Throughout Wednesday, the EUR/USD pair remained relatively unchanged. While there was some semblance of movement in the preceding three days, Wednesday saw minimal activity. During a congressional hearing, Jerome Powell expressed his belief that raising the key interest rate is appropriate. However, it's important to note that the Chairman's statements can differ between Congress and the Senate, as the questions asked in each may vary, leading to varying responses. We anticipate the Senate being more aggressive towards Powell, resulting in potentially more impactful responses on Thursday. Nevertheless, it is unlikely that the Fed Chairman will declare the completion of near-future monetary policy tightening or specify a target rate. Consequently, the market reaction on Thursday is expected to be insignificant, with the dollar losing approximately 40 points on Wednesday.

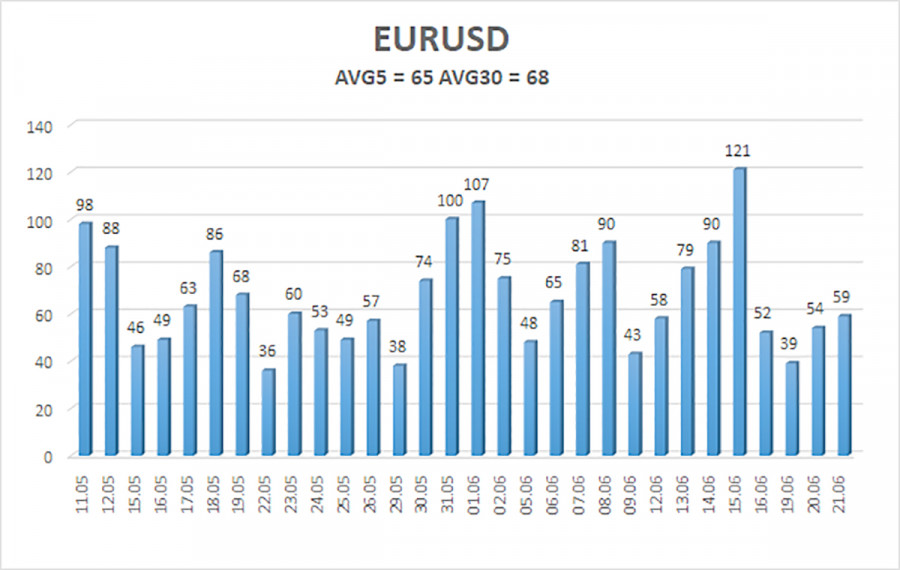

There are a few notable events scheduled for the rest of the week. The ECB and the Fed have already delivered their speeches during the initial three days, yet the currency pair has remained stagnant. Therefore, we don't anticipate sharp or strong movements this week, with volatility likely to remain low at around 40–50 points daily. Given this situation, a few technical observations can be made. First, the pair is in a state close to a flat market. Even if it surpasses the moving average line, its strength would be limited in a flat market. Second, trading the pair becomes essentially meaningless without movement, regardless of the timeframe being considered. In such circumstances, taking a break, waiting for trend movements to resume on smaller timeframes, or simply maintaining medium-term positions is better.

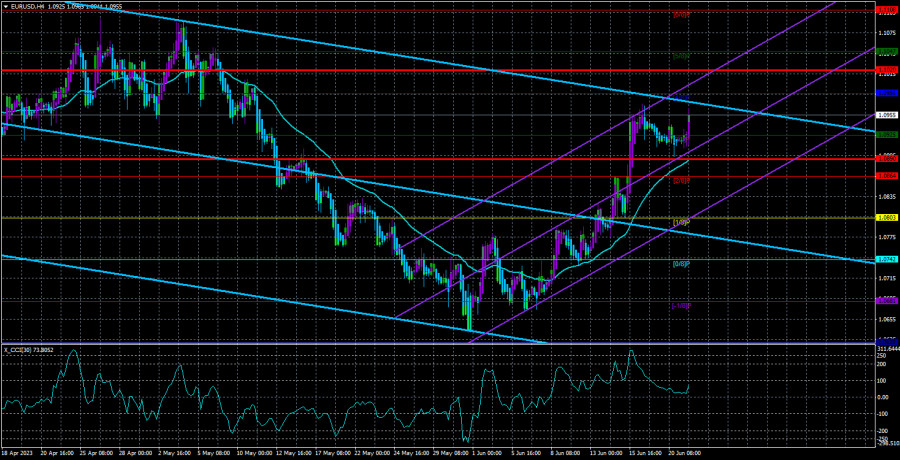

Now let's discuss the significant overbought signal observed on the 4-hour timeframe through the CCI indicator. Although it may have already exhausted itself as the pair retreated from its recent high, we still anticipate a more substantial decline. Signals from the CCI indicator are relatively rare, occurring once a week or less frequently, and hold particular importance and strength. Therefore, we maintain our expectation of a decline in the euro.

It's worth noting that following the previous monthly decline, the pair corrected upwards by approximately 61.8%, indicating a minor correction within the recent growth. Once again, we can expect a significant decline in the euro. Furthermore, in the 24-hour timeframe, the pair failed to break out of the Ichimoku cloud. While the Senkou Span A line is not particularly strong, it occasionally provides significant support or resistance to the price. Since the beginning of the year, the EUR/USD pair has been consolidating, effectively being in a flat market, with the price range between 1.0500 and 1.1100 maintained for the past six months. Considering the daily chart, a 600-point wide channel is reasonable. Therefore, there are more reasons to sell than to buy in the current market.

Market expectations regarding the ECB's interest rate may be overestimated. While the possibility of additional tightening of the ECB's monetary policy has recently increased, we believe that definitive conclusions should be drawn after the July meeting. The rate is expected to increase by another 0.25% to reach the target level of 4.25%. Further rate hikes pose risks to economic growth, and we highly doubt that the European regulator will continue raising rates beyond this level. To some extent, the euro's current high levels are supported by optimistic market expectations concerning the key interest rate. Nonetheless, it can be concluded that the euro has experienced minimal growth over the past six months, and significant factors are necessary to drive new growth as no notable downward correction has been observed.

As of June 22nd, the average volatility of the EUR/USD currency pair over the past five trading days is 65 pips, categorized as "average." Consequently, we expect the pair to move between 1.0890 and 1.1020 on Thursday. Returning the Heiken Ashi indicator to a downward direction would indicate the resumption of the downward correction.

Nearest support levels:

S1 - 1.0925

S2 - 1.0864

S3 - 1.0803

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1047

R3 - 1.1108

Trading recommendations:

The EUR/USD pair continues to remain above the moving average line. Maintaining long positions with targets at 1.0986 and 1.1020 is advised until the Heiken Ashi indicator reverses downward. Short positions will become relevant again only after the price consolidates below the moving average line, with targets at 1.0864 and 1.0803.

Illustration explanations:

Linear regression channels - help determine the current trend. If both channels are directed in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel the pair is expected to trade in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold region (below -250) or overbought region (above +250) indicates an upcoming trend reversal in the opposite direction.