Analysis of GBP/USD 5M

GBP/USD managed to recover on Thursday. Take note that for the last two weeks leading up to yesterday, the pound had been falling almost every day, and overall, it has been declining for two months. Therefore, this situation is entirely logical and predictable, as we have already mentioned before. The pair is simply exhibiting a correction after relentlessly rising in the first half of the year. Therefore, the pound doesn't exactly need strong fundamentals to fall, and it also doesn't need a convincing reason to correct higher either, as currency pairs cannot constantly move in one direction. Traders have simply started to close their short positions, and they don't need strong reports for that. The UK's economic calendar was basically empty on Thursday, and the US reports only led to an unnecessary emotional spike at the beginning of the session.

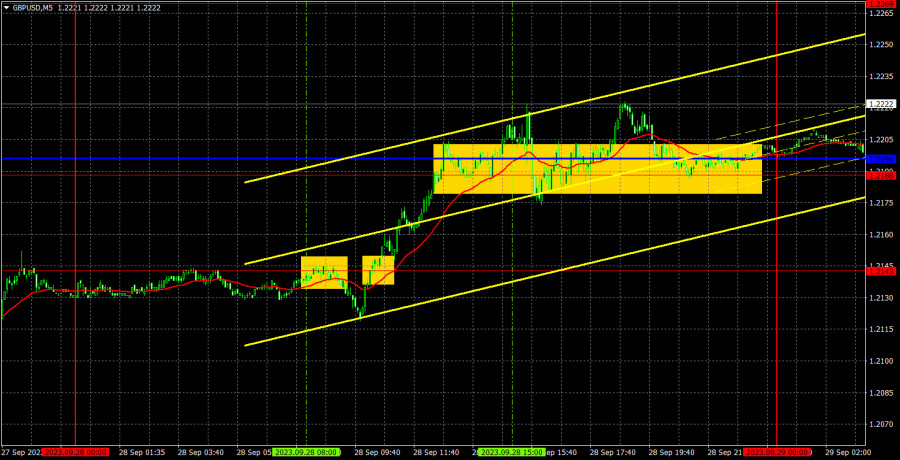

There were several trading signals on Thursday. First, the pair rebounded from the level of 1.2143, and then it surpassed it after half an hour. In the first case, it was advisable to open short positions, which resulted in a small loss, and in the second case, long positions were advised. As a result, the price rose into the range of 1.2188-1.2196, which it overcame but it still remained within this range by the end of the day. Therefore, long positions could have been closed at any time after surpassing the specified range. The profit from these positions certainly covered the loss from the first trade.

COT report:

According to the latest COT report on GBP/USD, the Non-commercial group closed 12,300 long positions and opened 200 short positions. Thus, the net position of non-commercial traders decreased by 12,500 contracts over the week. The net position indicator has been steadily increasing over the past 12 months, but the pound sterling has started to fall in the last two months, which we have been waiting for for so many months now. Perhaps we are at the very beginning of a protracted downtrend. At least in the coming months, we do not see any bullish prospects for the pound.

The British currency has jumped by a total of 2,800 pips from its absolute lows reached last year. All in all, it has been a stunning rally without a strong downward correction. Thus, further growth would be utterly illogical. We're not against the upward trend. We just believe GBP/USD needs a good downward correction first and then assess the factors supporting the dollar and the pound. A correction to the level of 1.1844 would be enough to establish a fair balance between the two currencies. The Non-commercial group currently holds a total of 85,000 longs and 51,400 shorts. The bears have started to take the initiative in recent weeks, and we believe that this trend will continue in the near future.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD has started the long-awaited correction. The pound sterling is still poised to decline, so we believe it will eventually resume its downward movement. We have repeatedly mentioned that it is logical for the pound to fall, and over the past two months, the pound has depreciated by 1000 pips, which is entirely reasonable. The trendline is still relevant, but the consolidation above the Kijun-sen allows us to expect movement towards the Senkou Span B line.

On September 29, traders should pay attention to the following key levels: 1.1760, 1.1874, 1.1927-1.1965, 1.2143, 1.2188, 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2605-1.2620, 1.2693. The Senkou Span B (1.2369) and Kijun-sen (1.2180) lines can also be sources of signals, e.g. rebounds and breakout of these levels and lines. It is recommended to set the Stop Loss orders at the breakeven level when the price moves in the right direction by 20 pips. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are support and resistance levels that can be used to lock in profits.

Today's trading session will kick things off with UK Gross Domestic Product figures for the second quarter, which could surprise with a significant value and stir some market reaction. The US will release a couple of minor reports that are unlikely to significantly move the market. If the pair has started a corrective phase, the pound will continue to correct higher regardless of the macroeconomic background.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.