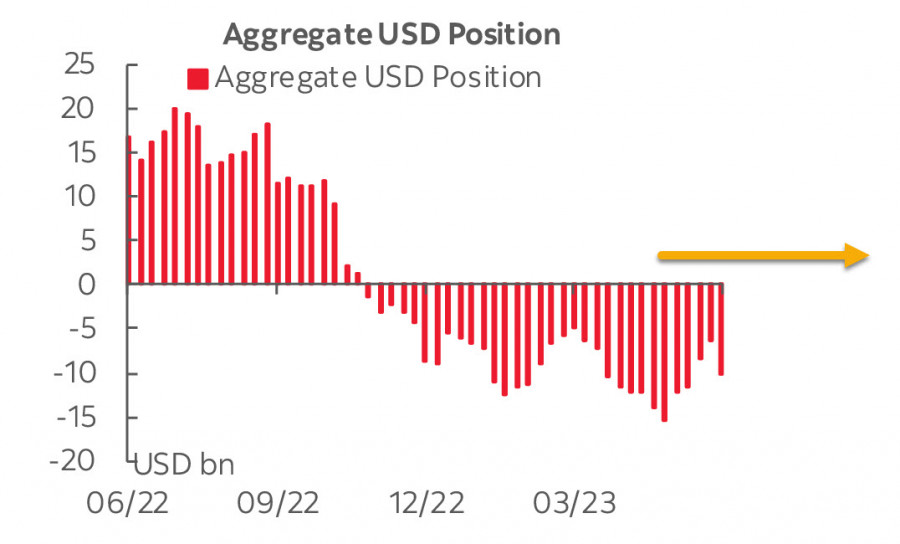

For the first time in six weeks, the aggregate short position on the US dollar has increased, primarily due to aggressive purchases of the British pound. The weekly change amounted to $3.75 billion, and the overall bearish position on the dollar increased to -$10.1 billion.

For other currencies, changes are within the usual weekly fluctuations. Take note of the growing demand in risk, with increased purchases of the Canadian dollar, Australian dollar, and Mexican peso. In terms of gold, long positions have increased by $418 million, indicating bullish sentiment.

Outlook for the Federal Reserve interest rate after Fed Chair Jerome Powell's testimony in Congress remains unchanged. Powell confirmed two more rate hikes, but markets continue to ignore this signal and believe that the peak will be reached after one more, final quarter-point increase.

The market opening on Monday confirmed the overall negative sentiment that formed on Friday. Stock markets in most countries were trading lower, yields decreasing, and risk appetite is expectedly diminishing in the current situation.

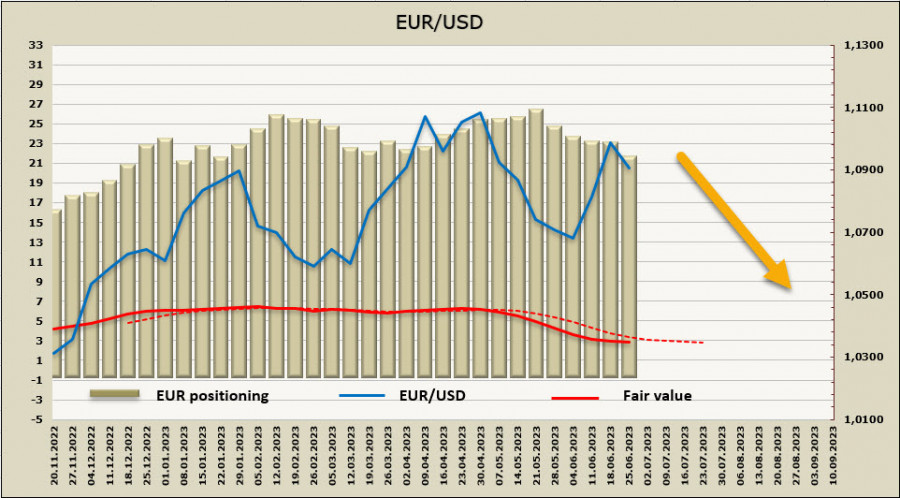

EUR/USD

Eurozone PMIs sharply declined in June, with the manufacturing sector dropping from 44.8 to 43.6 and services sector from 55.1 to 52.4. The Eurozone's Composite PMI decreased to 50.3, compared to the expected 52.8. In France, the services PMI fell below 50, making it the first major economy in the eurozone to enter contraction territory. The number of new orders is decreasing, and expectations regarding future production volumes have worsened.

There is some positive news - prices for production resources have been declining for the fourth consecutive month, and the pace of service price growth has slowed to a minimum since May 2021. The fight against inflation is taking unexpected forms - there is evident economic slowdown, while wage growth is accelerating. Weak PMI reports may indicate that higher interest rates are starting to impact consumption, especially as savings reserves gradually deplete.

When comparing the US and eurozone economies, at the moment, it is necessary to consider that inflation in the US is decelerating at a faster pace, while in the eurozone it appears more stable. The euro area economy seems weaker due to the lagging cumulative effect of monetary tightening, which has not yet fully affected the economy. With the approach of autumn, the possibility of a resurgence of the energy crisis in Europe is likely, which will exert additional pressure on the euro.

From Monday to Wednesday, a major conference will take place in Sintra, Portugal, involving representatives from most major central banks, concluding with a joint policy discussion with Christine Lagarde from the European Central Bank, Jerome Powell from the Fed, Andrew Bailey from the Bank of England, and Kazuo Ueda from the Bank of Japan.

The net long position on the euro decreased by $742 million during the reporting week, to $19.741 billion. The decline in demand has been observed for 5 consecutive weeks, but the overall EUR gains are still very strong. The calculated price is below the long-term average, but the momentum is clearly slowing down.

The probability of a euro rebound is considered low, and it's unlikely that the local peak at 1.1010 will be retested. We expect the pair to trade within a sideways range as it gradually shifts to a bearish bias, targeting 1.0700/20.

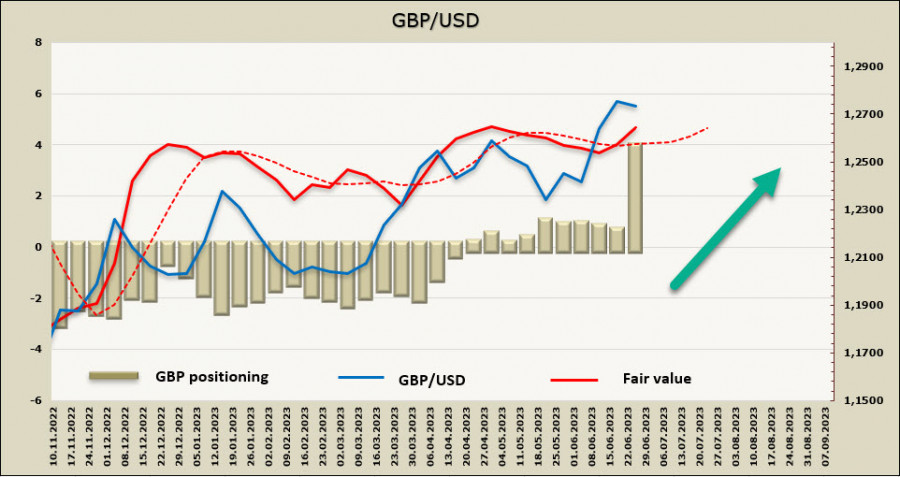

GBP/USD

The Bank of England (BoE), with a majority of 7 votes against 2, raised the key interest rate by 50 basis points to 5.00%. This hawkish decision is driven by the fact that inflation remains high while inflation expectations remain elevated. As a result, the BoE believes that the risks to inflation are "significantly skewed to the upside." The Bank reiterated that "if there is evidence of more persistent pressure, further tightening of monetary policy will be required."

The current rate forecast is for two more 0.25% rate hikes at the July and August meetings, with a peak at 5.50%, with risks tilted towards a higher peak rate. Another labor market report (July 11) and inflation data (July 19) for June will be published before the next meeting on August 3. Since the BoE is mainly concerned with the wage data and the rise in service prices, it is evident that expectations will not change before these reports, and the pound will experience bullish pressure.

Meanwhile, the UK economy is slipping into a recession. The manufacturing sector PMI decreased from 47.1 to 46.2 in June, and the services sector PMI decreased from 55.2 to 53.7. However, consumer demand remains high, as indicated by retail trade data for May.

Speculative investors aggressively raised long positions on the pound, boosting bullish sentiment by $3.2 billion. Pound positioning has been weak for a long time, with a gradual shift towards buying sentiment since April, but the surge this week is significant, with the overall long position increasing to $3.718 billion, the highest bullish sentiment on the pound since 2014.

The calculated price has risen, and positioning has shifted to confidently bullish.

In the previous week, we mentioned that if the BoE supports a bullish sentiment on the pound, it could surpass the support level at 1.2678 and reach the psychological level of 1.30. The probability of persistent growth became noticeably higher on Monday, and we do not expect the pair to fall below the support level at 1.2678. The most likely scenario is an uptrend after a brief consolidation phase.