On Friday, GBP/USD extended its upward movement despite a lack of driving factors. Last week, the US Federal Reserve held a monetary policy meeting. Although it did not raise rates, the market was ready for that. At the same time, Chair Powell hinted that the regulator might lift rates in July and in the fall if inflation goes down at a slower pace. The Bank of England meeting, which could theoretically provide support for the pound, will take place only this week. In addition, Friday was a calm day in the market as no macro releases were scheduled.

However, we have repeatedly stressed that the pound rises without any reason for that. Against this backdrop, all we can do is trade with the trend and observe the insane growth of the currency whose economy is far from being in a good state. In previous articles, we speculated that the pound could show explosive growth on expectations for the Bank of England's interest rate. Although inflation decreased steeply in May, it may show a sluggish fall in the future. We hardly believe that the BoE will raise the key rate to 5% or 5.5%, as in this case, a recession would be inevitable. Nevertheless, inflation may be of utmost importance to the British regulator. If the market bets on a prolonged rate-hike cycle, it may trigger a strengthening of the pound.

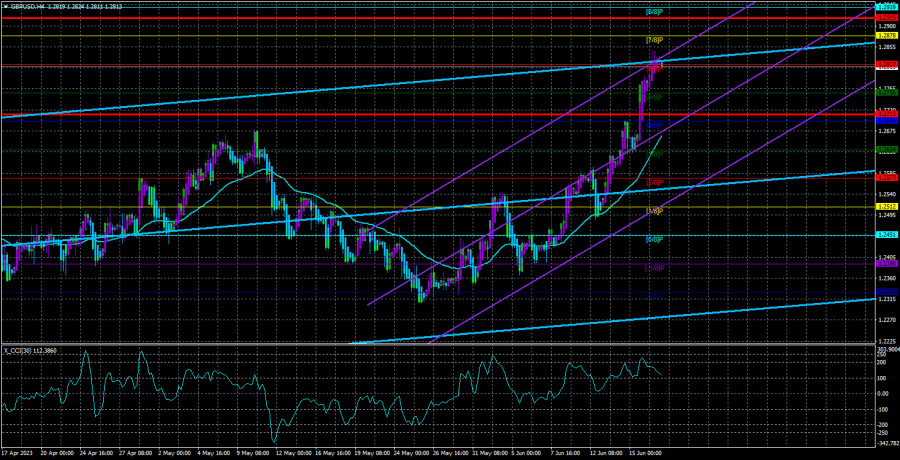

In the 24-hour time frame, the upward trend has once again resumed and no correction followed. The pair has retraced a few hundred pips downward recently, which has had no impact on the overall technical picture. At the same time, it is entirely unclear what factors are driving the pound up and how long this uptrend will continue. The bullish market can stop at any time because there are no fundamental reasons for that.

Powell's testimony and the Bank of England's meeting

There will be quite a few interesting events in the United Kingdom this week. It all starts on Wednesday when the new inflation report for May is released. Consumer prices are forecast to decrease to just 8.4-8.5 from 8.7%. Such inflation figures may boost the pound. Taking into account that the market currently believes in a prolonged tightening cycle in the UK, a slight drop in inflation will further support these expectations.

On Thursday, the Bank of England will announce its decision on the interest rate, which (without any doubt) is expected to increase by another 0.25% to 4.75%. We believe that this hike may be the last one. However, it is best to rely on the voting of the Monetary Policy Committee. In previous meetings, 2 members voted for keeping the rate unchanged, and 7 voted for an increase. If one of the hawks turns into a dove, it will be another signal of an imminent end to the tightening cycle. Considering that the pound has been rising for two weeks without substantial grounds, we believe it may start to fall after the BoE meeting. The thirteenth consecutive rate hike has already been priced in.

On Friday, the UK will see the release of data on retail sales and business activity in the services and manufacturing sectors. We don't expect much from these reports; they are likely to be neutral. Meanwhile, all eyes will be on Jerome Powell's testimony in Congress and the Senate. The truth is that such speeches (which occur twice a year) rarely reveal any specific details, and some market participants even know their contents in advance. Powell's remarks will hardly differ from those made after the Federal Reserve meeting last week. Therefore, the market may show a restrained reaction to his words. However, any dovish hints may be enough for the market to once again sell the dollar and buy the pound.

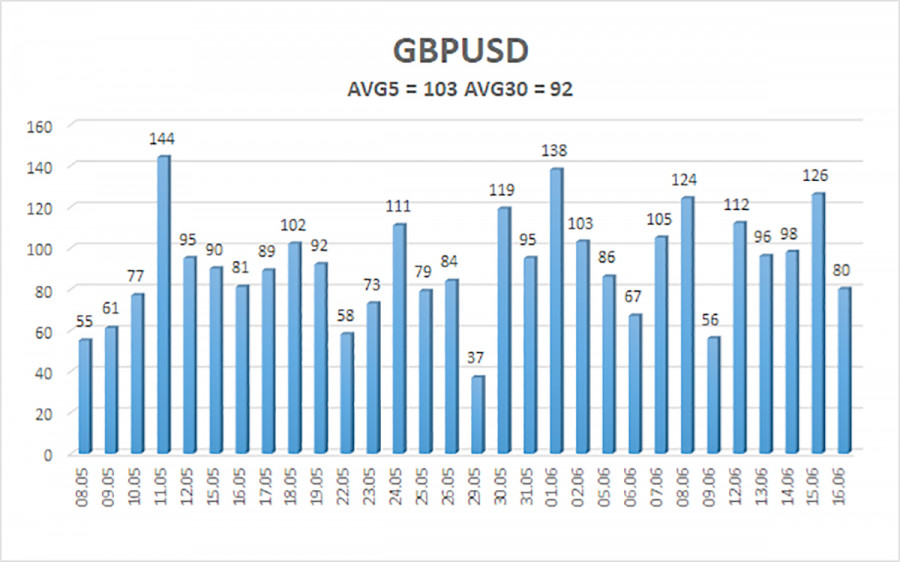

The 5-day average volatility of GBP/USD is 103 pips and is evaluated as moderate. On June 19, the pound/dollar pair will likely move within a range between 1.2710 and 1.2916. Heiken Ashi's downward reversal will signal a correction.

Support:

S1 – 1.2817

S2 – 1.2756

S3 – 1.2695

Resistance:

R1 – 1.2878

R2 – 1.2939

R3 – 1.3000

Outlook:

In the 4-hour time frame of GBP/USD, we have a bullish continuation. We will buy with targets at 1.2878 and 1.2916 until Heiken Ashi's bearish reversal occurs. We will consider selling after consolidation below the MA, targeting 1.2573 and 1.2512.

Indicators on charts:

Linear Regression Channels help identify the current trend. If both channels move in the same direction, a trend is strong.

Moving Average (20-day, smoothed) defines the short-term and current trends.

Murray levels are target levels for trends and corrections.

Volatility levels (red lines) reflect a possible price channel the pair is likely to trade in within the day based on the current volatility indicators.

CCI indicator. When the indicator is in the oversold zone (below 250) or in the overbought area (above 250), it means that a trend reversal is likely to occur soon.