The GBP/USD pair attempted again on Thursday to resume its upward trend – quite successfully. After the pair's quotes plunged downward on Wednesday, some traders might have thought the upward trend was over. However, the price didn't even consolidate below the moving average line. All we saw was a regular, banal pullback. By Thursday, the pair had already resumed its growth.

We've mentioned this many times, but we'll repeat it – the only factor causing the dollar's decline at the moment is the market's expectations of the Federal Reserve's monetary policy easing. Even though the impact of this factor began long before September 18, and the market is completely ignoring any other factors, the dollar continues to fall amid these dovish expectations. On September 18, the Fed decided to lower the rate by 0.5% immediately, which the market turned out to be entirely unprepared for, even though such a decision had been anticipated since the beginning of August. Now, market participants are expecting a similar decision following the November meeting. And if the Fed representatives had taken a cautious, neutral stance at this time, the dollar might have gotten some respite. But no.

On Monday, one of the Fed representatives, Adriana Kugler, stated that she fully supports a 0.5% rate cut in November. Another Fed official, Austan Goolsbee, said, "We can expect many rate cuts in 2025." Kugler also added that she supports unscheduled monetary policy easing if inflation continues to slow down as the Fed expects. What else can the market do in light of such statements?

Kugler also stated that it's time for the Fed to shift its focus from inflation to the labor market. According to her, there is a significant slowdown in the labor market, which needs to be addressed. "The time has come for us to focus on job stimulation rather than continuing to fight inflation with the same intensity," Kugler believes. She added that the PCE index fell to 2.2% in August, close to the target level. The FOMC official considers that if NonFarm Payrolls drop below 100,000 per month, it will indicate a critical weakening of the labor market, and once again emphasized that the rate needs to be lowered as quickly as possible to avoid a disaster in employment.

It should also be noted that not all Fed representatives agree with Kugler and Goolsbee. Some believe that inflation is still high and needs to be fought further. They support two stages of easing by the end of the year, with 0.25% reductions each, which aligns with the base scenario. The only question is to find out how many "doves" and "hawks" are currently in the Fed's monetary committee. But for now, everything suggests that there are more "doves," and the dollar will continue its decline based on this single factor of rate cuts in the US.

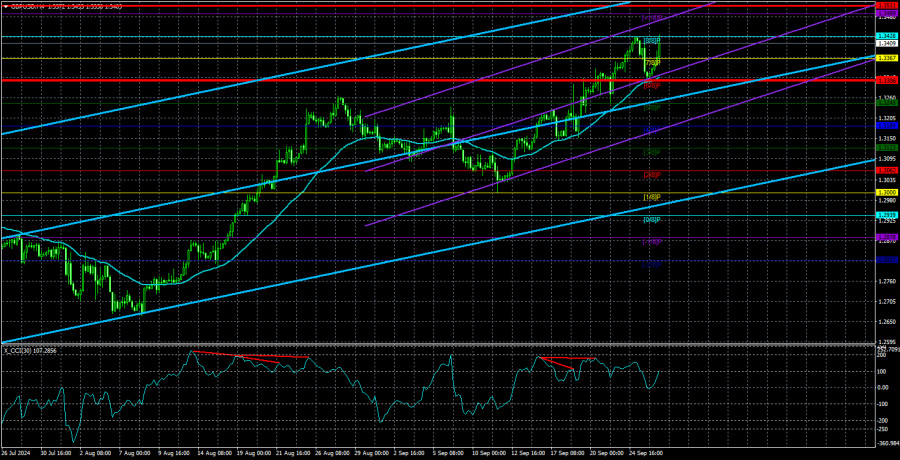

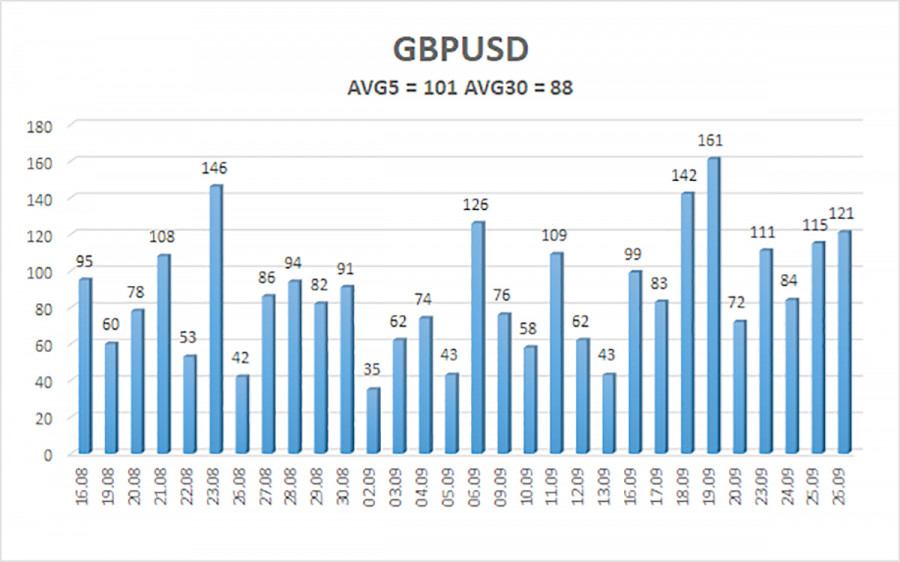

The average volatility of the GBP/USD pair over the last five trading days is 101 pips. For the pound/dollar pair, this value is considered "medium-high." Thus, on Friday, September 27, we expect movement within the range limited by the levels of 1.3309 and 1.3511. The higher linear regression channel is pointing upward, indicating the continuation of the upward trend. The CCI indicator has formed four bearish divergences, and now even the fifth and sixth ones, which suggests a substantial decline that we still have not seen.

Nearest support levels:

S1 – 1.3368

S2 – 1.3306

S3 – 1.3245

Nearest resistance levels:

R1 – 1.3428

R2 – 1.3489

R3 – 1.3550

Trading Recommendations:

The GBP/USD currency pair continues its upward movement easily and steadily. We are not considering long positions at this time, as we believe that all factors for the growth of the British currency have already been factored in by the market multiple times. However, it's hard to deny that the pound may well continue rising by momentum. The market still uses any opportunity to sell the dollar. Therefore, if you are trading purely on technical analysis, long positions are possible with targets at 1.3428 and 1.3489 if the price remains above the moving average. Short positions can be considered with targets at 1.3062 and 1.3000 if the price consolidates below the moving average line.

Explanations for Illustrations:

Linear Regression Channels: These help determine the current trend. If both point in the same direction, the trend is currently strong.

Moving Average Line (settings 20,0, smoothed): It defines the short-term trend and the direction in which trading should currently be conducted.

Murray Levels: Target levels for movements and corrections.

Volatility Levels (red lines): The likely price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.