The GBP/USD currency pair also adjusted on Wednesday, failing to overcome the Murray level of "7/8" (1.1475). The Heike indicator has already turned down, so at this time, the price may go down or has already gone down to the moving average. The situation is again very similar to the EUR/USD pair. For some time, the two main pairs in the foreign exchange market traded differently, but now the correlation is again very high. The only difference is that the pound's volatility remains much higher than the volatility of the euro currency. But that shouldn't be surprising either because it's always been that way. If the quotes of the British currency consolidate below the moving average line, we can expect a resumption of the downward trend. Although we believe this trend has been completed purely for technical reasons, we have repeatedly said that fundamental and geopolitical backgrounds can spoil everything.

The fundamental background had not changed recently, even when the pound grew. The Bank of England and the Fed will continue to raise the key rate, and the difference between the two rates for at least a few months may remain unchanged or increase in favor of the dollar. This factor alone may be enough for the pound to resume falling. Further, the Bank of England (which we will discuss below) began an unplanned program of buying treasury bonds. However, a few months ago, it announced the launch of the QT program, which involves the sale of these bonds from the balance of the regulator. What's that? Will BA sell and buy them at the same time? Recall that the QT program is a tightening measure along with an increase in the rate. If the market did not react particularly to the seven rate hikes and BA's plans to reduce the balance by 80 billion pounds, then why should it buy the pound now if the regulator will buy bonds by October 14 and not sell them?

Geopolitics is even more difficult. One of the versions of the explosion of the Nord Stream is the Anglo-Saxon trace. If Washington was behind this operation, there is no doubt that London was nearby. The states benefit from the Nord Stream's dysfunction since it will now sell LNG to Europe. In addition, Washington approved several more packages of military assistance to Ukraine and imposed new sanctions against Moscow because of the recognition of the annexed territories. All these factors do not favor risky currencies to which the pound belongs.

A mess in the British Parliament, and an absurdity from the Bank of England.

A little above, we have already said that BA has announced a program of buying long-term bonds, which is a stimulating measure. Against the background of a sharp rise in bond yields, BA made such a decision to stabilize the debt market. So far, the program should work until October 14, but the regulator may extend its validity period. Simultaneously raising the key rate, the Bank of England, it turns out, "presses on the gas and brake pedals" simultaneously. Meanwhile, inflation remains very high, and Goldman Sachs experts said that the rate would have to be raised to at least 5% for inflation to return to 2% in the medium term. If the Fed is going to increase its rate to 4-4.5%, this is logical since British inflation is higher than American inflation.

Against all that is happening, there was an assumption that BA is preparing for a record rate increase in November and December by 1.00%. All the previous increases did not affect the growth of inflation in any way. When buying bonds is also required to stabilize the debt market, the regulator can apply a "compensation mechanism." That is, to raise the rate higher than planned to smooth out the consequences of the asset purchase program, which is an incentive measure. If the BA raises the rate twice by 1.00%, it can help the pound a lot since, in this case, the rate will catch up with its Fed rate, and the gap will decrease. However, this is only an assumption, not a fact.

In general, we can say that there are grounds for further growth of the pound and its new fall. Geopolitics can lower the pound to its absolute lows, and BA's aggressiveness can help recover against the dollar. Macroeconomic statistics now have a low percentage of influence on market sentiment, as both the States and the UK indicators are falling, and a recession is looming.

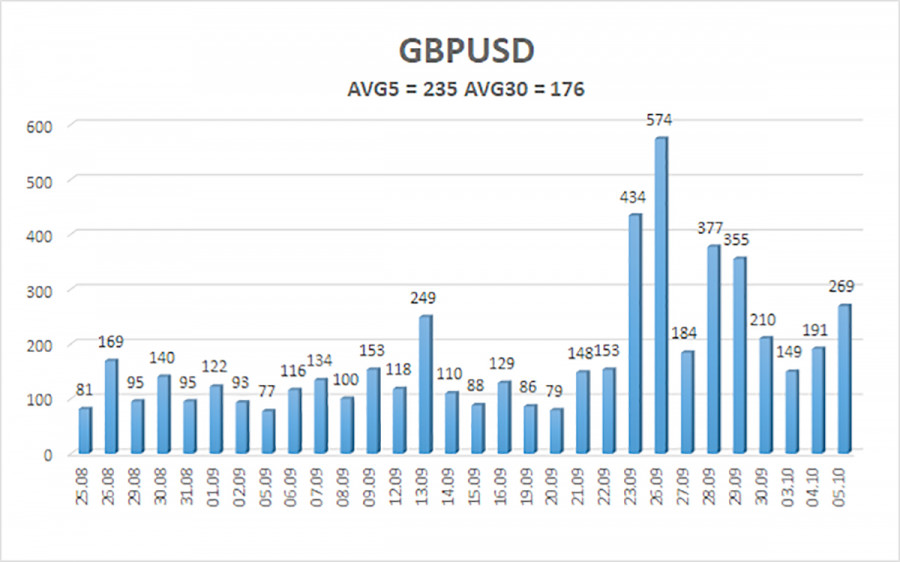

The average volatility of the GBP/USD pair over the last five trading days is 235 points. For the pound/dollar pair, this value is "very high." Therefore, on Thursday, October 6, we expect movement inside the channel, limited by the levels of 1.1032 and 1.1502. The upward reversal of the Heiken Ashi indicator signals the completion of the downward correction.

Nearest support levels:

S1 – 1,1230

S2 – 1,0986

S3 – 1,0742

Nearest resistance levels:

R1 – 1,1475

R2 – 1,1719

R3 – 1,1963

Trading Recommendations:

The GBP/USD pair started a downward correction in the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.1475 and 1.1502 should be considered in the event of a reversal of the Heiken Ashi indicator up or a rebound from the moving average. Open sell orders should be fixed below the moving average with targets of 1.1032 and 1.0986.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.