During the past few weeks, the GBP/USD currency pair has been in "swing" mode. The 4-hour timeframe makes this quite evident, and as of Monday, the trading situation hasn't changed at all. However, the pair showed "extra volatility" of 55 points throughout the day and just refused to move. Yet, there were no fundamental reasons for the British pound to move significantly, and Mondays are frequently when a flat is seen. We will thus presume that everything happened according to plan. Notwithstanding the underlying fundamentals or macroeconomic conditions, it is realistic to assume the price will continue moving upward after it has recovered from the side channel's lower boundary or the Murray level of 1.1932. As there won't be any significant reports today, we think the pair's growth will continue. We do, however, have a Heiken Ashi indicator that flawlessly identifies local reversals.

In the present circumstance, it would be wise to wait until the "swing" was over before making any firm conclusions about the future. In this phase, the pair can trade for a very long time. In summary, given that the British pound's price adjusted considerably lower, we continue to anticipate a further decline in its quotes. At the time, the fundamental background did not quite support it. The market has already worked out most of the "bullish" factors, and the Bank of England has left it utterly uncertain what to expect. Of course, the market has paused, but that break won't continue forever either.

There are almost no events scheduled in the UK.

This week, there won't be many significant events or reports in the UK. Only on Friday will statistics on industrial production and GDP be released. But, given the current situation, industrial production is not a crucial report, and since GDP statistics will only be released every month, they are also not the most crucial. Of course, some inferences can be made from them, but the quarterly ones are more significant. Trading will therefore need to focus on American data, where there will already be something to watch.

Today is the day for Jerome Powell's speech in the United States Congress. And another one will be tomorrow. The head of the Federal Reserve often reads a prepared address before Congress. It very rarely contains new theses that haven't hit the market yet. Yet perhaps this time, investors will learn something new. In any case, these are significant events that could impact the market's mood. The ADP data on the change in the number of employees in the private sector will be released on Wednesday as well. Normally, the market doesn't respond strongly to this information, and it doesn't even coincide with the non-farm payroll data, which is much more highly appreciated by traders. But, there are several situations in which the market can be interested in this report.

The entire "wonderful" lineup is planned for Friday. Of course, these are unemployment reports and non-farm reports. Due to last month's even further decline in unemployment, the Fed is now free to raise interest rates as much as it wants. The nonfarm report for February came in two times higher than expected. The US economy and labor market are in excellent condition, so we have every right to expect new support for the US currency, even though such excellent values shouldn't be anticipated every month. Nonetheless, except for Friday, the current week may turn out to be fairly uninteresting. The majority of the trading in the pound/dollar pair can still be done in "swing" mode.

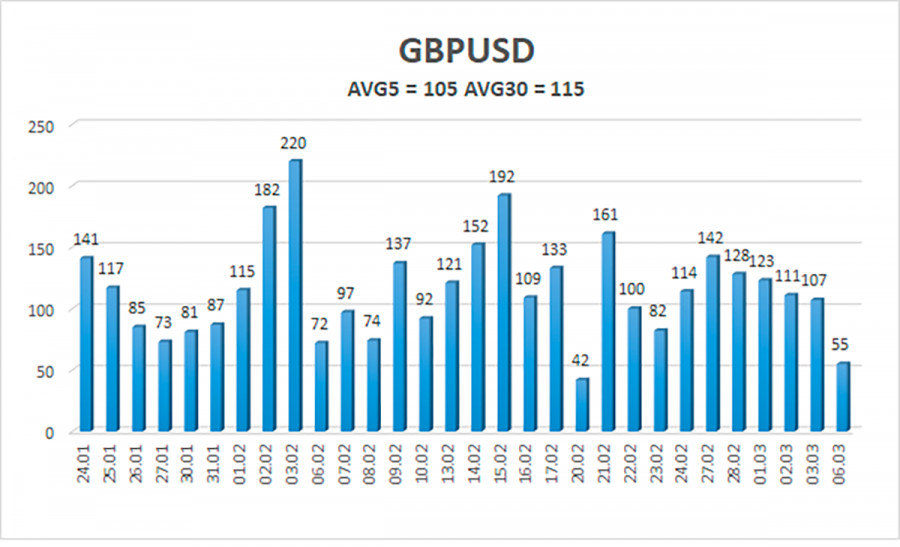

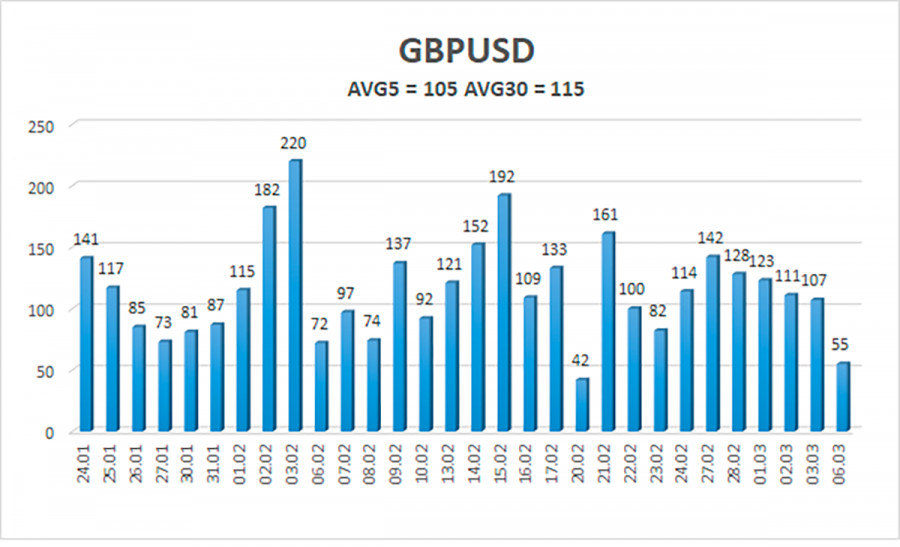

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 105 points. This value is "average" for the dollar/pound exchange rate. So, on Tuesday, March 7, we anticipate movement to remain inside the channel and be limited by the levels of 1.1923 and 1.2135. A new round of downward movement within the "swing" is indicated by the downward reversal of the Heiken Ashi indicator.

Nearest levels of support

S1 – 1.2024

S2 – 1.1993

S3 – 1.1963

Nearest levels of resistance

R1 – 1.2054

R2 – 1/2085

R3 – 1.2115

Trade Suggestions:

The GBP/USD pair has once again stabilized above the moving average on the 4-hour period, but it is now irrelevant because the side channel already exists. The pair is currently in a "swing" movement, which allows you to trade on a recovery from the levels of 1.1932 and 1.2115. Alternatively, trade at a lower TF, where it is simpler to identify moves with more accurate and short-term signals.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.