Analysis of GBP/USD 5M

GBP/USD also showed a significant downward movement on Wednesday. It was so strong that the price simultaneously broke through the trend line, the Ichimoku indicator lines, and the levels of 1.2605 and 1.2620. We haven't seen such movement in a long time, but it had almost no impact on the technical picture. By the end of the trading day, the pair dropped to the level of 1.2516, which can be considered the boundary of the sideways channel on the 24-hour timeframe. Therefore, unless we can confirm that the price has successfully breached this boundary, we shouldn't expect the pair to just start a downward trend. Unfortunately, even yesterday's decline does not guarantee a trend reversal at the moment. The pair could easily bounce back from the level of 1.2516 and start a new move towards the upper boundary of the sideways channel – the level of 1.2800.

The only reason why the dollar grew by 200 pips was because of the US inflation report, which we already informed you was a crucial report. There was a risk that the market would once again "overlook" such an important report, but this time it properly worked out. It seems that the market, within a few hours, also digested all the US reports from last week, which was also strong and supported the dollar. However, it is still too early to talk about the end of the flat.

The pound's trading signals from yesterday were better than the euro's. Even during the European trading session, the pair entered the range of 1.2691-1.2701, so one could expect a bounce from it and open short positions in advance, remembering to set a Stop Loss just in case the US inflation figures turned out to be lower than expected. However, the Stop Loss was not necessary. The pair fell by about 200 pips and stopped only around the level of 1.2512, where traders could take profit on short positions. Now, we are likely to see a bullish rebound, and then everything will depend on the pressure from the bears, who have the support of almost all fundamental and macroeconomic factors.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent months. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and, in most cases, remain close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 7,000 buy contracts and closed 1,100 short ones. As a result, the net position of non-commercial traders increased by 8,100 contracts in a week. The fundamental background still does not provide a basis for long-term purchases of the pound sterling, and the currency remains in a sideways channel.

The non-commercial group currently has a total of 98,300 buy contracts and 55,000 sell contracts. The bulls no longer have a significant advantage. Although the pound refuses to fall, such absurd movements cannot persist forever. The technical analysis also suggests that the pound should fall further (descending trend line), but we still have a flat state on the 24-hour timeframe.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD was forced to stop forming a new upward movement within the sideways channel of 1.25-1.28. If it weren't for the inflation report, which was quite important as it could affect the dollar's strength, we probably would have seen the pound rise for several more weeks. Nonetheless, the sideways channel remains intact at the moment. To end the flat phase, the price must firmly consolidate below the level of 1.2516. The flat cannot last forever, but it has already been ongoing for 4 months...

As of April 11, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691-1.2701, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2609) and Kijun-sen (1.2616) lines can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

There are no important events scheduled in the UK on Thursday. Meanwhile, the US will only release secondary reports like the producer price index and unemployment claims. We can expect the dollar to strengthen further considering that there is an 80% chance that the Fed will not lower its rate in June. However, everything will now depend on the level of 1.2516 and the market's ability to overcome it.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;