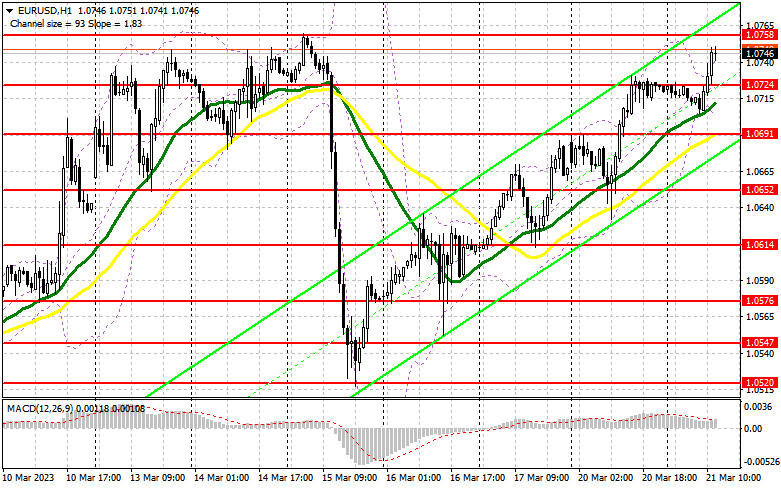

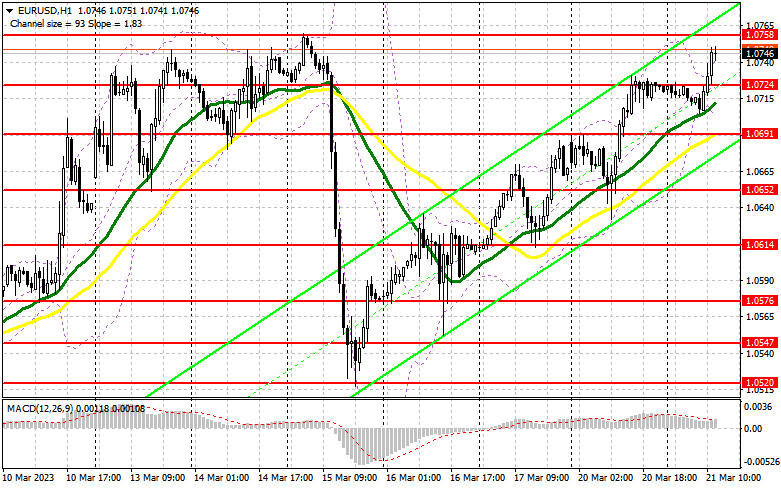

In my morning forecast, I focused on the 1.0724 level and suggested making decisions about entering the market from there. Let's take a look at the 5-minute chart and see what happened. The 1.0724 level was broken through, and a reverse test from the top down provided a signal to purchase the euro, which at the time of writing led to an increase of more than 20 points. The focus will be on this level in the afternoon because we have not yet reached the nearest target of 1.0758.

If you want to trade long positions on EUR/USD, you will need:

The euro ignored all the bad news from the eurozone statistics and grew further on the expectation that the European Central Bank will adopt the same tough stance against inflation as it did last week. We are only awaiting information on the number of homes sold in the secondary market of the United States during the American session, and weak signs will undoubtedly allow bulls to update monthly highs. Yet, I do not believe that buyers will have enough strength to take them down given that the Federal Reserve System meets tomorrow and it is unclear what the politicians will decide there. In the case of a return of pressure on the euro following a positive labor market report and speculators' decision to lock in profits without updating the monthly maximum, I urge you to act only after the test and development of a false breakout in the 1.0724 support area, which would create a direct road to the 1.0758 resistance. This level's breakout and top-down test provide an extra entry point for establishing long positions with a move to 1.0801—a level where bulls will struggle quite a bit. In response to Christine Lagarde's speech, the breakdown of 1.0801 will hit the stop orders for the bears, sending another signal that there may be a move to the maximum of 1.0834, where I will fix profits. The pressure on the euro could return if EUR/USD weakens in the afternoon and there are no buyers around 1.0724, which is also likely. If this level is broken, the price will drop to the next support level of 1.0691, where moving averages that are working with the bulls are passing. The only indication to buy the euro will be the development of a false breakout there. For a rebound from the low of 1.0652, or even lower (around 1.0614), I will begin long positions right away with the target of an upward corrective of 30-35 points during the day.

If you want to trade short positions on EUR/USD, you'll need:

Even the publicly available information on the eurozone failed to attract new sellers, who are likely considering whether to act around the monthly limit or retreat even further, returning to the market. To a certain, the bears will have to put out a lot of work to defend the resistance level of 1.0758, which buyers are now aiming for. The development of a false collapse will be the ideal scenario for initiating short positions there. The euro will then fall to the area of the closest support level of 1.0724, which serves as resistance in the morning. The pair will continue to correct due to the breakout and reversal test of this range, which will serve as a further signal to start short positions with an exit at 1.0691. After Christine Lagarde's speech, a fix below this range will result in a larger drop to the 1.0652 area, where I will collect profits. If the EUR/USD continues to rise during the American session and there are no bears around 1.0758, which is highly likely, I suggest you delay opening short positions until 1.0801. Only after an unsuccessful consolidation can you sell. In anticipation of a rebound from the high of 1.0834, I will open short positions right away with a 30- to 35-point corrective in mind.

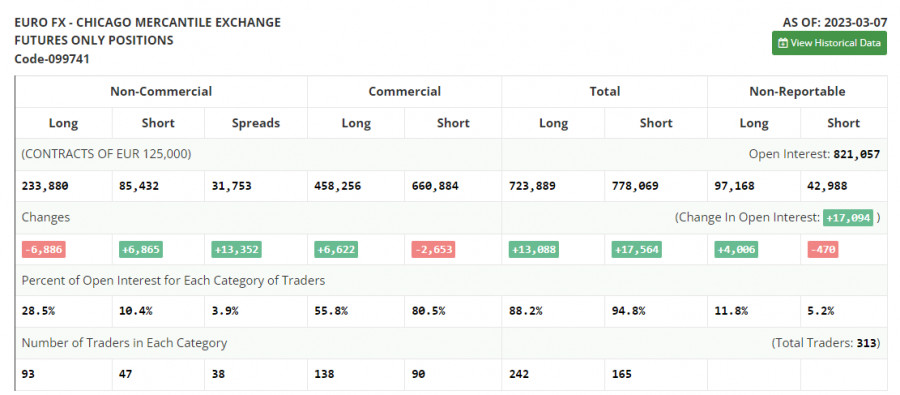

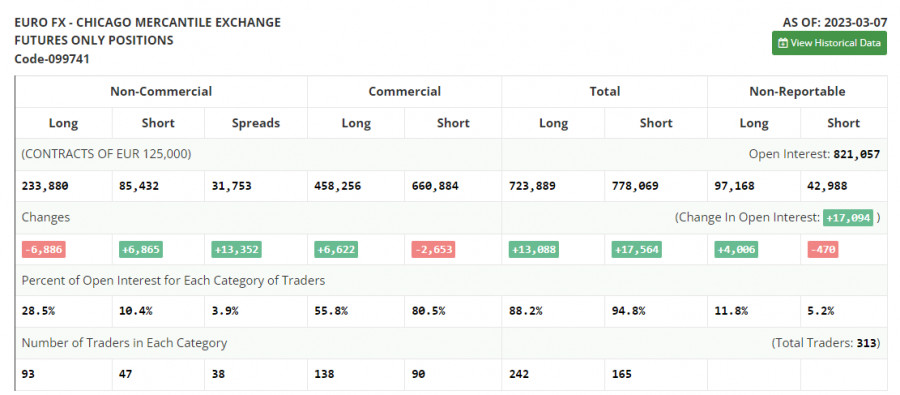

According to the COT report (Commitment of Traders) for March 7, there were fewer long positions and more short ones. It should be clear that these figures are of no interest at the moment because, amid the CFTC cyberattack, statistics are only now starting to catch up, making the information from two weeks ago somewhat out of date. I'll hold off till new reports are released and rely on more recent data. We will have a meeting of the Federal Reserve System this week, and there are reports that the committee may decide without raising rates at all given the troubles in the banking industry and the opening of a new credit swap line for other central banks to provide them with liquidity. These developments make us seriously consider what lies ahead for the economy. If Jerome Powell surprises the markets and continues to raise rates, the dollar would suffer because investors are already relying on the Fed's tight grip easing and policy easing by the end of the year. According to the COT data, the number of long non-commercial positions fell by 6,886 to 233,880, while the number of short non-commercial positions rose by 6,865 to 85,432. The total non-commercial net position dropped from 165,038 to 148,448 at the end of the week. The weekly ending price dropped and was 1.0555 as opposed to 1.0698.

Signals from indicators

Moving Averages

Trade is taking place above the 30 and 50-day moving averages, which suggests that the euro will keep rising.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located around 1.0690, will provide support in the event of a decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.