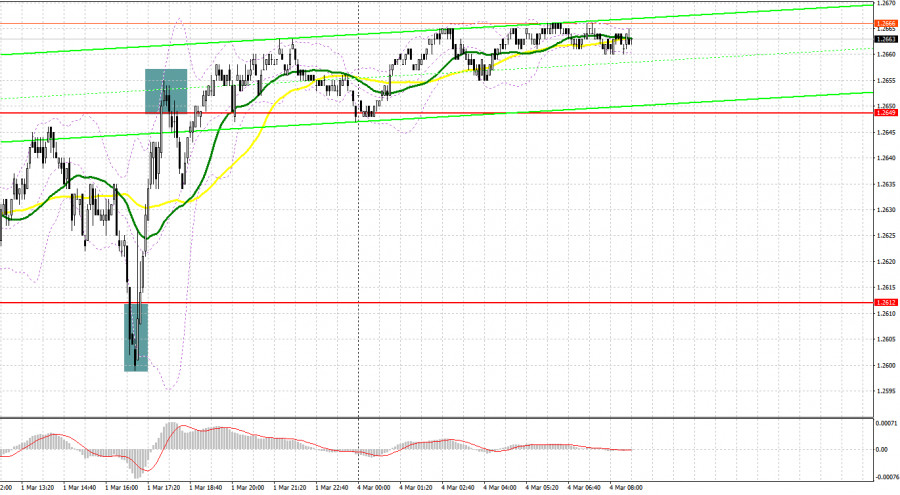

Last Friday, several signals were generated to enter the market. Let's take a look at the 5-minute chart and figure out what happened there. In my previous forecast, I paid attention to the level of 1.2612 and planned to make decisions on entering the market from it. The currency pair declined indeed, but it never came to a test and a false breakout. It was not possible to find suitable entry points into the market. In the afternoon, a false breakout at 1.2612 generated a signal to buy the pound. As a result, GBP/USD climbed by 30 pips. The sellers protected 1.2649 that allowed us to catch a suitable entry point for selling. However, after a downward correction of 15 pips, demand for the pound returned.

What is needed to open long positions on GBP/USD

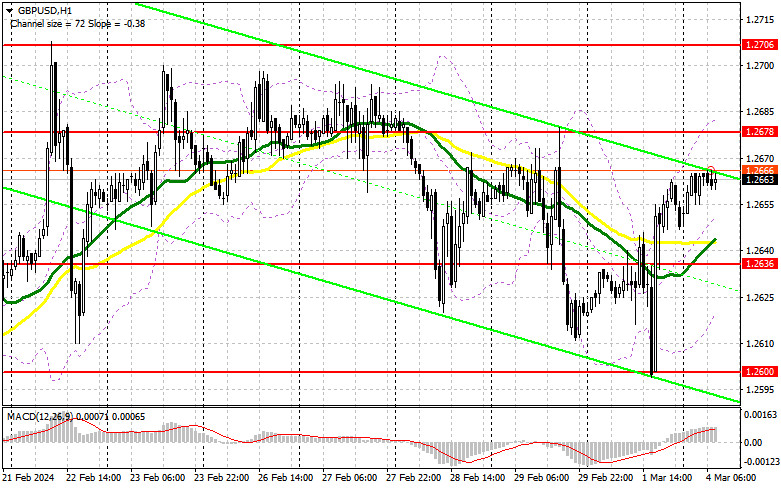

Very weak data on manufacturing activity in the US became a catalyst for the growth of the British pound at the end of last week. GBP took advantage of the situation and developed a new bearish trend. The economic calendar for the UK is empty, so it will be difficult for the buyers. If the instrument falls, I will act only after a false breakout in the area of the nearest support 1.2636, formed on Friday. This will provide a suitable entry point into long positions in hopes of the price recovering to 1.2678 where the buyers are likely to face serious problems. A breakout and consolidation above this range will strengthen demand for the pound and open the way to 1.2706, which will reinforce the bulls' position in anticipation a new bullish trend. The farthest target will be a high of 1.2741, where I am going to take profits. In a scenario where GBP/USD declines and there is no activity of the bulls at 1.2636, the pound sterling may sink significantly again, and the sellers will take control of the market. In this case, only a false breakout in the area of the next support 1.2600 will confirm the correct entry point into the market. I plan to buy GBP/USD immediately on a dip from the low of 1.2581, bearing in mind a correction of 30-35 pips within the day.

What is needed to open short positions on GBP/USD

The bears did everything on Friday to forge ahead with the downtrend, but weak US manufacturing data changed market sentiment. Today I would like to make sure of their presence in the market. So, a false breakout at 1.2678 would be an excellent reason for this. This will lead to selling with the aim of a downward correction and decline to support at about 1.2636 where moving averages are located, playing on the side of the buyers. A breakout and reverse test from the bottom to the top of this range will deal another blow to the positions of the bulls, leading to the activation of stop orders and opening the way to 1.2600 where I expect large buyers to appear. The farthest target will be the area of 1.2581, where they will take profits. If GBP/USD grows and there is no activity at 1.2678, the buyers will again feel confidence in anticipation of a further uptrend. In this case, I will postpone selling until a false breakout at the level of 1.2706. If there is no downward movement even there, I will sell GBP/USD immediately at a rebound from 1.2741, bearing in mind a downward correction by 30-35 pips within the day.

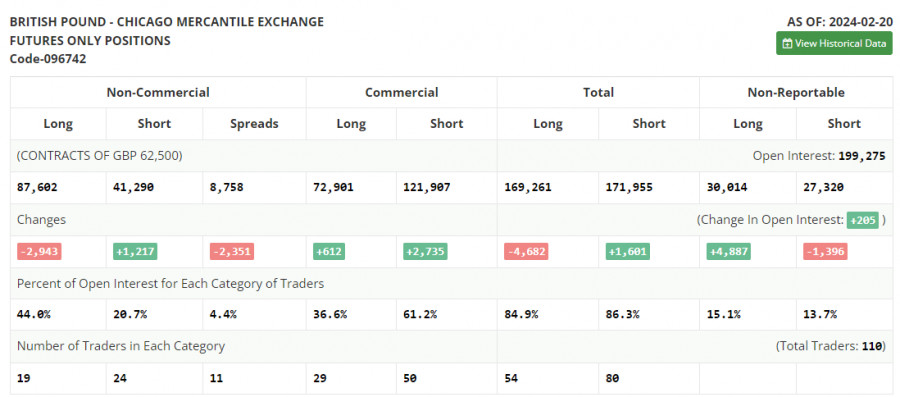

In the COT (Commitment of Traders) report for February 20, we see an increase in short positions and a decrease in long positions. Recent statements from Bank of England's policymakers that interest rates could be cut even if inflation does not reach its 2.0% target are clearly not reflected in this COT report. Hence, it does not make sense to attach gravity to it. But even despite this, the pound sterling continues to rise, although, as the latest data show, the climb could end at any moment, especially with the hawkish rhetoric of the Federal Reserve. The latest COT report said that long non-commercial positions fell by 2,934 to 87,602, while short non-commercial positions increased by 1,217 to 41,290. As a result, the spread between long and short positions decreased by 2,351.

Indicators' signals

Moving averages

The instrument is trading above the 30 and 50-day moving averages. It indicates high odds of a further growth in GBP/USD.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD goes down, the indicator's lower border at about 1.2625 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.