To open long positions on EURUSD, you need:

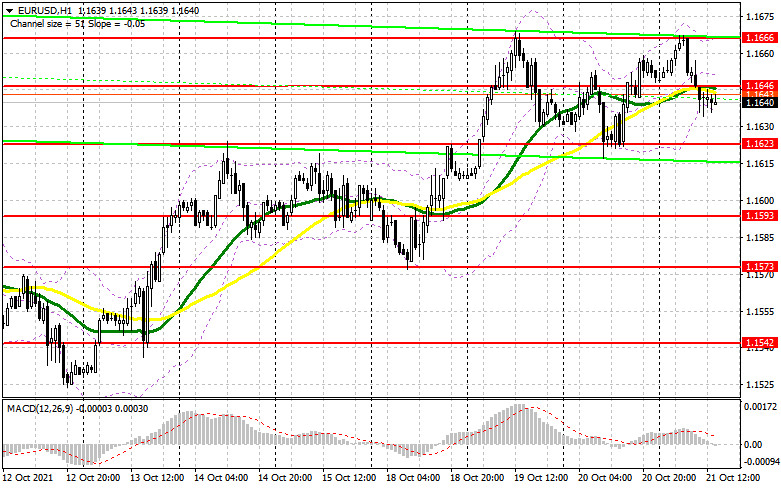

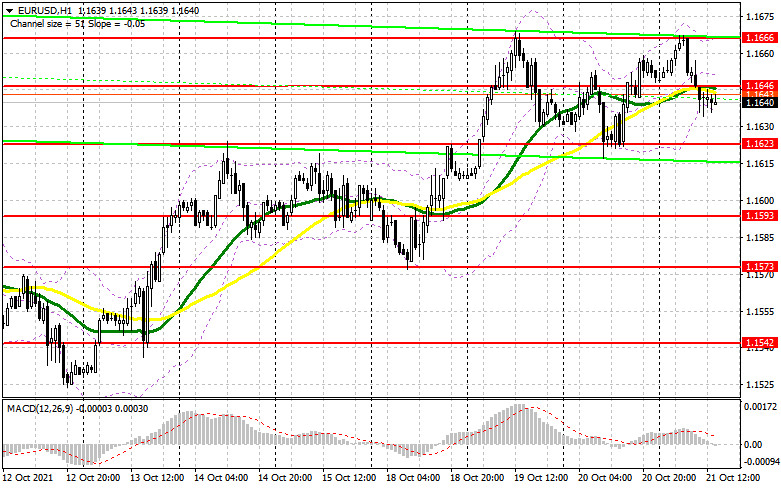

The European currency quickly lost all its positions against the US dollar during the European session due to the rapid increase in the number of coronavirus infections around the world. Most likely, the pressure on risky assets will continue. Let's take a look at the 5-minute chart and analyze the entry points into the market. In the morning forecast, I paid attention to the support of 1.1646 and recommended making decisions from it. The breakthrough and the reverse test of this level from the bottom up gave a good signal to sell the euro to reduce to the next support - 1.1623, but we did not reach it. For the second half of the day, the technical picture has not changed much. Only the nearest support and resistance levels have changed places.

The primary task of the bulls for the second half of the day will be the return of the 1.1646 level, which has now turned into resistance and above which it will be quite problematic to get out. Only weak fundamental data on the US labor market will contribute to the return of bullish sentiment. However, due to the general pessimism of investors due to the new wave of the pandemic, it is unlikely that growth will receive a major continuation. Therefore, only a breakthrough and consolidation above 1.1646 with a reverse test from top to bottom will give a good entry point into long positions on the euro with the prospect of a return to the resistance of 1.1666, where I recommend fixing the profits. A break in this range will open a direct path to new monthly highs: 1.1691 and 1.1713. If the pressure on the euro persists in the afternoon, the entire focus of buyers will be shifted to protecting the lower border of the side channel around 1.1623. Do not forget about several interviews with the Federal Reserve System representatives – they can increase the pressure on the pair even more. Therefore, only the formation of a false breakdown around 1.1623 forms a signal to open long positions to restore the euro to the resistance area of 1.1646. If the bears become stronger during the American session, and the bulls do not offer anything at 1.1623, it is best to be patient and postpone purchases to larger support of 1.1593. It is possible to open long positions immediately for a rebound only from the minimum of 1.1573 based on an upward correction of 15-20 points within a day.

To open short positions on EURUSD, you need:

The COT report (Commitment of Traders) for October 12 recorded an increase in short and long positions. However, the former turned out to be more, which slightly reduced the negative delta. Political problems in the United States of America have been resolved. The latest fundamental reports do not cease to please traders, which indicates that the US economy continues to recover at a good pace. The fact that the Federal Reserve is already seriously considering curtailing the bond-buying program is not news that could help dollar buyers at the moment. But the fact that representatives of the European Central Bank began to express concern about the rate of inflation growth, even if not in the same form as colleagues from the Fed, allows the European currency to begin to win back positions gradually. This trend may continue in the future, especially in the case of strong statistics on the European economy. However, the larger medium-term demand for risky assets will remain limited due to the wait-and-see attitude of the European Central Bank. The COT report indicates that long non-commercial positions rose from the level of 196,819 to 202,512, while short non-commercial positions jumped from 219,153 to the level of 220,910. At the end of the week, the total non-commercial net position increased slightly and amounted to -18,398 against -22,334. The weekly closing price dropped to 1.1553 against 1.1616.

The COT report (Commitment of Traders) for October 12 recorded an increase in short and long positions. However, the former turned out to be more, which slightly reduced the negative delta. Political problems in the United States of America have been resolved. The latest fundamental reports do not cease to please traders, which indicates that the US economy continues to recover at a good pace. The fact that the Federal Reserve is already seriously considering curtailing the bond purchase program is no longer news that could help dollar buyers at the moment. But the fact that representatives of the European Central Bank began to express concern about the rate of inflation growth, even if not in the same form as colleagues from the Fed - all this allows the European currency to begin to win back positions gradually. This trend may continue in the future, especially in the case of strong statistics on the European economy. However, the larger medium-term demand for risky assets will remain limited due to the wait-and-see attitude of the European Central Bank. The COT report indicates that long non-profit positions rose from the level of 196,819 to 202,512, while short non-profit positions jumped from the level of 219,153 to the level of 220,910. At the end of the week, the total non-commercial net position increased slightly and amounted to -18,398 against -22,334. The weekly closing price dropped to 1.1553 against 1.1616.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates a confrontation between buyers and sellers.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the lower limit of the indicator in the area of 1.1643 will lead to a major drop in the euro. A breakthrough of the upper limit of the indicator in the area of 1.1666 will lead to instant recovery of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.