US Stocks Show Strong Growth as Investors Await Key Events

US stocks closed on a positive note on Monday, posting their biggest weekly percentage gain since the start of the year. Investors focused on the Democratic National Convention and the upcoming Jackson Hole Economic Conference.

Tech Giants Lead Markets Higher

All three key US indexes ended the day in positive territory, led by strong gains in Nvidia, Microsoft, and Alphabet. The Nasdaq led the gains among the major indexes.

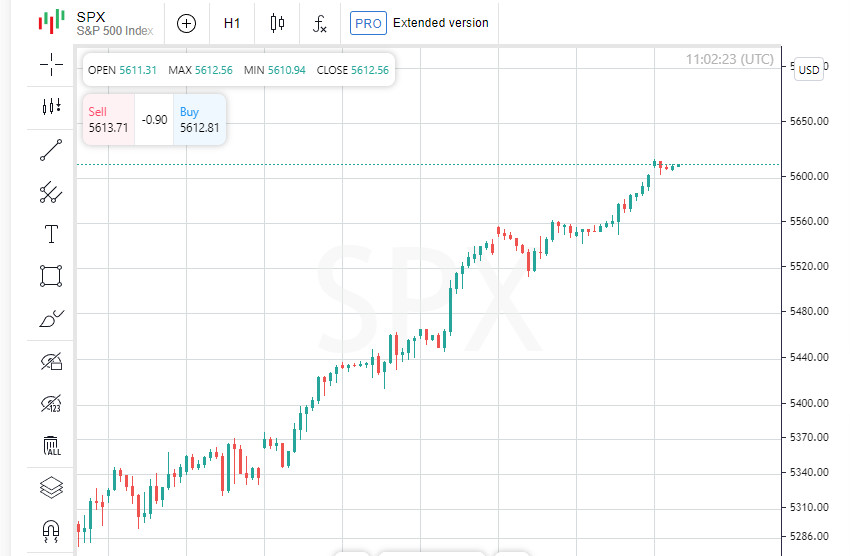

The S&P 500 and Nasdaq extended their winning streak to eight straight sessions, the longest gains in 2024. The strong rally followed a sharp drop two weeks ago amid recession fears.

Markets rebound after recent selloff

U.S. stocks are enjoying their strongest weekly rally this year, with the major indexes jumping 2.9% to 5.3%. The recovery was fueled by data showing continued resilience in consumer demand despite slowing economic growth. That has fueled hopes that the Federal Reserve will begin cutting interest rates as early as September, cutting its target federal funds rate by 25 basis points.

Fed Rate Cut Hopes

"These expectations are fueling hopes that liquidity will hold up and the Federal Reserve could cut rates in September," said Paul Nolte, senior wealth management consultant and strategist at Murphy & Sylvest in Elmhurst, Illinois.

Most economists expect the Fed to cut rates three times by 25 basis points before the end of the year, which they say could help the economy avoid a recession as inflation pressures ease.

Eyes on Jackson Hole: Markets Await Powell's Speech

With the annual Jackson Hole Economic Symposium set to kick off Thursday, all eyes will be on Federal Reserve Chairman Jerome Powell's speech on Friday. Economists and investors are eagerly awaiting signs of how the central bank plans to transition from its current tight monetary policy to a more neutral approach.

Powell and the Market: What to Expect from the Fed Statement

According to Paul Nolte, a senior wealth management consultant at Murphy & Sylvest, Powell is likely to confirm that the Fed is beginning to acknowledge that inflation is gradually coming down toward its target. This statement could be taken by markets as a sign that the Fed is ready to consider cutting interest rates as early as September.

"They are satisfied with the way the economy is performing, and that opens the door to possible easing," Nolte added.

Political Events Add Volatility to Markets

At the same time, the Democratic National Convention is set to kick off in Chicago, which could also add uncertainty to financial markets. Volatility, already heightened by low liquidity during the summer season, could further increase.

The CBOE Volatility Index (VIX), often referred to as a "gauge of fear" for investors, fell sharply last week after reaching a four-year high. The decline came amid optimism that the U.S. economy can avoid a severe recession.

Market optimism: Recession may not happen

Goldman Sachs, a leading investment bank, has cut the probability of a U.S. recession in the next 12 months to 20% from 25%. The decision was based on the latest jobless claims and retail sales data, which showed the economy is stable.

Indexes rise on positive expectations

Amid this news, indexes on Wall Street showed confident growth. The Dow Jones Industrial Average rose by 236.77 points, which was an increase of 0.58%, reaching 40,896.53. The S&P 500 added 54 points, increasing by 0.97% and reaching 5,608.25. The Nasdaq Composite also strengthened, adding 245.05 points or 1.39%, and reached 17,876.77.

Financial markets continue to closely monitor events, waiting for further developments and the reaction to the statements of the Fed representatives.

S&P 500: All Sectors Gain, Communications Leads

All 11 major sectors of the S&P 500 ended Monday with solid gains, with communications services companies leading the way.

Advanced Micro Devices Expands AI Position

Advanced Micro Devices (AMD) shares rose 4.5% after announcing its plan to acquire server maker ZT Systems for $4.9 billion. The deal aims to bolster AMD's position in artificial intelligence and increase competition from industry leader Nvidia.

B. Riley Financial Continues to Fall

B. Riley Financial (RILY) fell 5.8%, extending a losing streak that began last week, when the stock tumbled more than 65%. Co-founder and CEO Bryant Riley made an offer to buy the bank on Friday after the company warned of a significant loss related to an investment in Vitamin Shoppe owner Franchise Group.

Waiting for Quarterly Reports from Major Companies

Investors are eagerly awaiting quarterly results from major players like cybersecurity company Palo Alto Networks, retailer Target and home improvement chain Lowe's. The reports are due later this week and could have a significant impact on the market going forward.

Stock Market Optimism: NYSE and Nasdaq

On the New York Stock Exchange (NYSE), advancers outnumbered decliners by a 3.54-to-1 ratio. On the Nasdaq, the ratio was 2.71-to-1 in favor of gainers.

Markets Make New Highs

The S&P 500 has made 32 new highs in the past 52 weeks and no new lows. The Nasdaq Composite also posted impressive results, with 105 new highs and 65 new lows.

Volume Declines in Late Summer

Trading volume on U.S. exchanges totaled 10.3 billion shares, below the 12.24 billion share average over the past 20 trading days. The decline in activity reflects traditionally low liquidity at the end of the summer season. However, investors continue to watch events closely, preparing for further market moves.

U.S. Futures Cautiously Gain Ahead of Powell Speech

U.S. stock futures edged up slightly in a tight trading range on Tuesday, as market participants bet on a rate cut in September ahead of Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole Symposium later this week.

Consumer resilience boosts rate cut hopes

Fresh economic data suggests that the consumer sector continues to show resilience despite the overall slowdown in economic activity, fueling expectations that the Federal Reserve could ease its monetary policy at its upcoming September meeting.

Currently, traders are pricing in a 75.5% chance of a 25 basis point rate cut in September, according to the CME FedWatch Tool. A week ago, the probability of such a scenario was much lower, with the market almost evenly split between a 50 and 25 basis point cut.

Market braces for surprises: expert opinion

Despite the market optimism, investment analyst at forex broker XM Achilleas Georgolopoulos warns of possible risks. He believes that traders' current expectations for a possible Fed easing may be overly optimistic, given the state of the US economy.

"These forecasts may be overly ambitious and are based on the assumption that Powell will take a softer stance at the symposium," Georgolopoulos said, adding that if Powell maintains a balanced approach and is not prepared to make significant concessions, the market could react sharply.

Key Speeches and Releases: What to Expect Next

Investors will also be focused on speeches from Atlanta Federal Reserve Bank President Raphael Bostic and Federal Reserve Bank Vice Chairman for Supervision Michael Barr on Tuesday. These statements could provide additional signals about the Fed's policy direction.

Also, the minutes of the Federal Reserve's most recent policy meeting will be released on Wednesday, giving investors additional information to assess the central bank's next steps.

Markets remain on edge as the outcome of the Jackson Hole symposium could have a significant impact on the financial sector going forward.

U.S. Index Futures Show Modest Gains on Positive News

U.S. stock index futures showed modest gains in morning trading on Tuesday. At 5:15 a.m. ET, Dow E-mini futures were up 3 points, or 0.01%, S&P 500 E-mini futures were up 3.75 points, or 0.07%, and Nasdaq 100 E-mini futures were up 25.75 points, or 0.13%.

Palo Alto Networks Gains Premarket Gains

Palo Alto Networks shares rose 2.1% in premarket trading after the company provided fiscal 2025 revenue and earnings guidance that beat analysts' expectations. The gains were driven by increased demand for the company's cybersecurity solutions as digital threats become more sophisticated in the modern world.

Cryptocurrency Sector Gains: Bitcoin Rises 3.1%

Cryptocurrency and blockchain stocks also showed positive momentum, as Bitcoin rose 3.1%. Cryptocurrency exchange operator Coinbase Global rose 2.1%, while mining company Riot Platforms gained 2.7%.

Bitcoin Gainers

MicroStrategy, known for its heavy Bitcoin investments, gained 3% in premarket trading. In addition, the ProShares Bitcoin Strategy ETF (BITO) rose 3.4%, reflecting positive investor sentiment towards cryptocurrencies.

These early gains show continued investor interest in the tech and cryptocurrency sectors despite ongoing market uncertainty ahead of key events of the week.