5M chart of EUR/USD

The EUR/USD pair showed quite strange movements again on Wednesday. The pair edged up for almost the entire day, and overall volatility was low. Naturally, we don't consider the last hours of Wednesday when the market was in an excited state due to the results of the Federal Reserve meeting. However, during the day, at least two reports were published in the United States, which could and should have supported the dollar. The ISM index for the services sector and the ADP employment report came out stronger than expected, but the dollar failed to even strengthen by a few dozen points. The market was set to buy the pair in the morning, so it simply ignored macro data. Once again, we saw an absolutely baseless fall of the dollar. When we found out about another Fed rate hike, the dollar fell even further. Of course, by morning it may recover some losses, but judging by yesterday, we can only say one thing – the pair continues to move in an illogical manner.

There was only one trading signal for yesterday. The pair rebounded from the critical line at the beginning of the European trading session and went up about 25 points before the announcement of the results of the Fed meeting. Volatility was low enough, so the trade didn't make much profit. It was also possible to set a break-even Stop Loss and wait for the pair to reach the 1.1076 level without risking anything. Then the profit would have been slightly higher.

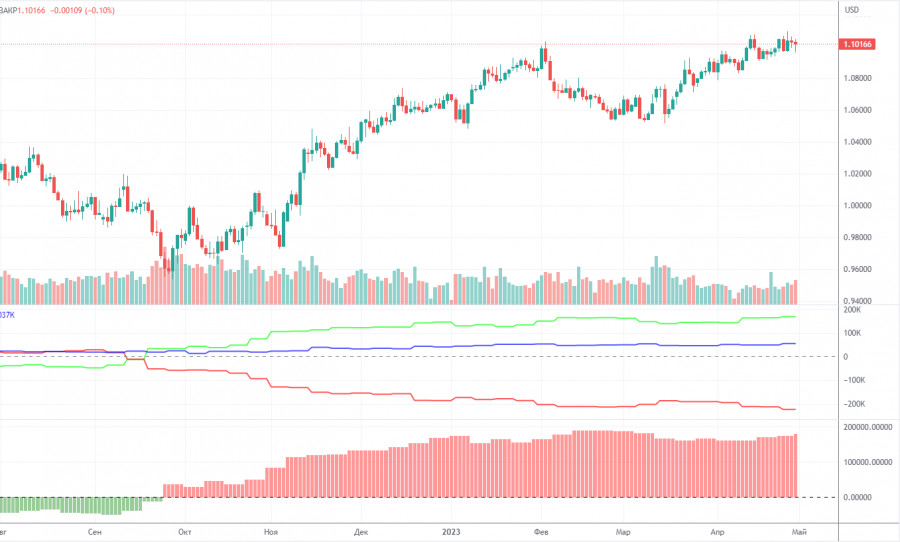

COT report:

On Friday, a new COT report for April 25 was released. In the last 8-9 months, the COT reports have perfectly reflected what has been happening in the market. The charts above clearly show that the net position of large traders (the second indicator) began to increase in September 2022. At about the same time, the euro resumed a bullish bias. Currently, the net position of non-commercial traders is bullish and remains very high. It boosts further growth of the euro. The high level of the net position signals the competition of the uptrend. The first indicator also points to such a scenario. The red and green lines are very far from each other, which often happens before the end of the trend. The euro tried to resume a downward movement. However, so far, we have seen only a pullback. During the last reporting week, the number of long positions of the non-commercial group of traders increased by 1,100 and the number of short ones dropped by 3,900. The net position advanced by 5,000 contracts. The number of long positions is bigger than the number of short ones. Non-commercial traders already have opened 169,000 long positions. The gap is almost threefold. Investors are still unable to start a correction. Even without COT reports, it is clear that the pair is likely to resume a new fall. Yet, currently, bullish momentum is strong.

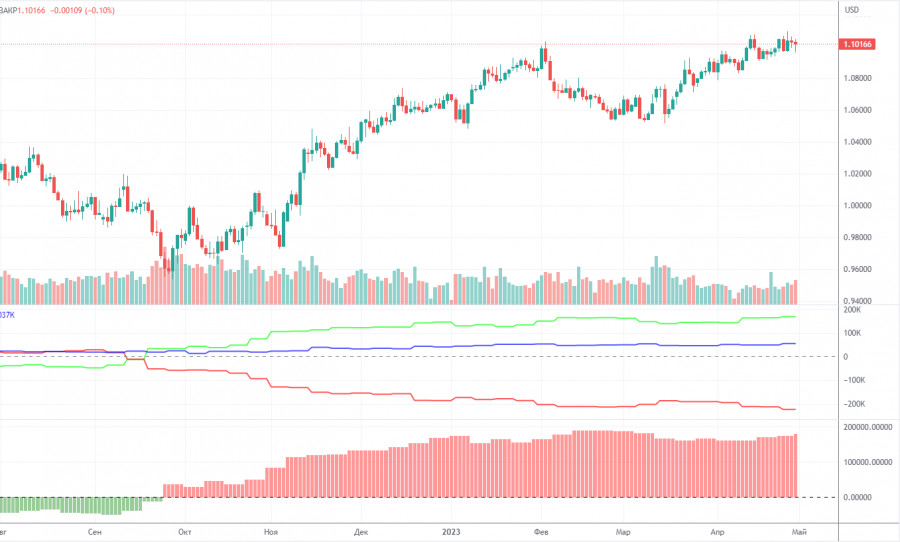

1H chart of EUR/USD

On the one-hour chart, the pair continues strange and unjustified movements. The pair went past the ascending trend line, but it didn't decline further. The pair constantly rolls back up, corrects, rides on "swings," significantly complicating the trading process. Yesterday, the dollar fell on information that the market had already known in recent weeks and even before Powell's speech. On Thursday, important levels are seen at 1.0762, 1.0806, 1.0868, 1.0926, 1.1068, 1.1137-1.1185, 1.1234, 1.1274, as well as the Senkou Span B lines (1.1003) and Kijun-sen (1.1020) lines. Ichimoku indicator lines can move intraday, which should be taken into account when determining trading signals. There are also support and resistance although no signals are made near these levels. They could be made when the price either breaks or rebounds from these extreme levels. Do not forget to place Stop Loss at the breakeven point when the price goes by 15 pips in the right direction. In case of a false breakout, it could save you from possible losses. On May 4, the results of the European Central Bank meeting will be summed up, and we are expecting another day with "crazy" and, quite possibly, illogical movements. The market has resumed its old habit – buying the euro. In America, there is only a report on unemployment benefit claims, which is unlikely to interest traders against the backdrop of ECB and FOMC meetings.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

Kijun-sen and Senkou Span B are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.