If it had been weaker, it wouldn't be considered a correction. Currently, it appears more like a pullback than a correction. Over the three days, the price barely reached the moving average, which had grown more than the price descended to. Consequently, we still don't observe a typical correction in the British currency. It's worth noting that the pound has encountered significant issues with corrections in the past six months. Despite the weak macroeconomic conditions in the UK and the stronger situation in the United States, the market primarily focuses on a single factor: the potentially significant increase in interest rates in the UK.

The Bank of England's key rate has already risen to 5% and may increase by another 0.5–0.75%. This factor is the only one that can partially explain the current growth of the British currency. However, the market is uninterested in the Federal Reserve's rate of 5.25%. Additionally, the market doesn't attach significance to the fact that the dollar has been declining for the past ten months, losing around 2800 points while the Fed tightens its monetary policy. We believe that the market interprets incoming information in an excessively one-sided manner.

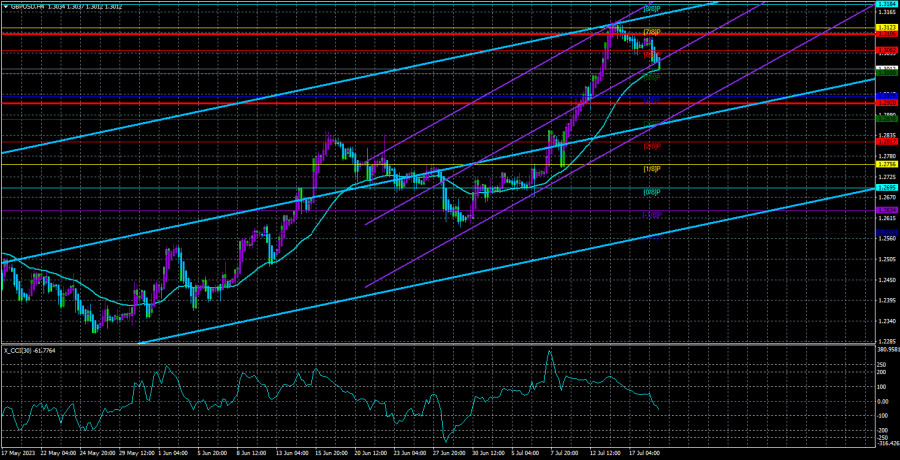

There are no indications of a correction or the emergence of a downward trend in the 24-hour time frame. Instead, all indicators point upward. While there have been a few attempts at correction within the overall upward trend, the price has never settled below the Ichimoku cloud. The price is above all the lines of the Ichimoku indicator. The overbought condition of the CCI indicator, which formed two weeks ago on the 4-hour time frame, also holds no significance.

UK inflation can trigger various market reactions.

Today, the report on British inflation for June will be published in half an hour. Market participants can expect the following scenarios. First, if inflation falls less than expected (8.2-8.3%), but core inflation rises again, it would provide grounds for the pound to strengthen further, as the market would have increased confidence in additional tightening of the Bank of England's monetary policy. Second, no strong market reaction is expected if the forecasts are met. The third scenario is if both inflation rates decrease more than expected, which may lead to the pound continuing its "poor" correction, as the likelihood of infinite rate hikes in the UK slightly decreases. This is how the market can and should interpret today's data.

However, in reality, the opposite outcome is possible. Given the pound's recent active rise, even a less pronounced slowdown in inflation could trigger its decline. Similar to yesterday, weak reports from the United States led to the dollar's rise. Considering the lack of logic in market movements, there is no guarantee for any particular outcome today. If inflation slows down further, the likelihood of a decline becomes more probable. We believe that today the pound should fall in almost any case, as all potential "growth factors" have already been extensively explored. Nevertheless, we should remember that the probability of any event in the market is 50/50. Moreover, the price has yet to settle below the moving average and shows no inclination to fall.

Consequently, it's essential to be prepared for any scenario. No other significant events are planned for today, and the remaining two days of the week will only bring secondary reports with extremely low chances of influencing market sentiment. The upcoming week will feature the Federal Reserve's meeting, but even a new rate hike does not guarantee the dollar's growth. It's worth noting that the dollar has been declining for the past ten months while the Fed has been raising rates during the same period.

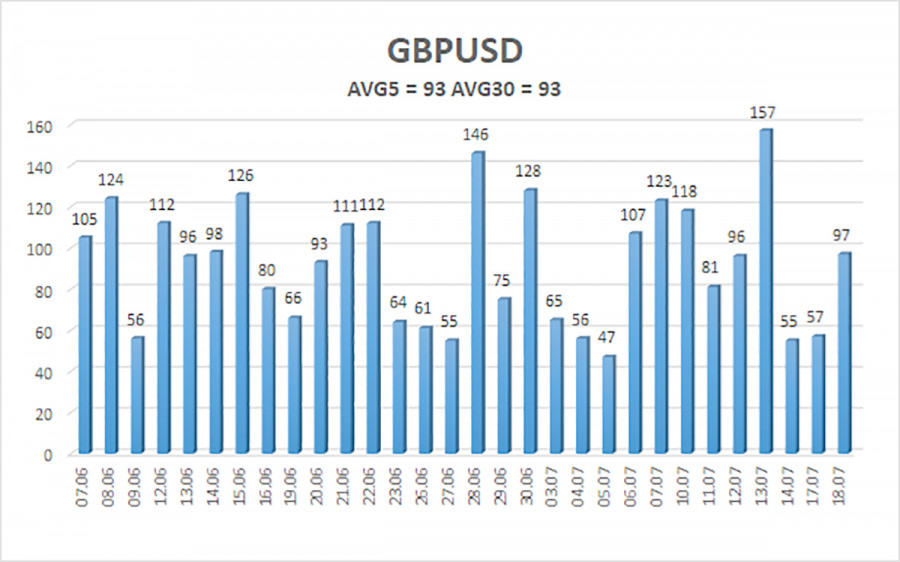

The average volatility of the GBP/USD pair over the last five trading days is 93 points, considered "average" for the pound/dollar pair. Therefore, on Wednesday, July 19, we anticipate movement between 1.2920 and 1.3106. A reversal of the Heiken Ashi indicator upwards will indicate the resumption of the upward trend.

Nearest support levels:

S1 - 1.3000

S2 - 1.2939

S3 - 1.2878

Nearest resistance levels:

R1 - 1.3062

R2 - 1.3123

R3 - 1.3184

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is attempting to correct. Currently, long positions remain relevant with targets at 1.3106 and 1.3123, which should be opened if the price rebounds from the moving average line. Short positions can be considered if the price consolidates below the moving average with targets at 1.2939 and 1.2920.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both channels are aligned in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel in which the pair will trade in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an approaching trend reversal in the opposite direction.