The GBP/USD currency pair has been trading much more fun and volatile than the EUR/USD pair in the last two trading days. And the movements should be closely studied. What happened on Tuesday? The pound sterling rose sharply, for no reason at all, by 150-160 points. Such a move is strong even for the traditionally volatile pound. Usually, we see such movements 10-15 times a year after strong fundamental events. However, on Tuesday, there was not a single event or macroeconomic publication in the UK. The next publication was scheduled for Wednesday - this is the inflation report. Nevertheless, traders began to urgently buy the British currency. But the next day they began to abandon it, which led to an equally strong movement, but in the opposite direction.

All this is very similar to a banal trap for smaller traders. Recall that inflation reports are currently interesting from the point of view that the more inflation increases, the higher the chances of tightening the monetary policy of the central bank. This does not apply to the Fed, since everything is already clear there: the rate will rise throughout 2022 in any case. But in the case of Britain, everything is not so clear. Therefore, the inflation that rose to 6.2% should have provoked the growth of the pound. But it provoked its fall. And even if the markets reacted illogically, do you remember when inflation reports provoked such strong movements? Inflation in the UK exceeded forecasts by 0.2%, so what? For whom is it a surprise now that inflation is growing rapidly and almost all over the world?

Therefore, we believe that the following has happened. Either the inflation data was known in advance, so the big players had a day in reserve to play this report, while the majority does not have any information. Or it was an ordinary bluff from the same big players. When the report became available to the markets and the public, all Tuesday's buyers began to take profits on long positions, as they did not expect further growth. As a result, the pound fell when it should have shown growth, and grew when it should have stood still.

What are the prospects for the British currency in the coming weeks?

Separately, it should be noted that the British currency has only 2 more reasons for long-term growth than the European one. The first is, of course, the monetary policy of the Bank of England, which has already raised the key rate three times. The second is the resistance of the British currency in the confrontation with the dollar in the last 15 months. We have already said earlier that the pound became cheaper during this period more reluctantly, and grew more actively. This led to the fact that the pound fell by 40% from the upward trend and the euro - by 90%. These two factors may continue to support the pound, but at the same time, it will also fall in the medium term. Just weaker than the euro currency. Because the British economy is weakened by Brexit, it also depends on Russian energy and Ukrainian food products. Not as much as Europe, but it also depends.

From our point of view, the 1.3320 level is extremely important for the pound right now. At this level, the Kijun-sen line runs on the 24-hour TF. Previously, at each turn of the upward correction, the critical line was overcome, which allowed the pair to go up a couple of hundred points more. If now this level does not let the price go further up, then the pound will resume its decline. Britain has already promised this year to completely abandon the import of Russian oil and gas, and, frankly, there is some kind of agreement with Washington behind this. Boris Johnson threatens Russia too easily and simply, imposes sanctions, and agitates other EU countries for the same actions. One way or another, it will also be difficult for Britain to replace Russian oil and gas. But at least it has the opportunity to develop new deposits in the North Sea, which, most likely, they will do in the coming years.

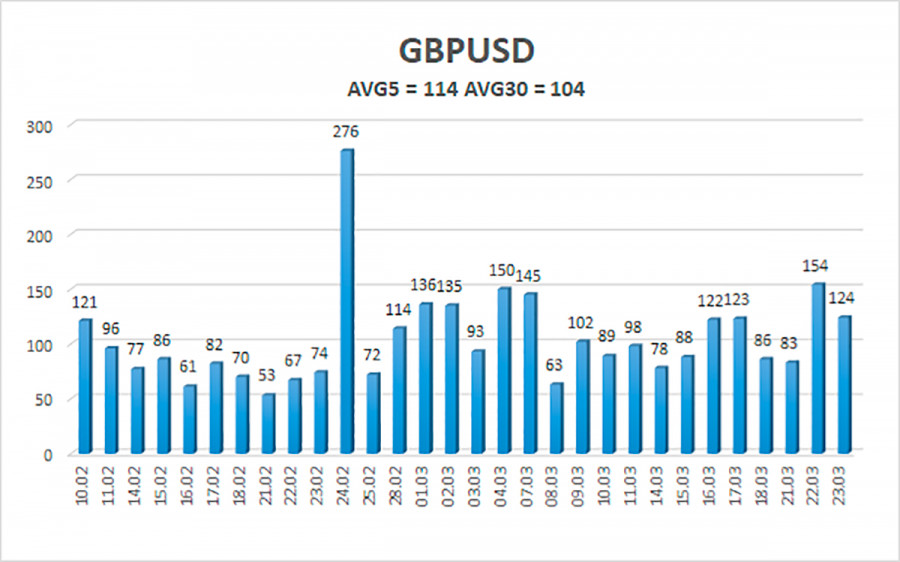

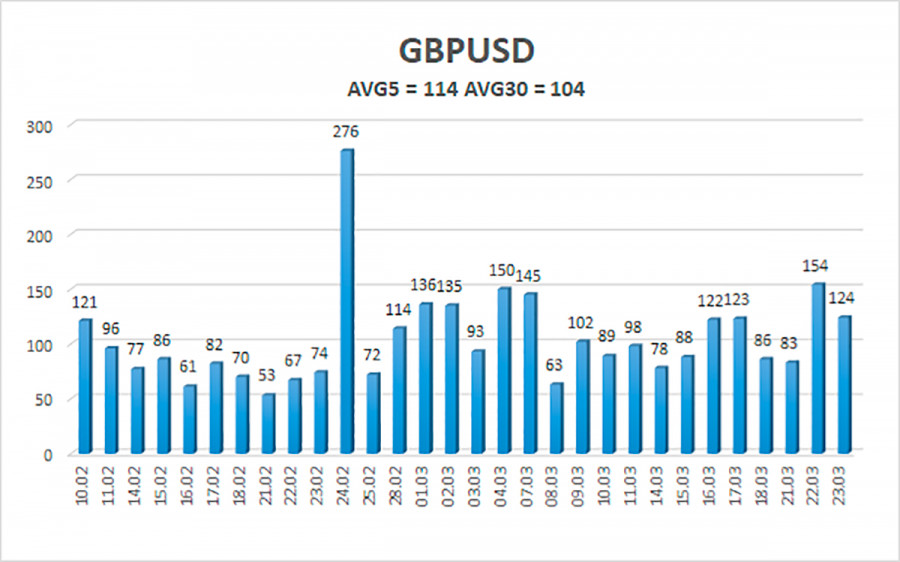

The average volatility of the GBP/USD pair is currently 114 points per day. For the pound/dollar pair, this value is "average". On Thursday, March 24, thus, we expect movement inside the channel, limited by the levels of 1.3089 and 1.3317. A reversal of the Heiken Ashi indicator upwards will signal a round of upward movement.

Nearest support levels:

S1 – 1.3184

S2 – 1.3123

S3 – 1.3062

Nearest resistance levels:

R1 – 1.3245

R2 – 1.3306

Trading recommendations:

The GBP/USD pair has started a new round of corrective movement on the 4-hour timeframe. Thus, at this time, it is possible to consider new purchase orders with targets of 1.3245 and 1.3306 in the event of a price rebound from the moving average. It will be possible to consider short positions no earlier than fixing the price below the moving average with targets of 1.3123 and 1.3089.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.