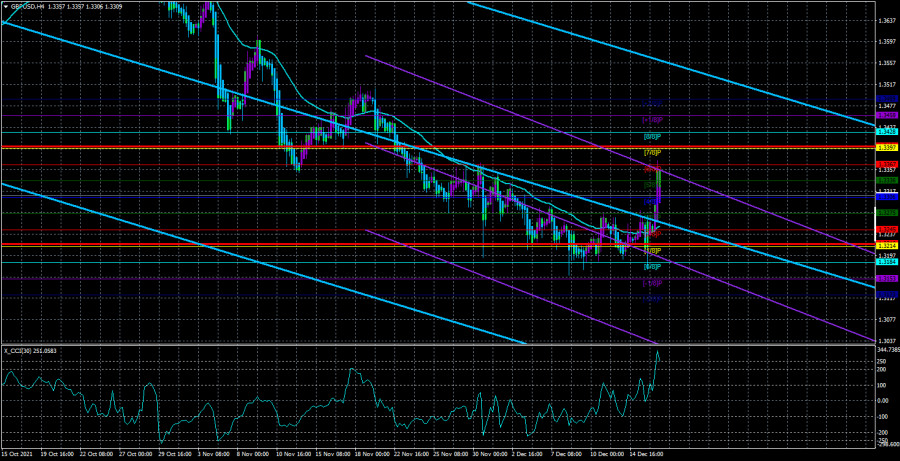

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - upward.

The GBP/USD currency pair also dropped slightly on Wednesday evening, which was logical, based on the results of the Fed meeting, and then rose by 90 points, which means a drop in the dollar and a rise in the British currency. Thus, Wednesday ended unfairly for the US currency. Also in the article on the euro/dollar, we said that, based on the results of the ECB meeting, the further growth of the pair was also absolutely illogical. We assumed that the markets were simply fed up with dollar purchases and therefore did not resume them. However, the situation with the pound/dollar pair on Thursday was different. During the day, its quotes rose by more than 100 points, and it was a reasonable increase because the Bank of England unexpectedly raised the key rate by 0.15%. Thus, the pound sterling soared sharply and went much higher than the moving average line. And it is the pound that now has an excellent chance of forming a new upward trend thanks to its central bank. Recall that the ECB did not make any decisions, but the BA pleased the buyers of the pound, who had been in the shadows for a long time. What's next? Then the bulls need to develop their success. Of course, after such a strong movement to the north, a downward correction should follow. However, we also recall that on the 24-hour timeframe, the pair bounced from the 38.2% Fibonacci level, the grid is built along with the entire upward trend of last year. Thus, after this rebound, the probability of completing the correction in 2021 has increased dramatically. So far, there are no necessary grounds to expect a new trend on the 24-hour TF, however, the Bank of England, which became the first among the "big three" who raised the rate, may decide to support its currency now for a long time. In general, we believe that now both major pairs have the opportunity to start forming an upward trend, but the pound has fundamental reasons for this, unlike the euro.

8 out of 9 members of the monetary committee voted for a rate increase.

It should be immediately recalled that at the last meeting, 2 members of the committee quite unexpectedly voted for a rate increase. It was since then that rumors about a possible rate hike by the British regulator began to be actively exaggerated faster than the Fed. These rumors were very actively spread during the first weeks after the November meeting, but then Michael Saunders and Andrew Bailey made it clear that in December there was no point in expecting a tightening of monetary policy, since the spread of the "coronavirus" increased in the UK, and the "omicron strain" appeared, and the bankers decided to wait and see what the consequences of the deterioration of the epidemiological situation would be, and after that consider raising the rate. However, at the December meeting, 8 members of the committee out of 9, that is, almost unanimously, voted for an increase of 0.15%. Thus, the decision was both unexpected and expected at the same time. The accompanying statement of the bank says that this decision was made due to the continuing growth of inflation, which accelerated to 5.1% in November, which is the highest value since 2011. As in the USA, as in the European Union, in Britain, the target value is 2%. The Bank of England expects inflation to remain at 5% this winter and accelerate to 6% by April next year. In this regard, the rate was raised. Interestingly, the quantitative stimulus program remained unchanged, although at the last meeting three out of nine members voted for its reduction. This time, all nine members voted against it. The final communique also noted the risks associated with the omicron strain. The Bank of England believes that omicron creates risks for business and economic activity, but it is still difficult to say what the level of impact on supply and demand and, as a result, on inflationary pressure will be.

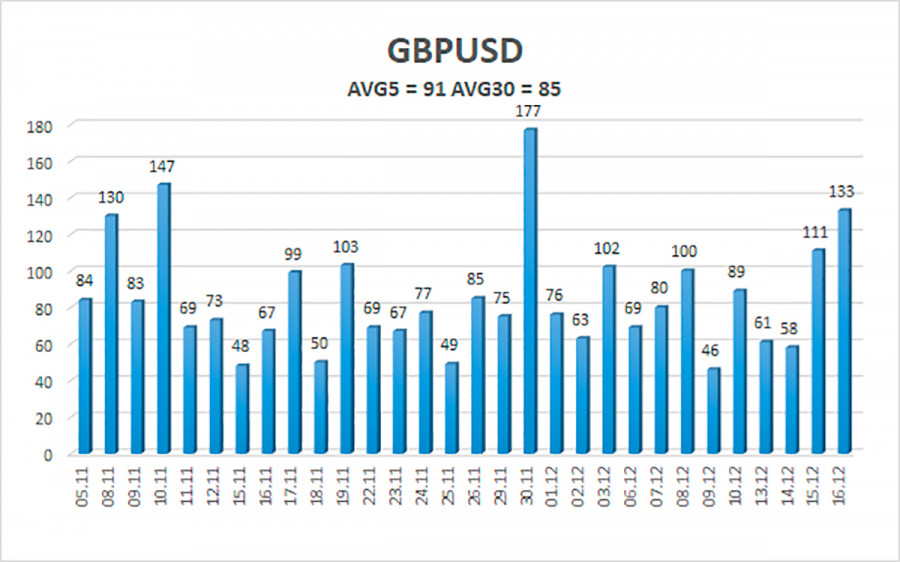

The average volatility of the GBP/USD pair is currently 91 points per day. For the pound/dollar pair, this value is "average". On Friday, December 17, we expect movement inside the channel, limited by the levels of 1.3217 and 1.3399. The reversal of the Heiken Ashi indicator downwards signals a round of corrective movement against a new upward trend.

Nearest support levels:

S1 – 1.3306

S2 – 1.3275

S3 – 1.3245

Nearest resistance levels:

R1 – 1.3336

R2 – 1.3367

R3 – 1.3397

Trading recommendations:

The GBP/USD pair started a strong upward movement on the 4-hour timeframe. Thus, it is necessary to stay in long positions with the targets of 1.3367 and 1.3397 levels until the Heiken Ashi indicator turns down. Sell orders can be considered if the price is fixed below the moving average with targets of 1.3214 and 1.3184.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.