To open long positions on EUR/USD you need:

In my morning forecast, I focused on the level of 1.1416 and recommended taking it into account when making decisions to enter the market. Let's observe the 5-minute chart and analyze it. The decline and false breakout of this range resulted in the formation of a strong buy signal for the euro's further growth. Besides, released fundamental eurozone data were favourable for the EUR/USD pair to break the daily highs. Trading is conducted above the range of 1.1416, therefore it is possible to expect the pair's more active upward movement. The technical picture for the second half of the day has not changed. Besides, what were the pound's entry points this morning?

No statistics could support the US dollar during the US session. However, it is recommended to focus on the data on US consumer lending. Only in case of the pair's decline and formation of a false breakout at the level of 1.1416, similar to discussed above, or in case of a weak US credit report, a good entry point to long positions following the uptrend is possible. Another key task in the second half of the day is taking control over the middle of the Friday's channel at 1.1450, which was not fulfilled in the morning. The break of this range and the fixation above will depend on traders' reaction to the statement of the president of the European Central Bank. Christine Lagarde is scheduled to speak this evening. A top down test at 1.1450 will provide additional buy signals and a chance for the recovery to the highs of the month at 1.1481. However, bulls will unlikely stop at this point. Therefore, the breakout of this range will make it possible to reach the levels of 1.1514 and 1.1562, where I recommend taking profit. If the pair declines again during the US session and there is no activity at 1.1416 with the moving averages favouring buyers, it is better to postpone purchases to 1.1390. However, I would recommend opening long positions at these levels if a false breakout occurs. It is possible to buy the euro immediately for a rebound from the level of 1.1363 with the goal of an upward correction of 20-25 pips within the day.

To open short positions on EUR/USD you need:

Sellers tried to catch traders' attention, however, they failed. A break below 1.1416 is not possible yet, indicating the euro's further rise in the short term. Many traders expect the European Central Bank's more aggressive policy. Otherwise, the pressure on the euro may resume. The report on the US economy will also help the dollar to recoup some of its losses. Now, sellers should try hard not to lose the initiative in the second half of the day. The key task is to protect the resistance at 1.1450. In case of US strong credit data, bulls will have difficulties to break any levels above this range. Therefore, the formation of a false breakout at 1.1450 will increase the pressure on the pair and form the first entry point to short positions with the goal of another EUR/USD decline to the area of 1.1416. A breakout and a test from the bottom up of this range will provide an additional signal to open short positions with the prospect of falling to a major low at 1.1390. A more distant target is 1.1363, where I recommend taking profits. If the euro rises and there are no bears at 1.1450, it is better not to sell. Short positions would be optimal in case of a false breakout at 1.1481. It is recommended to sell the EUR/USD pair immediately for a rebound from the level of 1.1514 or even higher, around 1.1562, with the goal of a downward correction of 15-20 pips.

I recommend to review:

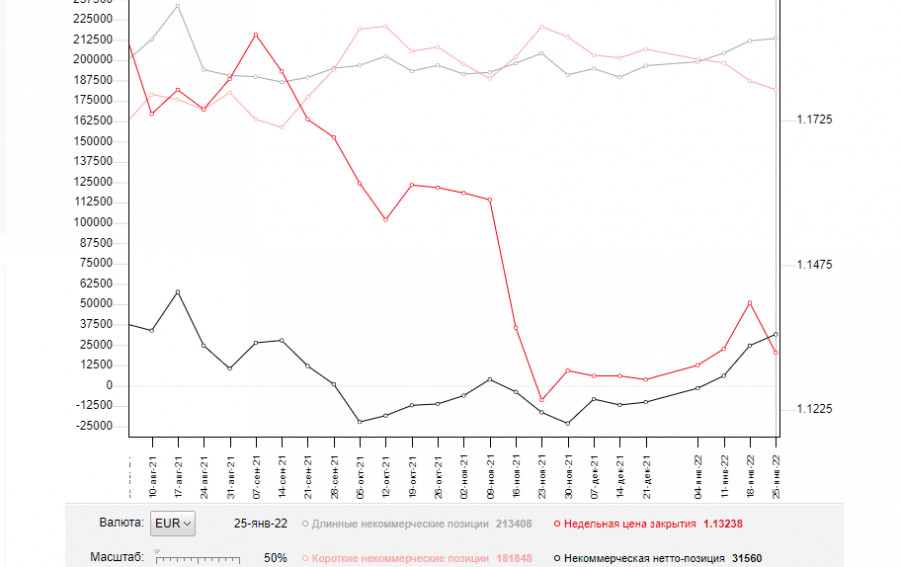

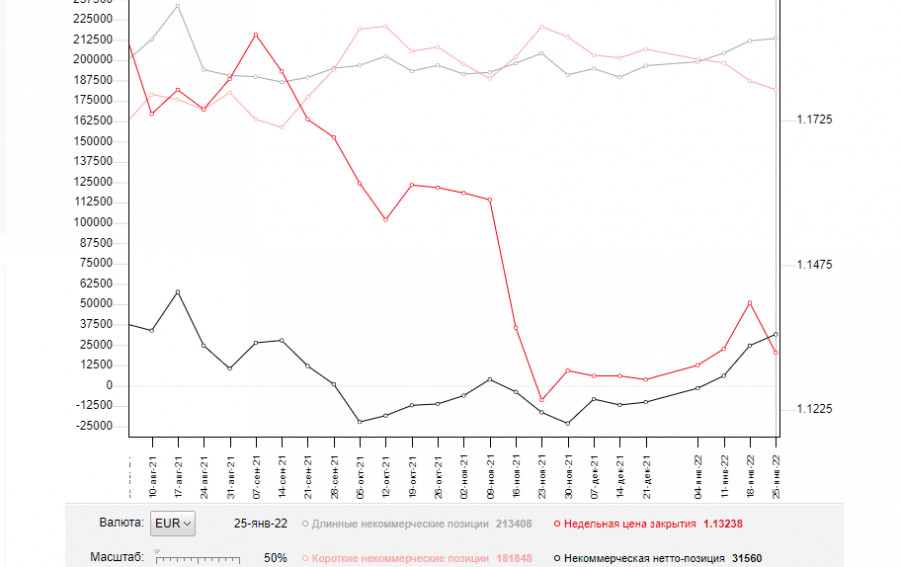

The COT report for January 25 recorded an increase in long positions and decrease in short positions which led to a further increase in the positive delta. The demand for risky assets will be maintained as after the Federal Reserve meeting giving clear hints to raise interest rates in March 2022, the market did not react to a significant drop in risky assets. Besides, the changing balance of power is evident. This week, everyone is awaiting the results of the European Central Bank meeting, which will decide on monetary policy. Some traders predict that the central bank may make more aggressive policy changes in the near future and cut its support measures due to the threat of high inflation. However, most analysts do not expect any changes from the European regulator. Much will depend on whether the ECB agrees to complete its program of urgent bond purchases in March 2022 or not. If so, the demand for the euro will only increase since such actions will sooner or later lead to an increase in interest rates in the eurozone. The COT report indicates that long non-commercial positions rose from the level of 211,901 to the level of 213,408, while short non-commercial positions fell from the level of 187,317 to the level of 181,848. This suggests that traders continue to build long positions on the euro, targeting to form an uptrend. At the end of the week, the total non-commercial net position remained positive and amounted to 31,569 against 24,584. However, the weekly closing price fell to 1.1323 against 1.1410 a week earlier.

Indicator Signals:

Moving averages.

Trading is conducted above the 30 and 50 day moving averages, indicating that bulls are trying to bounce back from bears.

Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands.

In the case of growth, the upper boundary of the indicator around 1.1465 will be the resistance level. Breakout of the bottom boundary at 1.1416 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart;

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart;

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.