The GBP/USD currency pair also tried to adjust on Monday. However, the pound sterling is much lower than the moving average line than the euro currency. Accordingly, it is much more difficult for him to break the current trend. The British currency is also in a "high-risk zone" due to its status as not the most stable currency. The dollar continues to look much more attractive, which is why it is growing. Hardly anyone has any doubts that everything that is happening now with the pound is the consequence of the Ukrainian-Russian conflict. Thus, the longer it persists, the stronger the consequences for the pound may be. Moreover, the UK has decided to completely abandon Russian hydrocarbons by the end of this year, replacing them with other imports. However, there may be problems with other imports.

Yes, negotiations are underway with Venezuela, which has huge oil reserves, but does not have the equipment to extract it in the required volumes, plus it is under sanctions. Negotiations are underway with Saudi Arabia and Iran, which can also easily replace Russia on the international oil market. However, for these countries to return to the market, sanctions must be lifted from them. And the sanctions were imposed for a reason and not out of the blue. It turns out that the West now needs to choose the lesser of two evils. And it is far from a fact that this plan will work, since oil sales are good and profitable, but will Venezuela, Iran, or Saudi Arabia want to make an enemy in the face of Russia? After all, it is absolutely clear to everyone who these countries will have to replace in the market. In the meantime, the relevant decision has not been made, and oil and gas will continue to grow in price. There is no need to worry about political pressure on the authorities due to rising prices for everything because everyone again understands why and for what such decisions are made. But at the same time, it's still a blow to the economy. A blow to the British economy.

Will the Bank of England be able to support the pound?

This week, there will be something to pay attention to for traders. There will be meetings of two central banks at once, which are very important for the pound/dollar pair. The Fed will meet on Wednesday, and the Bank of England will meet on Thursday. Markets are waiting for a rate hike from both regulators. However, these expectations have recently dropped sharply due to the completely unpredictable situation in Ukraine. Now traders believe that the FOMC will raise the rate by only 0.25% and an increase of 0.50% may come as a surprise to them. The Bank of England was supposed to raise the rate by 0.25%, and the absence of another tightening may also come as a surprise to the markets. Thus, the first thing I want to pay attention to is that surprises are possible this week. And how the markets, which are already very excited, will react to these surprises, I don't even want to think. Volatility remains, in principle, high, so new spikes and sharp reversals are possible.

In addition, data on unemployment, applications for unemployment benefits, and wages will be published in the UK this week. A report on retail sales will be published in the States. From our point of view, macroeconomic statistics now have extremely low chances to influence the movement of the pair. A local reaction of traders may follow these data, especially if they are unexpected, but it is unlikely that this reaction will affect the trend fundamentally. Thus, the focus of the market this week will be the meetings of the Central Bank and geopolitics. We have already talked about geopolitics. Everything will depend on the escalation or de-escalation of the military conflict. At the beginning of this week, the ruble took heart and rose to 110-115 rubles for 1 dollar. However, it is quite obvious that the Central Bank of the Russian Federation is behind this, which artificially keeps the ruble from falling. The Moscow Stock Exchange is still closed, and many experts believe that the ruble will collapse again when it opens.

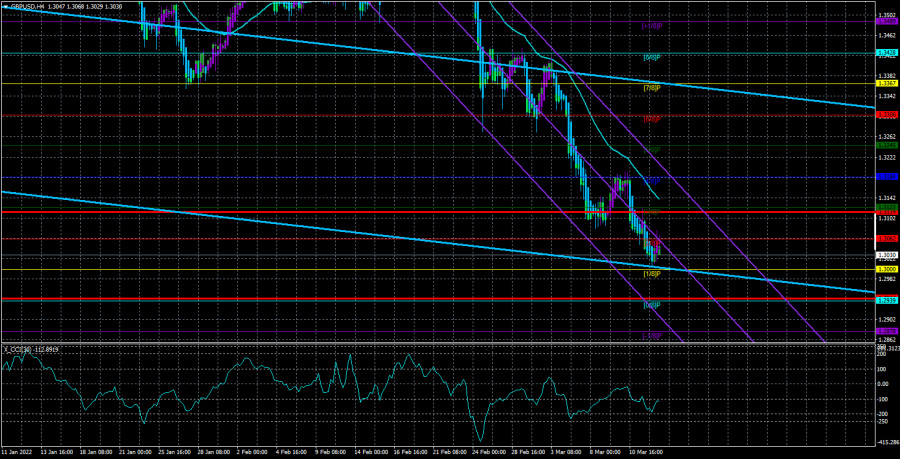

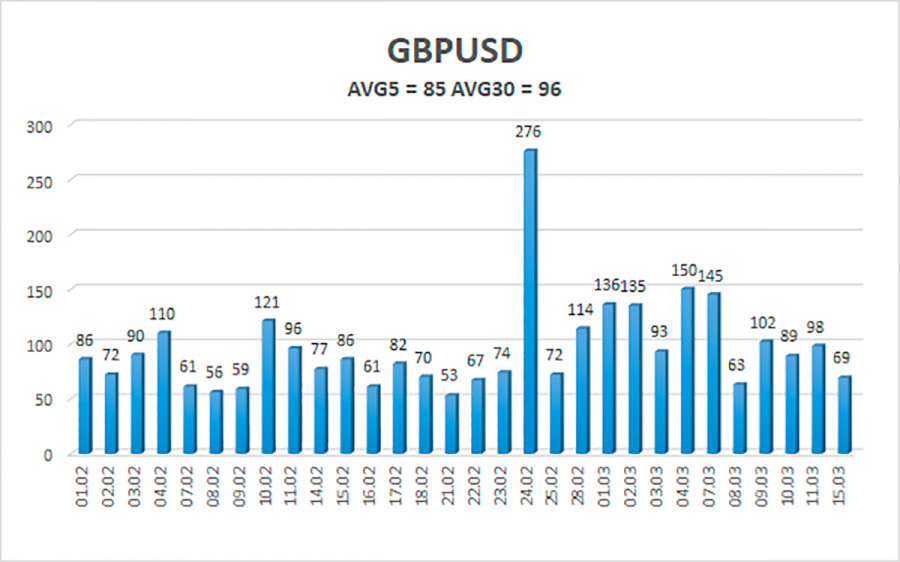

The average volatility of the GBP/USD pair is currently 85 points per day. For the pound/dollar pair, this value is "average". On Tuesday, March 15, thus, we expect movement inside the channel, limited by the levels of 1.2944 and 1.3114. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.3000

S2 – 1.2939

S3 – 1.2878

Nearest resistance levels:

R1 – 1.3062

R2 – 1.3123

R3 – 1.3184

Trading recommendations:

The GBP/USD pair has adjusted quite a bit on the 4-hour timeframe but is now preparing for a new fall. Thus, at this time, new sell orders with targets of 1.3000 and 1.2939 should be considered in the event of a downward reversal of the Heiken Ashi indicator. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3184 and 1.3245.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.