On Friday, the EUR/USD currency pair abruptly and for many unexpectedly changed the course of its "flight" by 180 degrees and showed extra volatility. Recall that on four out of the five trading days of the week, the European currency became cheaper. And it was getting cheaper for a good reason. The Fed has once again raised its key rate, for the fourth time in a row, by 0.75%, and Jerome Powell hinted at a press conference that the final rate level might rise more than previously expected. At the beginning of the week, rather weak statistics from the Eurozone came out. Traders learned that the GDP grew in the third quarter, but it grew minimally, and inflation continues to grow and is already 10.7% y/y. Thus, there were good reasons for the euro currency to fall. However, what happened on Friday is quite difficult to explain. After the reports on nonfarm payrolls and unemployment in the United States were published, the dollar began to fall sharply and lost more than 200 points by the end of the day. However, statistics from overseas are very difficult to call a failure or even just weak. The number of nonfarm payrolls exceeded the forecast values, and although the unemployment rate has increased, it remains at 50-year lows. After such data, the US currency could fall by 50 or 80 points, but a collapse of 200 points is too much.

Thus, we believe traders got confused with all the important data from last week and have been trading inadequately recently. After all, before the Fed meeting, the dollar was growing as if working out a future rate hike. But after the Fed meeting, it also grew, which surprised us on Thursday. It turns out that on Thursday, market participants did not quite logically work in pairs. In general, it may take a few more days for traders to "come to their senses," and the pair has completely moved on from the events of last week. In the meantime, the quotes have again consolidated above the moving average, so the trend has changed to an upward one. Formally, with such "swings" as in the last few weeks, a new round of decline may follow.

An empty calendar in the EU and an important inflation report in the US.

This week, there will be very few macroeconomic statistics and fundamental background in the EU. Everything will start on Tuesday when the retail sales report is published – far from the most important report for the market. Actually, on the same Tuesday, everything will end, since there will be nothing important and interesting on the other days of the week. There will be only a few speeches by ECB representatives, but Christine Lagarde already said everything a week earlier, so we don't expect any new information from them.

But in the USA, the "hit parade" will continue. There will be a few events again, but they will be much more important than European ones. First, there will be several speeches by Fed members. After Jerome Powell did not quite accurately hint at a weakening of monetary pressure and a possible longer rate hike on Thursday, the market desperately needs more information about this. Therefore, the monetary committee members can clarify the situation with rates at the next meetings. In principle, it will be enough for the market to understand how much the rate will grow and at what pace. In itself, slowing down the pace of tightening is nothing to worry about. After all, even if the rate grows slowly, it will still grow. Thus, this is a "hawkish" factor, not a "dovish" one. Moreover, Powell himself admitted that it could grow stronger than previously expected, so traders absolutely could not have time to consider the final rate level at the current rate of the pair.

Also, on Thursday, the October inflation report will be published, showing whether the Fed is on the right track and whether it is necessary to soften the monetary approach. According to forecasts, Powell will have to change his rhetoric and raise the rate by 0.75% for the fifth time in December because experts expect inflation to slow by 0.1-0.2%. We have already said earlier that at this rate, it will go to 2% for several years, which does not fit into the plans of the Fed. Well, if it turns out it did not slow down in October, it will be a failure.

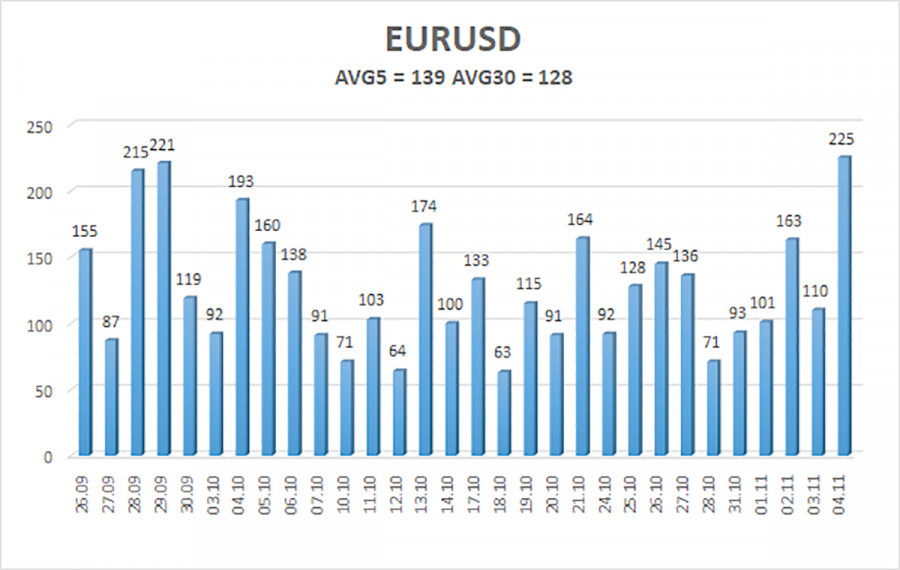

The average volatility of the euro/dollar currency pair over the last five trading days as of November 7 is 139 points and is characterized as "high." Thus, on Monday, we expect the pair to move between 0.9820 and 1.0098 levels. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 0.9888

S2 – 0.9766

S3 – 0.9644

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0132

R3 – 1.0254

Trading Recommendations:

The EUR/USD pair has consolidated back above the moving average. Thus, it would be best if you stayed in long positions with targets of 1.0010 and 1.0098 until the Heiken Ashi indicator turned down. Sales will become relevant again no earlier than the price fixing below the moving average line with a target of 0.9766.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.