4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

The EUR/USD currency pair traded extremely calmly on Thursday. Volatility was very low again, but this is not surprising, since there were no important events and publications scheduled for yesterday. Thus, the euro currency, which has perked up in the last few weeks and started moving as expected from it, is returning to its favorite trading style - 40-50 points a day. The pair continues to be located above the moving average line, so formally the upward trend persists. "Formally" - because there is no upward movement as such. Or it is very weak. After this week, the quotes of the euro currency collapsed down by 140 points in about 1 hour, when Jerome Powell spoke in the Senate, nothing more interesting is happening. On Wednesday, traders ignored several reports of moderate significance and several speeches by top US officials. To be honest, the reports were as neutral as possible, and the speeches were uninformative. But after all, there will be no news feed every day, so that the pair does not stand in one place. In the meantime, everything is going to the fact that the normal movement will again be observed 1-2 days a week, and the rest of the time the market will sleep. Recall that the US currency has been growing for quite a long time and has managed to grow by 600 points over the past few months. However, in general, the essence of the downward movement continues to be corrective. Thus, we continue to expect the end of the downward trend and the resumption of the global upward trend. But so far there is not a single significant signal for this. Therefore, we are not ready to conclude that a new, powerful movement to the north will begin from the current positions.

What impact has the omicron strain already had on the economy?

We have already heard everything Jerome Powell wanted to convey to the markets. This topic can be put aside for a while. At least until today's Nonfarm report, or better yet, until the Fed meeting on December 15. Meanwhile, the panic about the new strain "omicron", which was discovered on November 24 in South Africa, does not subside around the world. However, according to more recent data, this virus was detected in samples that were taken a few months ago. So far, a new strain has been announced in 10-15 countries around the world. The number of cases of the new virus is estimated in the hundreds so far, which is very little. However, doctors and epidemiologists say with one voice that the new strain can be much more contagious than all the previous ones. With what exactly is "more contagious", and not "more dangerous". According to doctors, the new strain may be more resistant to antibodies and vaccines, but it does not cause complications in most cases and does not lead to death. That is, its main danger lies in the fact that it can infect a large number of people and will be transmitted even to those who have already had COVID or were vaccinated. This is what threatens the world economy with a new decline. Even if the new virus is not fatal and rarely causes complications, it will still create pressure on the medical system, since with more diseases, even a smaller percentage of complications will lead to a large number of patients in hospitals. In addition, many people are already canceling vacations and trips abroad. Partly because countries are beginning to ban exit or entry, partly because they are afraid of catching a new virus. Thus, the tourism and recreation sectors are suffering again. In addition, the shares of air carriers, companies that organize travel, and so on are falling. Jerome Powell, in turn, has already stated that the new virus can significantly complicate the problem of supply chain disruption, the problem of high demand with low supply, and the problem of high inflation. Thus, the virus has not even reached the scale of any of the previous waves, and the world has already been covered by panic. The economy may face a new wave of recession.

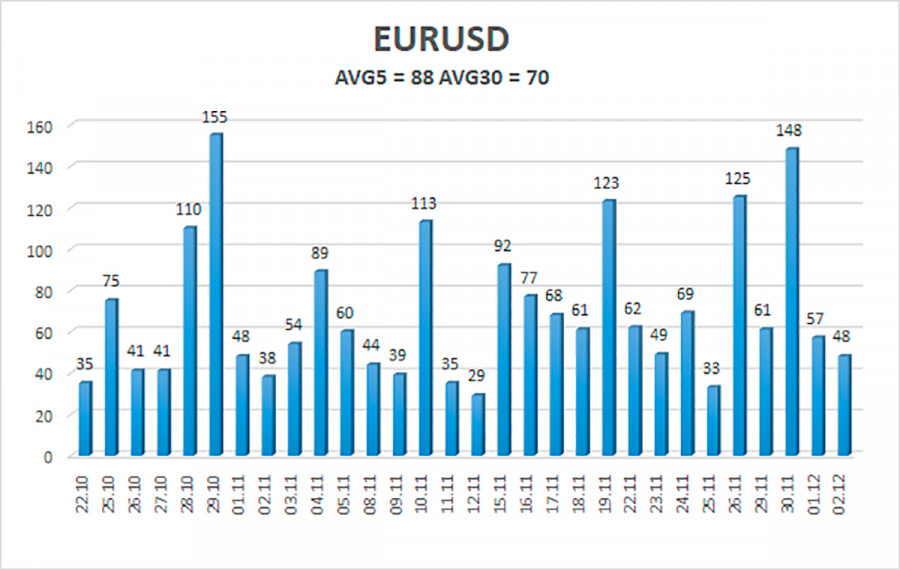

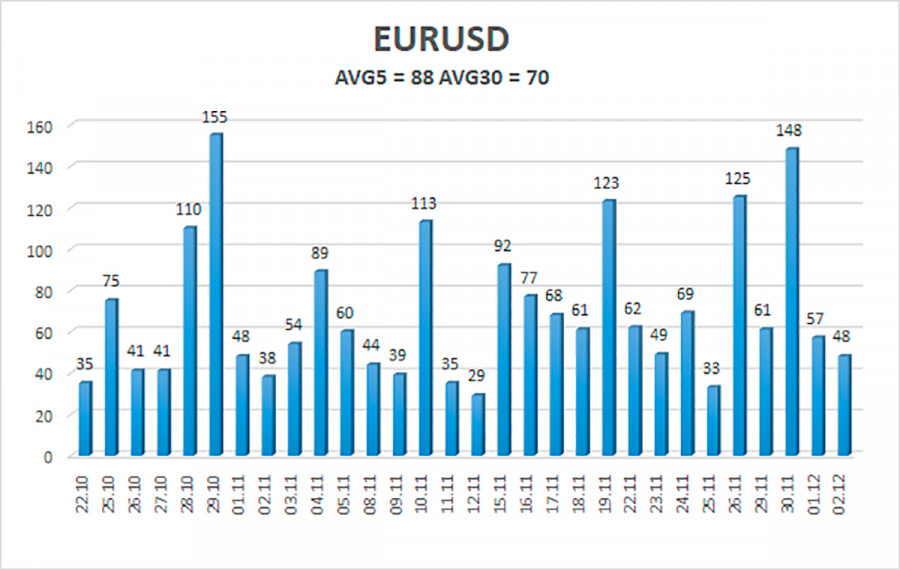

The volatility of the euro/dollar currency pair as of December 3 is 88 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1215 and 1.1391. A reversal of the Heiken Ashi indicator upwards will signal a new attempt to continue the upward movement.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1141

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to remain above the moving average, but so far it cannot continue to move up. Thus, today, you should stay in buy orders with targets of 1.1353 and 1.1391 until the price fixes below the moving average line. Sales of the pair should be considered if the price is fixed below the moving average, with targets of 1.1230 and 1.1215.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.